FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

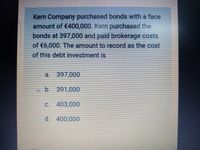

Transcribed Image Text:Kern Company purchased bonds with a face

amount of €400,000. Kern purchased the

bonds at 397,000 and paid brokerage costs

of €6,000. The amount to record as the cost

of this debt investment is

a. 397,000

b. 391,000

C. 403,000

d. 400,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- If $457,000 of 8% bonds are issued at 94, what is the amount of cash received from the sale? Select the correct answer. A. $420,440 B. $457,000 C. $429,580 D. $493,560arrow_forwardIf $1,059,000 of 12% bonds are issued at 102 3/4, the amount of cash received from the sale is a. $1,186,080 b. $1,088,123 c. $1,059,000 d. $794,250arrow_forwardIf $1,051,000 of 12% bonds are issued at 102 1/2, The amount of cash received from the sale is:arrow_forward

- A long-term investment in bonds with a cost of $80,000 was sold for $75,000 cash. What was the gain or loss on the sale? Group of answer choices $5,000 loss on sale of investment $75,000 gain on sale of investment No gain or loss on sale of investment $5,000 gain on sale of investmentarrow_forwardIf $571,000 of 9% bonds are issued at 98, the amount of cash received from the sale is a.$519,610 b.$571,000 c.$559,580 d.$622,390arrow_forward#7 ABC Company purchased bonds with a face amount of $1200000 between interest payment dates. ABC purchased the bonds at 102, paid brokerage costs of $15800, and paid accrued interest for three months of $25800. The amount to record as the cost of this long-term investment in bonds is $1239800. $1200000. $1224000. $1265600.arrow_forward

- If $1,153,000 of 9% bonds are issued at 102 1/2, The amount of cash received from the sale is a.$1,153,000 b.$864,750 c.$1,256,770 d.$1,181,825arrow_forward7arrow_forwardEddie Industries issues $926,000 of 8% bonds at 102. The amount of cash received from the sale is a.$926,000 b.$1,000,080 c.$898,220 d.$944,520arrow_forward

- If $510,000 of 8% bonds are issued at 94, the amount of cash received from the sale is a.$479,400 b.$510,000 c.$469,200 d.$550,800arrow_forwardCompany X pays interest to the amount of R1 500 a year on total liabilities of R10 000. It can also issue bonds with a YTM of 12%. What will the relevant before tax cost of debt be when calculating that WACC for the company? a. 18% b. 12% c. 15% d. 8%arrow_forwardHorizons plc had the following bank loans outstanding during the whole of 20X8 which form the company’s general borrowings for the year: £m 10% loan repayable 20X9 250 8% loan repayable 20Y2 750 Horizons plc began construction of a qualifying asset on 1 May 20X8 and withdrew funds of £45 million on that date to fund construction. On 1 September 20X8 an additional £60 million was withdrawn for the same purpose. Calculate the borrowing costs which can be capitalised in respect of this project for the year ended 31 December 20X8. Select one: a. £5,000,000 b. £4,250,000 c. £5,418,750 d. £850,000 e. £8,925,000 f. £3,056,250arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education