FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

King, Queen and Prince are partners sharing

_______ If the non-cash assets were sold at a gain of P150,000. How much is the cash proceeds?

a.P1,100,000 c. P1,400,000

b.P800,000 d. P1,050,000

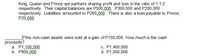

Transcribed Image Text:King, Queen and Prince are partners sharing profit and loss in the ratio of 1:1:2

respectively. Their capital balances are P500,000, P300,000 and P200,000

respectively. Liabilities amounted to P200,000. There is also a loan payable to Prince,

P20,000.

Ifthe non-cash assets were sold at a gain of P150,000. How much is the cash

proceeds?

a. P1,100.000

b. P800,000

c. P1,400,000

d. P1,050,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- 4. Zahid and Majid entered into a Joint Venture for purchase and sale of some household items. They agreed to share profits and losses as 2/5 and 3/5 respectively. Zahid contributed Rs. 350,000 in cash and Majid Rs. 450,000. The whole amount was placed in a Joint Bank account. Zahid purchased goods for Rs. 250,000 and expenses paid by Majid amounted to Rs. 75,000. They also purchased goods for Rs. 375,000 through the Joint Bank Account. The expenses on purchase and sale of the articles amounted to Rs. 150,000 (including those met by Majid). Goods costing Rs. 500,000 were sold for Rs. 1,125,000 and the balance was lost by fire. Required: Enter the above transactions in the books of both Zahid and Majid. Also show the necessary ledger accounts in the books of the Venture.arrow_forwardPartners Baldecir and Magallanes each have a P300,000 capital balance and share profits and losses in a 3:1 ratio. Cash equals P100,000, non-cash assets equal P1,000,000 and liabilities equal P500,000. IF the non-cash assets are sold for P400,000 and both partners agreed to make up for any capital deficits with persona cash contributions, Magallanes eventually will receive cash of *arrow_forwardGerald and Julia are joining their separate business to form a partnership and they agreed to share profits in the manner of 55% for Gerald and 45% for Julia. Property is to be contributed for a total capital of P800,000. The partners agreed to make their capital accounts equal after formation. How much cash must be contributed by each of the partners after they contributed their properties? Gerald Julia Book Value Fair Value Book Value Fair Value Accounts Receivable 60,000 60,000 - - Inventories 60,000 90,000 160,000 180,000 Equipment 100,000 80,000 180,000 190,000 Accounts Payable 30,000 30,000 20,000 20,000arrow_forward

- Mr. K, Mr. N and Mr. P are partners sharing profits and losses in the ratio of 4: 3: 2. Mr. N retires, and the goodwill is valued at Rs. 72,000. Mr. K and Mr. P decided to share future profits and losses in the ratio of 5: 3. Calculate the gaining ratio of Mr. K and Mr. P. 10:11 13:11 11:13 None of thesearrow_forwardKing, Queen and Prince are partners sharing profit and loss in the ratio of 1:1:2 respectively. Their capital balances are P500, 000, P300, 000 and P200, 000 respectively. Liabilities amounted to P200, 000. There is also a loan payable to Prince, P20, 000. If the cash balance amounted to P300,000. how much is the non-cash assets of the partnership? а. Р950,000 b. P1,250.000 c. P1,200,000 d. P900,000 If the non-cash assets were sold at a gain of P150,000. How much is the cash proceeds? a. P1,100.000 b. Р800,000 c. P1,400,000 d. P1,050,000arrow_forwardJosh and Krish are partners sharing profits and losses in the ratio of 3:1. Their capitals at the end of the financial year 2015-2016 were Rs. 1,50,000 and Rs. 75,000. During the year 2015-2016, Josh’s drawings were Rs. 20,000 and the drawings of Krish were Rs. 5,000, which had been duly debited to partner’s capitalaccounts. Profit before charging interest on capital for the year was Rs. 16,000.The same had also been debited in their profit sharing ratio. Krish had brought additional capital of Rs. 16,000 on October 1, 2015. Calculate interest on capital @ 12% p.a. for the year 2015-2016.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education