Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

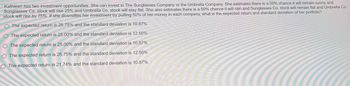

Transcribed Image Text:Kathleen has two investment opportunities. She can invest in The Sunglasses Company or the Umbrella Company. She estimates there is a 50% chance it will remain sunny and

Sunglasses Co. stock will rise 25% and Umbrella Co. stock will stay flat. She also estimates there is a 50% chance it will rain and Sunglasses Co. stock will remain flat and Umbrella Co.

stock will rise by 75%. If she diversifies her investment by putting 50% of her money in each company, what is the expected return and standard deviation of her portfolio?

The expected return is 28.75% and the standard deviation is 10.87%

O The expected return is 25.00% and the standard deviation is 12.50%

O The expected return is 25.00% and the standard deviation is 10.87%

O The expected return is 28.75% and the standard deviation is 12.50%

O The expected return is 21.74% and the standard deviation is 10.87%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Charlie is planning to buy a small apartment complex; the complex will cost $1,000,000 and they will generate $450,000 in profits over the next three years. The complex will also need $50,000 in renovations during year 4. Charlie's required rate of return is 17%. What is the NPV on Charlie's investment ___? and should Charlie purchase the apartments___? yes or noarrow_forwardJoe is a new investor and has been closely watching a company by the name of USA Ltd., a pharmaceutical company aiming to develop a coronavirus vaccine. Joe believes the following returns are possible in 2022 and has attached a probability to each potential outcome: Probability Possible Return .20 185.00% .30 83.50% .30 -5.00% .20 -100.00% d) Joe is considering investing all his savings in buying shares in USA Ltd. Explain to Joe why he should not do this by referring to the risk/return trade-off and what action Joe can take to reduce some of the riskarrow_forwardJade is CEO of InvestCo, a financial advisory firm for the wealthy. Her firm’s WACC is 9.00%. Her firm is investigating two projects, and they have asked you to determine which one to pursue. Project Y requires an initial investment of $132,000, while project Z requires an up-front investment of $122,000. Given the cashflows for each project listed below, answer the following questions. (important: make sure to place negative sign (-) in front of any negative cash flow.) A.) what is the NPV of the project that has the highest NPV? B.) what is the IRR of the project that has the highest IRR? C.) What is the Profitability Index of the Project that has the highest Profitability Index? Year Project Y Project Z 1 62,400 60,400 2 52,900 52,400 3 52,200 41,800 For NPV: write dollar amounts out to the penny with no dollar sign. Make sure you show negative sign (-) to indicate negative NPV. For IRR: interest…arrow_forward

- Mrs. John wants to take the next three years off work to travel around the world. She estimates herannual cash needs at $20,000. Mrs. John believes she can invest her savings at 10% until she depletesher funds. Table factor at 10% is 4.883 and at 7% is 4.152To find out how much she should invest now to fund her future cash flow if she invests at 10%. Or whatto invest if only earn 7 %.( Present value of annuity)arrow_forwardMisty needs to have $20,000 at the end of 6 years to fulfill her goal of purchasing a small sailboat. She is willing to invest a lump sum today and leave the money untouched for 6 years until it grows to $20,000, but she wonders what sort of investment return she will need to earn to reach her goal. Use your calculator or spreadsheet to figure out the annually compounded rate of return needed if she can invest $13,900 today.arrow_forwardFrank Zanca is considering three different investments that his broker has offered to him. The different cash flows are as follows: End of Year A 1 $300 B C $400 2 $300 3 $300 4 $300 $300 $600 5 $300 6 $300 $300 $300 $600 7 8 Because Frank only has enough savings for one investment, his broker has proposed alternative C to be, according to his expertise, "the best in town." However, Frank questions his broker. Calculate the present value of each investment, assuming a 15% discount rate. Which is Frank's best alternative? Select one: a. Investment A O b. Investment B c. Investment C O d. He should not invest in any of the suggested investments O e. All of the investments are equally goodarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education