FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Q.

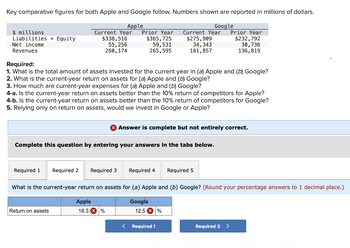

Transcribed Image Text:Key comparative figures for both Apple and Google follow. Numbers shown are reported in millions of dollars.

Apple

Google

Current Year Prior Year Current Year

$338,516

55, 256

$275,909

34,343

260, 174

161,857

$ millions

Liabilities + Equity

Net income

Revenues

Required:

1. What is the total amount of assets invested for the current year in (a) Apple and (b) Google?

2. What is the current-year return on assets for (a) Apple and (b) Google?

3. How much are current-year expenses for (a) Apple and (b) Google?

4-a. Is the current-year return on assets better than the 10% return of competitors for Apple?

4-b. Is the current-year return on assets better than the 10% return of competitors for Google?

5. Relying only on return on assets, would we invest in Google or Apple?

Required 1

$365,725

59,531

265,595

Complete this question by entering your answers in the tabs below.

Return on assets

> Answer is complete but not entirely correct.

Required 2 Required 3

<

Required 4

What is the current-year return on assets for (a) Apple and (b) Google? (Round your percentage answers to 1 decimal place.)

Apple

Google

16.3 %

Prior Year

$232,792

30,736

136,819

12.5 X %

Required 5

Required 1

Required 3 >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

Transcribed Image Text:2:53:11

Book

Print

eferences

****

G

f2

e:

4-b. Is the current-year return on assets better than the 10% return of competitors for Google?

5. Relying only on return on assets, would we invest in Google or Apple?

2

Mc

Graw

Hill

Type here to search

W

Complete this question by entering your answers in the tabs below.

S

Required 1

X

What is the total amount of assets invested for the current year in (a) Apple and (b) Google? (Enter your answers in millions

of dollars.)

Total amount of assets (in $ millions)

#

f3

3

Required 2

E

D

f4

$

JOI

4

31

Required 3

R

UL

f5

do

5

T

f6

G

DO

Required 4 Required 5

Apple

Required 1

N

6

12

hulu

B

f7

Y

&

Google

7

H

< Prev

Required 2 >

5

f8

*

U

N

6 of 7

8

x

J

hp

fg

L

W

9

K

M

Next >

f10

#

P

ait

f12

[

ins

pr

1

Solution

by Bartleby Expert

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

Transcribed Image Text:2:53:11

Book

Print

eferences

****

G

f2

e:

4-b. Is the current-year return on assets better than the 10% return of competitors for Google?

5. Relying only on return on assets, would we invest in Google or Apple?

2

Mc

Graw

Hill

Type here to search

W

Complete this question by entering your answers in the tabs below.

S

Required 1

X

What is the total amount of assets invested for the current year in (a) Apple and (b) Google? (Enter your answers in millions

of dollars.)

Total amount of assets (in $ millions)

#

f3

3

Required 2

E

D

f4

$

JOI

4

31

Required 3

R

UL

f5

do

5

T

f6

G

DO

Required 4 Required 5

Apple

Required 1

N

6

12

hulu

B

f7

Y

&

Google

7

H

< Prev

Required 2 >

5

f8

*

U

N

6 of 7

8

x

J

hp

fg

L

W

9

K

M

Next >

f10

#

P

ait

f12

[

ins

pr

1

Solution

by Bartleby Expert

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education