Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN: 9781285595047

Author: Weil

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Hello tutor please provide correct answer general accounting question

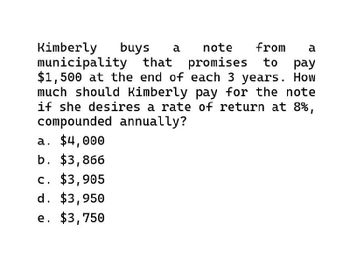

Transcribed Image Text:Kimberly buys a note from a

municipality that promises to pay

$1,500 at the end of each 3 years. How

much should Kimberly pay for the note

if she desires a rate of return at 8%,

compounded annually?

a. $4,000

b. $3,866

c. $3,905

d. $3,950

e. $3,750

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Refer to the present value table information on the previous page. What amount should Brett have in his bank account today, before withdrawal, if he needs 2,000 each year for 4 years, with the first withdrawal to be made today and each subsequent withdrawal at 1-year intervals? (Brett is to have exactly a zero balance in his bank account after the fourth withdrawal.) a. 2,000 + (2,000 0.926) + (2,000 0. 857) + (2,000 0.794) b. 2,0000.7354 c. (2,000 0.926) + (2,000 0.857) + (2,000 0.794) + (2,000 0.735) d. 2,0000.9264arrow_forwardDan buys a property for $290,000. He is offered a 20-year loan by the bank, at an interest rate of 6% per year. What is the annual loan payment Dan must make? A. $35,396.93 B. $30,340.22 C. $25,283.52 D. $40,453.63arrow_forwardYour father promise to give you RM150 at the end of each month for four years while you attend college. At a discount rate of 3 percent, what are these payments worth to you on the day you enter college? Select one: A. RM6,776.80 B. RM6,793.74 C. RM6,201.16 D. RM6,539.14arrow_forward

- Curtis buys a piece of commercial property for $230,000. He is offered a 20-year loan by the bank, at an interest rate of 9% per year. The loan requires annual payments to be made. What is the annual loan paymen Curtis must make assuming the first payment will be due one year from the date of purchase? O A. $40,313.10 O B. $30,234.83 O C. $35,273.97 O D. $25,195.69 O Time Remaining: 00:29:43 Next dtv 11 DD F11 F9 F10 F8 F7 F5 esc F4 F2 F3 F1 & @ 2# $ % 8 1 3. 4 { P < COarrow_forwardNoor is buying a home with a $200,000 mortgage using a 5.5 percent, 30-year loan. How much of the first month's payment will go toward the principal if the payment per $1000 on this loan is $5.6779? O a. $917 O b. $219 O c. $0 O d. $538arrow_forwardYour grandmother will be gifting you $150 at the end of each month for four years while you attend college. At an annual discount rate of 3.7 percent, what are these payments worth to you on the day you enter college? A. $6, 201.16 B. $ 6,539.14 C. $6,608.87 D. $6,682.99 E. $6,870.23arrow_forward

- 2arrow_forwardEvery three years, D will pay Mr. J 5,000 at 8% rate to settle his loan. Mr. D will use which formula to compare with cash payment? A. Future value of IB. FV of AnnuityC. Present Value of ID.arrow_forwardAnna receives $150 a month for four years while she attends college to earn a bachelor's degree. At a 6.25 percent discount rate compounded monthly, what are these payments worth to you on the day she enters college? O $4,800.00 $6,355.98 O$4,608.87 O $4,201 20 O $6.789.92arrow_forward

- Emma plans to loan $1,000 to her friend, who will pay a simple interest rate of 5.8% every year for the loan. If no payments are made and no further borrowing occurs between them for 13 years, then how much money will Emma' s friend owe her? $1,061.36 $1,754.00 $2,081.20 $158.00 Now, assume that Emma's friend volunteers to pay compound interest instead of simple interest for her loan. If interest is accrued at 5.8% compounded annually, all other things being equal, how much money will Emma's friend owe her in 13 years? $2,081.20 $1,058.00 $120.71 $ 1,754.00 Emma has another investment option in the market that pays 5.8% nominal interest, but it's compounded quarterly. Keeping everything else constant, how much money will Emma have in 13 years if she invests $1,000 in this fund? $158.00 $129.72 $2,114.01 $1,059.27arrow_forwardJeffrey deposits $406.00 every month into his son's RESP for the next fifteen years until his son goes to college. Jeffrey's son will receive quarterly payments from the RESP for the four years he is in college. If the RESP earns interest at a rate of 5.20% compounded monthly find the size of the quarterly payments Jeffrey's son will receive. PMT I Round to the nearest cent hip SUBMIT QUESTION SAVE PROGRESS V7cuarrow_forwardHumphrey purchases a 100,000 home. Mortgage payments are to be made monthly for 30 years, with the first payment to be made one month from now. The annual effective rate of interest is 4%. After 10 years, the amount of each monthly payment is increased by 319.74 in order to repay the mortgage more quickly. Calculate the amount of interest paid over the duration of the loan. Select one: O A. 52,000 B. 52,100 C. 52,200 D. 52,300 E. 52,400arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning