Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

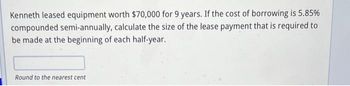

Transcribed Image Text:Kenneth leased equipment worth $70,000 for 9 years. If the cost of borrowing is 5.85%

compounded semi-annually, calculate the size of the lease payment that is required to

be made at the beginning of each half-year.

Round to the nearest cent

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Similar questions

- If lease payments on an office call for $1,550 per month (paid at the beginning of the month) for 24 months, what is the current value of the lease to the landlord. Assume an annual discount rate of 15 percent. Ans.arrow_forwardA lease valued at $18,000 requires payments of $1,813 at the beginning of every month. If money is worth 6% compounded monthly, what is the size of the final lease payment? The size of the final payment is $. (Round the final answer to the nearest cent as needed. Round all intermediate values to six decimal places as needed.)arrow_forwardA company lease equipment for 7 years. The equipment cost 28,000 and the owner wants to earn 9.5 percent on the lease. What should be the required lease payments?arrow_forward

- After two years in business, the owners have saved (have a surplus of) $123,750.00. They must decide if they will invest in property or investment bonds. If they invest in a property and a vehicle, the total cost will be $445,500,00, of which $123,750.00 will be required as a down payment. The fixed interest rate on the mortgaged amount is 5.40% compounded semi-annually for a term of 13 years. 5. What is the size of the semi-annual payments required to settle this mortgage? 6. What is the size of the final payment? 7. How long would it take (in months) to settle this loan with regular monthly payments of exactly $2000 instead of the PMT value calculated in Part 5?arrow_forwardA lease valued at $40,000 requires payments of $5000 every three months. If the first payment is due three years after the lease was signed and interest is 10% compounded quarterly, what is the term of the lease? The term of the lease is quarters. (Round up to the nearest quarter.)arrow_forwardKatie secured a lease on a machine by paying $1,550 as a down payment and then $650 at the beginning of every month for 6 years. The lease rate was 4.50% compounded monthly. a. What was the principal amount of the lease? $0.00 Round to the nearest cent b. What was the cost of the machine? $0.00 Round to the nearest cent c. What was the amount of interest paid over the term of the lease? $0.00 Round to the nearest centarrow_forward

- Compute the interest paid on a 4-year lease for a $26, 498 car if the annual rate of depreciation is 17% and the lease's annual interest rate is 5.1%.arrow_forwardKyle secured a lease on a machine by paying $2,000 as a down payment and then $700 at the beginning of every month for 5 years. The lease rate was 5.75% compounded monthly. a. What was the principal amount of the lease? Round to the nearest cent b. What was the cost of the machine? Round to the nearest cent c. What was the amount of interest paid over the term of the lease? Round to the nearest centarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education