KEW Enterprises began operations in January 20X1 to manufacture a hand sanitizer that promised to be more effective and gentler on the skin than existing products. Family members, one of whom was delegated to be the office manager and bookkeeper, staffed the company. Although conscientious, the office manager lacked formal accounting training, which became apparent when the growing company was forced in March 20X4 to hire a CPA as controller. Although ostensibly brought in to relieve some of the office manager’s stress, management made it clear to the new controller that they had some concerns about the quality of information they were receiving. Accordingly, the controller made it a priority to review the records of prior years, looking for ways to improve the accounting system. From this review, the following errors were uncovered.

- The office manager expensed rent on equipment and facilities when paid. Amounts paid in 20X1, 20X2, and 20X3 that represented rent for the subsequent year were $5,000, $4,500, and $4,900, respectively.

- No

adjusting entries were ever made to reflect accrued salaries. The amounts that should have been presented as accrued wages at December 31, 20X1, 20X2, and 20X3, respectively, were $12,000, $13,500, and $8,300. - Errors occurred in the

depreciation calculations that resulted in depreciation expense being overstated by $3,500 in 20X1, understated by $7,000 in 20X2, and understated by $6,000 in 20X3. - In February 20X3 some surplus production equipment that originally had cost $14,000 was sold for $4,000; $12,000 in depreciation had correctly been taken on this equipment. The office manager made this entry to record the sale:

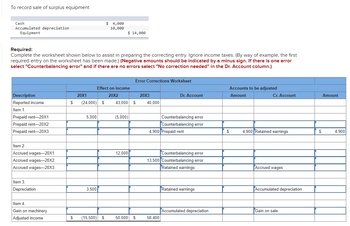

Preparation of worksheet are as follows

Step by stepSolved in 2 steps with 2 images

- Sanchez Trucking has been experiencing delays at its warehouse operations. Management hired a consultant to find out why service deliveries to local businesses have taken longer than they should. The consultant narrowed down the problem to the number of work crews loading and unloading trucks. Each crew consists of 7 employees who work as a team on a variety of tasks; each employee works a full 40 hours a week. However, costs are also a concern. The consultant advised management that they could supplement work crews with short-term employees, at a higher cost, to cover unexpected needs on a weekly basis. Each work crew permanently hired by Sanchez costs $3,500 per week in wages and benefits, while a crew of short-term employees costs $6,000 per week. Complicating the decision is the fact that the weekly hourly requirements for work crews is uncertain because of the volatility in the number of deliveries to be made. Deliberating with management, the consultant arrived at the following…arrow_forwardA small air conditioning repair and parts supply company employ 25 workmen who perform services tasks and 3 office staff: One of the office staff, Harold Jones, has been with the company since it opened its doors. During that time, he has earned the trust of the owner and has proven to be a diligent employee who often works late, occasionally comes in on weekends for no additional pay, and hasn’t taken a substantial vacation in over 10 years. Instead, he staggers his vacation days throughout the year to avoid the need for a replacement and ensures that none of the other office staff is burdened with his work. Harold’s primary tasks include: • Responsible for POS cash and credit sales • Bills those customers who purchase on credit • Opens the mail and posts cash receipts to AR records, and • Prepares the daily cash deposits for the business. Another office worker, Mike Larkin, handles purchasing of inventory and supplies from vendors, stocking, shipping merchandise, updating…arrow_forwardMajor League Products provides merchandise carrying the logos of each fan’s favorite major league team. In recent years, the company has struggled to compete against new Internetbased companies selling products at much lower prices. Andrew Ransom, in his second year out of college, was assigned to audit the financial statements of Major League Products. One of the steps in the auditing process is to examine the nature of year-end adjustments. Andrew’s investigation reveals that the company has made several year-end adjustments, including (a) a decrease in the allowance for uncollectible accounts, (b) a reversal in the previous write-down of inventory, (c) an increase in the estimated useful life used to calculate depreciation expense,and (d) a decrease in the liability reported for litigation.Required:1. Classify each adjustment as conservative or aggressive.2. What effect do these adjustments have on expenses in the current year?3. What effect do these adjustments have on the…arrow_forward

- Jessie Lu is a new audit manager with your firm, Rowlands, Marcellin and Khan (RMK).They have been assigned to the audit of Mauro Moldings Limited (MML). MML is family Owned and is seeking bank financing to expand its factory. Sales at MML last year were $ 43 Million. MML makes decorative moldings such as door casing, baseboards, and crown moldings, duplicating The look of historical millwork. Business has been growing as more people restore older homes rather than just renovate. As part of the planning process Jessie visited MML’s factory. They made the following note: “It is A good thing MML is expanding. There was good and sawdust everywhere. The factory manager told me That there is so little space they have had to start storing wood in the parking lot. That’s true. I parked right next to what I think was a pile of oak. I asked the new controller, Frank Mauro, about it and he said They put a trap over each pile if they thought it was going to rain. He also told me that they…arrow_forwardAn employee at an electrical engineering firm was unhappy about being overlooked for a promotion opportunity and decided to resign. He started working at a competing firm in the same city. The former firm soon realized that their innovative designs in engineering solutions were being made available at the new firm where the employee was now working. After a thorough investigation, it was found that the disgruntled employee’s account and password (and therefore his access to confidential designs) were still active. The investigation indicated that the employee had regularly accessed his account and reviewed the confidential designs. REQUIRED Identify and explain the type of fraud that has taken place. What must have motivated the employee to commit the fraud? Explain your answer. List two contributing factors to the type of fraud that had taken place.arrow_forwardThis case is based on an actual situation. Centennial Construction Company, headquartered in Dallas, Texas, built a Rodeway Motel 35 miles north of Dallas. The construction foreman, whose name was Slim Chance, hired the 40 workers needed to complete the project. Slim had the construction workers fill out the necessary tax forms, and he sent their documents to the home office. Work on the motel began on April 1 and ended September 1. Each week, Slim filled out a timecard of hours worked by each employee during the week. Slim faxed the timecards to the home office, which prepared the payroll checks on Friday morning. Slim drove to the home office on Friday, picked up the payroll checks, and returned to the construction site. At 5 p.m. on Friday, Slim distributed payroll checks to the workers. Requirements Describe in detail the main internal control weakness in this situation. Specify what negative result(s) could occur because of the internal control weakness. Describe what you would…arrow_forward

- The operations vice president of Security Home Bank is investigating the efficiency of the bank's operations. She is concerned about the costs of handling routine transactions at the bank and would like to compare these costs at the bank's various branches. If the branches with the most efficient operations can be identified, their methods can be studied and replicated elsewhere. While the bank maintains meticulous records of wages and other costs, there has been no attempt to show how those costs are related to the various services provided by the bank. The operations vice president has asked for your help in conducting an activity-based costing study of bank operations. In particular, she would like to know the cost of opening an account, the cost of processing deposits and withdrawals, and the cost of processing other customer transactions. The Westfield branch of Security Home Bank submitted the following cost data for last year: Teller wages Assistant branch manager salary Branch…arrow_forwardConsider each of the following independent scenarios:a. Terrin Belson, plant manager for the laser printer factory of Compugear Inc., brushed hishair back and sighed. December had been a bad month. Two machines had broken down,and some factory production workers (all on salary) were idled for part of the month.Materials prices increased, and insurance premiums on the factory increased. No way outof it; costs were going up. He hoped that the marketing vice president would be able topush through some price increases, but that really wasn’t his department.b. Joanna Pauly was delighted to see that her ROI figures had increased for the third straightyear. She was sure that her campaign to lower costs and use machinery more efficiently(enabling her factories to sell several older machines) was the reason why. Joanna plannedto take full credit for the improvements at her semiannual performance review.c. Gil Rodriguez, sales manager for ComputerWorks, was not pleased with a memo…arrow_forwardFrank Weston, supervisor of the Freemont Corporation's Machining Department, was upset after being reprimanded for his department's poor performance over the prior month. The department's cost control report is given below: Machine-hours Direct labor wages Supplies Maintenance Utilities Freemont Corporation-Machining Department Cost Control Report For the Month Ended June 30 Supervision Depreciation Total Actual Results Machine-hours Direct labor wages Supplies Maintenance Utilities Supervision Depreciation Total 42,000 $ 81,800 25,300 24,300 22,000 49,000 49,000 83,000 83,000 $ 285,400 $ 276,800 Planning Budget 40,000 $ 79,600 23, 200 Actual Results "I just can't understand all of these unfavorable variances," Weston complained to the supervisor of another department. "When the boss called me in, I thought he was going to give me a pat on the back because I know my department worked more efficiently last month than ever before. Instead, he tore me apart. I thought for a minute it…arrow_forward

- Kendall & Floyd provides landscaping services in Eastvale. Sara Kendall, the owner, is concerned about the recent losses the company has incurred and is considering dropping its yard cleanup services, which she feels are marginal to the company's business. She estimates that doing so will result in lost revenues of $67,800 per year (including the lost tree business from customers who use the company for both services). The present manager will continue to supervise the tree services with no reduction in salary. Without the yard cleanup business, Sara estimates that the company will save 14 percent of the equipment leases, labor, and other costs. She also expects to save 29 percent on rent and utilities. The Income statement before dropping the yard cleanup service follows. Required: a. Prepare a report of the differential costs and revenues if the yard cleanup service is discontinued. b. Should Sara discontinue the yard cleanup service? Complete this question by entering your answers…arrow_forwardJan Harry, a mechanical engineer, was informed that she would be promoted to assistant factory manager. Jan was pleased but uncomfortable. In particular, she knew little about accounting. She had taken one course in "Financial" accounting. Jan planned to enroll in a management accounting course as soon as possible. Meanwhile, she asked you, as company's cost accountant, to state four of the principal distinctions between financial and management accounting. Prepare your response to Jan Harry.arrow_forwardjarrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education