FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

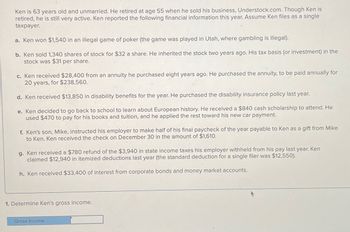

Transcribed Image Text:Ken is 63 years old and unmarried. He retired at age 55 when he sold his business, Understock.com. Though Ken is

retired, he is still very active. Ken reported the following financial information this year. Assume Ken files as a single

taxpayer.

a. Ken won $1,540 in an illegal game of poker (the game was played in Utah, where gambling is illegal).

b. Ken sold 1,340 shares of stock for $32 a share. He inherited the stock two years ago. His tax basis (or investment) in the

stock was $31 per share.

c. Ken received $28,400 from an annuity he purchased eight years ago. He purchased the annuity, to be paid annually for

20 years, for $238,560.

d. Ken received $13,850 in disability benefits for the year. He purchased the disability insurance policy last year.

e. Ken decided to go back to school to learn about European history. He received a $840 cash scholarship to attend. He

used $470 to pay for his books and tuition, and he applied the rest toward his new car payment.

f. Ken's son, Mike, instructed his employer to make half of his final paycheck of the year payable to Ken as a gift from Mike

to Ken. Ken received the check on December 30 in the amount of $1,610.

g. Ken received a $780 refund of the $3,940 in state income taxes his employer withheld from his pay last year. Ken

claimed $12,940 in itemized deductions last year (the standard deduction for a single filer was $12,550).

h. Ken received $33,400 of interest from corporate bonds and money market accounts.

1. Determine Ken's gross income.

Gross income

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- George has a gross estate valued at $1.8 million. His estate consists almost entirely of publicly held stock owned solely by him. He owes no debts. George's only living relative is a nephew whom he hasn't seen or heard from in 30 years. George has not executed a valid will. If George were to die in the current year without change in any of the related facts, which one of the following is a disadvantage of the probate process for George? A) It will not allow payment of a personal representative's fee to reduce his estate tax so that it can be covered by the allowable unified credit. B) It will not allow George's estate to be subject to court supervision regarding payment of claims and distribution. C) It will not allow George's estate to claim a marital deduction to reduce the taxable estate. D) It will not allow distribution of his estate without incurring considerable cost in attempting to locate his nephew.arrow_forwardJust prior to a major medical procedure, Cody gives his son, Liam, stock in Robin Corporation (fair market value of $1,624,200 and basis of $2,273,880). At the time of the gift, Cody held some unused capital losses. The surgery is unsuccessful, and after Cody's death, Liam sells the stock for $2,501,268. Question Content Area a. What is the income tax result for Liam? $fill in the blank c46f48f55fc1018_1 Question Content Area b. What if the gift had not been made and the stock passed to Liam as a bequest from Cody?arrow_forwardBob died with a gross estate of $4,500,000, half of which is attributable to the value of stock in Graystone Inc., a closely held corporation. Bob owns 80% of Graystone Inc. He had no debts, and his estate administrative expenses were $50,000, of which $10,000 constitutes the personal representative's statutory fee. His will named his wife, Pearl, as the sole beneficiary of his estate and as his personal representative. Bob made no lifetime taxable gifts. Which of the following postmortem techniques are available and advisable for Bob's estate or its sole beneficiary, Pearl? Election of Section 6166 payment of estate taxes Use of the alternate valuation date Waiver by Pearl of the right to her statutory fee as personal representative Election of a Section 303 stock redemption A) III and IV B) II only C) I and II D) I, III, and IVarrow_forward

- Tom Brown is 36 years old and has never been married. Frank, age 13, is Tom1s nephew who lived with hin all year. Tom provided all of his support and provifded over half the cost of keeping up the home. Tom earned 44,000 in wages Tom is legally blind and cannot be claiment as a dependent by another taxpayer. Tom and Frank are U.S citizens, have valid social securities numbers, and lived in the U.S. the entire year. Do the individual income tax return? If need to use a state use mississippiarrow_forwardRahularrow_forwardSadie sold 11 shares of stock to her brother, George, for $600 sixteen months ago. Sadie had purchased the stock for $800 two years earlier. If George sells the stock for $1,000 what is the amount and character of his recognized gain or loss in the current year?arrow_forward

- Bruce and Amanda are married during the tax year. Bruce is a botanist at Green Corporation. Bruce earns a salary of $56,000 per year. Green Corporation has an accountable reimbursement plan. During the year, Bruce has $5,000 of employee expenses. Green Corporation reimburses Bruce for only $4,000 of expenses.Bruce decides to put $5,500 into a Traditional IRA. Amanda owns a financial consulting firm as a sole proprietor (it qualifies as a full trade or business). Amanda generates $80,000 of revenues during the year. She has the following business payments associated with her firm:● Utilities: $2,000● Office Rent: $14,000● Self-Employment Tax: $5,000● Salary for her secretary: $20,000● Fines/Penalties: $8,000● Payroll Taxes (Employer Portion): $1,000● Business Meals: $2,000● Bribe to police officer to forgive parking violation $1,500Due to the income and expenses above, Amanda has $39,500 of Qualified Business Income. Also, during the year a tornado damaged the roof of their personal…arrow_forwardHannah Tywin owns 100 shares of MM Inc. stock. She sells the stock on December 11 for $25 per share. She received the stock as a gift from her Aunt Pam on March 20 of this year when the fair market value of the stock was $18 per share. Aunt Pam originally purchased the stock seven years ago at a price of $12 per share. What is the amount and character of Hannah's recognized gain or loss on the stock?arrow_forwardPaul sold 200 shares of C Corporation stock on September 3, 2018, for $42 a share. He received the stock from his father on June 25, 1980, as an inheritance. His father originally purchased the stock for $10 per share in 1967. The stock was valued at $14.50 per share on the date of inheritance. How to compute Paul's capital gain for tax return.arrow_forward

- Sean sells land to Eli, his brother, for the fair market value of $39,000. Six months later when the land is worth $45,000, Eli sells the property to his son, Jon, without gift tax. His son sells the land for $47,000. Sean’s adjusted basis for the land is $24,000 what is Jon’s recognized gain or loss on the sales?arrow_forwardrequired: complete page 1 of form 1040, line 1-7b and form 1040, schedule 1, lines 1-9 for Kenarrow_forwardGary receives $40,000 worth of Quantro, Inc., common stock from his late grandmother's estate. Early in the year, he receives a $100 cash dividend. Four months later, he received a 2% stock dividend. Near the end of the year, Gary sells the stock for $42,000. Due to these events only, how much must Gary include in his gross income for the year?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education