FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

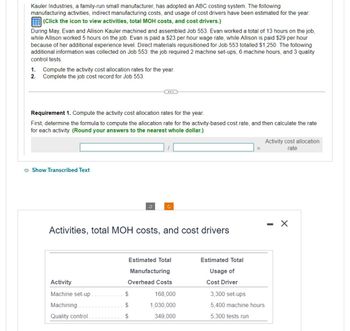

Transcribed Image Text:Kauler Industries, a family-run small manufacturer, has adopted an ABC costing system. The following

manufacturing activities, indirect manufacturing costs, and usage of cost drivers have been estimated for the year:

(Click the icon to view activities, total MOH costs, and cost drivers.)

During May, Evan and Allison Kauler machined and assembled Job 553. Evan worked a total of 13 hours on the job,

while Allison worked 5 hours on the job. Evan is paid a $23 per hour wage rate, while Allison is paid $29 per hour

because of her additional experience level. Direct materials requisitioned for Job 553 totalled $1,250. The following

additional information was collected on Job 553: the job required 2 machine set-ups, 6 machine hours, and 3 quality

control tests.

1. Compute the activity cost allocation rates for the year.

2. Complete the job cost record for Job 553.

Requirement 1. Compute the activity cost allocation rates for the year.

First, determine the formula to compute the allocation rate for the activity-based cost rate, and then calculate the rate

for each activity. (Round your answers to the nearest whole dollar.)

Show Transcribed Text

Activity

Machine set-up.

Machining.

Quality control.

v

Activities, total MOH costs, and cost drivers

C

Estimated Total

$

$

$

Manufacturing

Overhead Costs

168,000

1,030,000

349,000

Estimated Total

Usage of

Cost Driver

3,300 set-ups

5,400 machine hours

5,300 tests run

Activity cost allocation

rate

X

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The company applies all of its overhead costs to jobs based on direct labor-hours. At the beginning of the year, it made the following estimates: Direct labor-hours required to support estimated output Fixed overhead coat Variable overhead cost per direct labor-hour Required: 1. Compute the predetermined overhead rate. 2. During the year, Mr. Wilkes brought in his vehicle to replace his brakes, spark plugs, and tires. The following information was available with respect to his job: Direct materials Direct labor cost Direct labor-bours used Compute Mr. Wilkes' total job cost. 3. If Speedy establishes its selling prices using a markup percentage of 40% of its total job cost, then how much would it have charged Mr. Wilkes? Required 1 Required 2 $ 703 $317 . Complete the question by entering your answers in the tabs given below. Overhead applied Total cost assigned to Mr. Wilkes 22,000 $ 253,000 $ 1.00 Required 3 Compute Mr. Wilkes' total job cost. (Round your intermediate calculations to…arrow_forwardYou work for Thunderduck Custom Tables Inc. This is the first month of operations. The company designs and manufactures specialty tables. Each table is specially customized for the customer. This month, you have been asked to develop and manufacture two new tables for customers. You will design and build the tables. The company does not have indirect materials. You will keep track of the costs incurred to manufacture the tables using Job #1 Cost Sheet and Job #2 Cost Sheet.The company uses a job order costing system and applies manufacturing overhead to jobs based on direct labor hours. The total estimated manufacturing overhead costs per month is $6,300. The company estimates that there will be 120 direct labor hours worked during the month.1 - What is the predetermined overhead rate (POHR)?Data 2: The cost of the direct materials that can be used to manufacture the table are as follows. Table Top $2,200Table legs, quantity 4 ($750 per leg)$3,000Drawer$420 Data 3: Assume a $70 per…arrow_forwardLancelot Manufacturing is a small textile manufacturer using machine-hours as the single indirect-cost rate to allocate manufacturing overhead costs to the various jobs contracted during the year. The following estimates are provided for the coming year for the company and for the Case High School band jacket job. Direct materials Direct labor Manufacturing overhead costs Machine-hours $1,160 some other amount What is the bid price for the Case High School job if the company uses a 40% markup of total manufacturing costs? $4,746 $4,060 Company $55,000 $22,000 $49.000 70,000 mh $1.356 Case High School Job $2,300 $600 700 mharrow_forward

- Coronado Company produces high-quality microscopes for education and health care uses. The company uses a job order costing system. Because the microscopes’ optics require significant manual labor to ensure adherence to strict manufacturing specifications, the company applies overhead on the basis of direct labor hours. At the beginning of 2021, the company estimated its manufacturing overhead would be $1,960,000 and that employees would work a total of 49,000 direct labor hours. During March, the company worked on the following five jobs: Job BeginningBalance Direct Materialsadded duringMarch Direct Laboradded duringMarch Direct Labor Hoursadded duringMarch 134 $120,600 $6,000 $9,400 140 158 125,450 3,500 12,160 450 212 21,800 88,400 36,650 3,500 287 36,350 71,800 31,850 2,550 301 18,990 21,845 1,400 Total $304,200 $188,690 $111,905 8,040 Jobs 134 and 158 were started in January,…arrow_forwardA company employees two consultants who each have a different specialization. Caitlin specializes in industrial commercial construction and Zachary specializes in residential construction. The company expects to incur total overhead costs of $573,540 during the year and applies overhead based on annual salary costs. Caitlin's annual salary is $168,300, and she is expected to bill 2,400 hours during the year. Zachary's annual salary is $92,400, and he is expected to bill 2,200 hours during the year. Required: a. Calculate the predetermined overhead rate. b. Assuming that the hourly billing rate should be set to cover the total cost of services plus a 25% markup, compute the hourly billing rates for Caitlin and Zachary Complete this question by entering your answers in the tabs below. Required A Required B Calculate the predetermined overhead rate. Predetermined overhead rate %arrow_forwardHartley Uniforms produces uniforms. The company allocates manufacturing overhead based on the machine hours each job uses. Hartley Uniforms reports the following cost data for the past year: Budget Actual 7,600 hours 6,100 hours Direct labor hours Machine hours 7,200 hours 6,300 hours Depreciation on salespeople's autos $23,000 $23,000 Indirect materials $48,500 $50,500 Depreciation on trucks used to deliver uniforms to customers solla $13,000 $70,000 $40,000 $11,000 Depreciation on plant and equipment Indirect manufacturing labor $72,500 $42,000 Customer service hotline $19,000 $21,000 Plant utilities $35,900 $38,400 Direct labor cost $72,500 $85,500 Requirements 1odel tba 1. Compute the predetermined manufacturing overhead rate. 2. Calculate the allocated manufacturing overhead for the past year. 3. Compute the underallocated or overallocated manufacturing overhead. How will this underallocated or overallocated manufacturing overhead be disposed of? 4. How can managers usA accoarrow_forward

- McClellan Recreation manufactures and sells two models of paddle boards: Starter and Pro. The Starter model is a basic board used for instruction and purchased by novices. The Pro model is made with premium materials and comes with several accessories. The boards are produced to order, and there are no inventories at the end of the year. The cost accounting system at McClellan allocates overhead to products based on direct labor cost. Overhead in year 1, which just ended, was $2,536,800. Data on units sold for year 1 along with the unit sales price and unit direct costs for the two models follow: Sales price per unit Direct materials per unit Direct labor per unit Required: a. Compute product line profits or loss for the Starter model and the Pro model for year 1. b. A study of overhead shows that without the Starter model, overhead would fall to $1,442,000. Assume all other revenues and costs would remain the same for the Pro model in year 2. Compute product line profits for the Pro…arrow_forwardAirQual Test Corporation provides on-site air quality testing services. The company has provided the following cost formulas and actual results for the month of February: Revenue Technician wages Mobile lab operating expenses Office expenses Advertising expenses Insurance Miscellaneous expenses Jobs Revenue Expenses: Technician wages Mobile lab operating expenses Office expenses The company uses the number of jobs as its measure of activity. For example, mobile lab operating expenses should be $4,700 plus $32 per job, and the actual mobile lab operating expenses for February were $9,340. The company expected to work 150 jobs in February, but actually worked 158 jobs. Advertising expenses Insurance Miscellaneous expenses Required: Prepare a flexible budget performance report showing AirQual Test Corporation's revenue and spending variances and activity variances for February. (Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education