FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

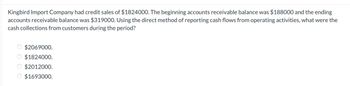

Transcribed Image Text:Kingbird Import Company had credit sales of $1824000. The beginning accounts receivable balance was $188000 and the ending

accounts receivable balance was $319000. Using the direct method of reporting cash flows from operating activities, what were the

cash collections from customers during the period?

$2069000.

$1824000.

$2012000.

O $1693000.

OO

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Munster Company reports the following net cash in its statement of cash flows: net inflow from operating activities: $200; net outflow from investing activities: $300; net outflow from financing activities: $50. The ending balance in cash is $20; the beginning balance must have been Multiple choice question. $190. $210. $150. $170.arrow_forwardMa1.arrow_forwardWhile examining cash receipts information, the accounting department determined the following information: opening cash balance $162, cash on hand $1,215.80, and cash sales per register tape $1,067.71. Prepare a tabular analysis of the required adjustment based upon the cash count sheet. (Ifa transaction results in a decrease in Assets, Liabilities or Stockholders' Equity, place a negative sign (or parentheses) in front of the amount entered for the particular Asset, Liability or Equity item that was reduced. Round answers to 2 decimal places, e.g. 52.75.) Assets Liabilities Stockholders' Equity Cash Revenues Expensesarrow_forward

- i need the answer quicklyarrow_forward(1) Use the information below to compute the days in the cash conversion cycle for each company. (2) Which company is more effective at managing cash based on this measure? Days' sales in accounts receivable Days' sales in inventory Days' payable outstanding Required 1 Required 2 Sparta Company 36 22 29 Complete this question by entering your answers in the tabs below. Cash conversion cycle Athens Company 49 26 34 Use the information below to compute the number of days in the cash conversion cycle for each company. Sparta Athens Company Companyarrow_forwardprovide a solution.arrow_forward

- The following selected account balances appeared on the financial statements of Washington Company: Accounts Receivable, January 1 Accounts Receivable, December 31 Accounts Payable, January 1 Accounts Payable, December 31 $14,013 6,449 5,841 7,294 10,420 15,188 Sales 62,580 Cost of Merchandise Sold 36,279 Washington Company uses the direct method to calculate net cash flow from operating activities. Cash payments for merchandise were Merchandise Inventory, January 1 Merchandise Inventory, December 31 a. $42,500 Ob. $30,058 c. $39,594 Od. $65,895 Check My Work 1 more Check My Work uses remaining. Previousarrow_forwardUse the following excerpts from Brownstone Company's financial statements and complete the worksheet below to determine cash received from customers in 2018. From Balance Sheets Accounts Receivable Dec. 31, 2018 $ 25,000 Dec. 31, 2017 $20,000 2018 220,000 From Income Statement: Sales PLEASE NOTE: You are to follow the format shown in the textbook. Cash Collected from Sales Revenue [ Select ] [ Select ] [ Select ] [ Select ] [ Select ] [ Select ] [ Select ] [ Select ] [ Select ] [ Select ]arrow_forwardDeduce the missing amounts and prepare the income statement.arrow_forward

- Ee.77.arrow_forwardLino Company’s worksheet for the preparation of its 20X1 statement of cash flows included the following information: Dec31 Jan 1 Accounts receivable 29,000 $ 23,000 Allowance for uncollectible accounts 1,000 800 Prepaid rent expense 8,200 12,400 Accounts payable 22,400 19,400 Lino’s 20X1 net income is $150,000. Required: What amount should Lino include as net cash that is provided by operating activities in the statement of cash flows?arrow_forward(Determining Cash Balance) Presented below are a number of independent situations.InstructionsFor each individual situation, determine the amount that should be reported as cash. If the item(s) is not reported as cash,explain the rationale. 1. Checking account balance $925,000; certificate of deposit $1,400,000; cash advance to subsidiary of $980,000; utility depositpaid to gas company $180.2. Checking account balance $600,000; an overdraft in special checking account at same bank as normal checking account of$17,000; cash held in a bond sinking fund $200,000; petty cash fund $300; coins and currency on hand $1,350.3. Checking account balance $590,000; postdated check from customer $11,000; cash restricted due to maintaining compensating balance requirement of $100,000; certified check from customer $9,800; postage stamps on hand $620.4. Checking account balance at bank $37,000; money market balance at mutual fund (has checking privileges) $48,000; NSF check received from customer…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education