FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

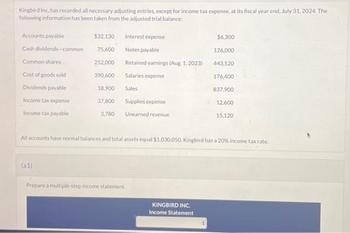

Transcribed Image Text:Kingbird Inc. has recorded all necessary adjusting entries, except for income tax expense, at its fiscal year end, July 31, 2024. The

following information has been taken from the adjusted trial balance:

Accounts payable

$32.130

Cash dividends-common 75,600

Common shares

252,000

Cost of goods sold

390,600

Dividends payable

18,900

Income tax expense

37,800

Income tax payable

3,780

Interest expense

Notes payable

Retained earnings (Aug. 1, 2023)

Salaries expense

Sales

Supplies expense

Unearned revenue

(a1)

All accounts have normal balances and total assets equal $1,030.050. Kingbird has a 20% income tax rate.

Prepare a multiple-step income statement.

$6,300

126,000

443,520

176,400

837,900

12,600

15,120

KINGBIRD INC.

Income Statement

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On January 1, 2020, Ehrlich Corporation issued 7%, 10-year bonds with a face amount of $800,000 at 97. Interest is payable annually on January 1. Instructions Prepare the following entries: record the issuance of the bonds on 1/1/20 first annual interest accrual on 12/31/20 amortization, assuming that the company uses straight-line amortization on 12/31/20 payment of interest on 1/1/21 What is the unamortized balance of the discount account at 1/1/21? What is the carrying value of the bond at 1/1/21?.arrow_forwardOcean Ltd recorded an accounting profit before tax of $50,000 for the year ended 30 June 2020. Included in the accounting profit were the following income and expenses: Rent revenue Interest revenue Bad debts expense An extract of the Statement of Financial Position for 30 June 2020 revealed the following: Accounts receivable Allowance for doubtful debts Interest receivable Rent Revenue in Advance $46,000 $28,000 $34,000 The company tax rate is 30%. 2020 $96,000 ($44,000) $40,000 $22,000 2019 $56,000 ($18,000) $24,000 $38,000 Required: Calculate taxable income (loss) and record the necessary journal entry for current income tax expense for the year ended 30 June 2020.arrow_forwardFollowing are the financial statements and other supplementary information for Summer Corporation for its year-ended December 31, 2022: Sales Cost of goods sold Gross Margin Depreciation Expense Wage Expense Other operating expenses Interest Expense Loss on Sale of Equipment Income Before Tax Income Tax Expense Net Income Current Assets Cash Accounts receivable Inventory Prepaid Expenses Non-Current Assets Equipment Accumulated Depreciation Total Assets Current Liabilities Accounts Payable Income Taxes Payable Wages Payable barnet Davable $1,055,000 (545,000) 510,000 (37,000) (103,000) (55,000) (25,000) (Z.800) 282,200 (112,880) $169,320 2022 $102,560 98,000 85,900 6,700 275,000 (54,000) $514,160 $32,500 5,600 8,800 6,500 Long-Term Liabilities and Shareholders' Equity LT Notes Payable Common Shares Retained Earnings Total Liabilities and Shareholders' Equity 6,500 2021 $145,000 -42,440 110,000 -12,000 43,000 42,900 1,200 5,500 Change 125,000 150,000 (25,000) 29,000 $399,200 114,960…arrow_forward

- Wildhorse Corporation, a publicly traded company, is preparing the comparative financial statements to be included in the annual report to shareholders. Wildhorse's fiscal year ends May 31. The following information is available. 1. 2. 3. 4. 5. 6. 7. 1. Income from operations before income tax for Wildhorse was $1,500,000 and $1,900,000, respectively, for the fiscal years ended May 31, 2021, and 2020. 2. Wildhorse experienced a loss from discontinued operations of $600,000 from a business segment disposed of on March 3, 2021. A 20% combined income tax rate applies to all of Wildhorse Corporation's profits, gains, and losses. Wildhorse's capital structure consists of preferred shares and common shares. The company has not issued any convertible securities or warrants and there are no outstanding stock options. Wildhorse issued 136,000 of $10 par value, 5% cumulative preferred shares in 2013. All of these shares are outstanding, and no preferred dividends are in arrears. Determine the…arrow_forwardSagararrow_forwardOn December 31 (fiscal year-end) financial statements of Collette, Inc. reported the following information (in millions) Inventories (net) LIFO reserve Net Income 2022 468,611 3,476 13,918 Assume corporate tax rate of 40%. 2021 437,396 3,271 13,622 Question: If Collette had used FIFO method instead of LIFO method, what net income would Collette report in 2022?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education