FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

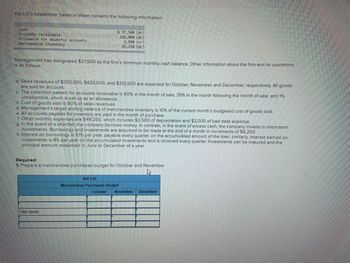

Transcribed Image Text:Kat Ltd.'s September balance sheet contains the following information:

Cash

Accounts receivable.

Allowance for doubtful accounts

Merchandise inventory

$ 37,500 (dr)

126,000 (dr)

2,800 (cr)

26,250 (dr)

Management has designated $37,500 as the firm's minimum monthly cash balance. Other information about the firm and its operations

is as follows:

a. Sales revenues of $350,000, $420,000, and $312,500 are expected for October, November, and December, respectively. All goods

are sold on account.

b. The collection pattern for accounts receivable is 60% in the month of sale, 39% in the month following the month of sale, and 1%

uncollectible, which is set up as an allowance.

c. Cost of goods sold is 60% of sales revenues.

d. Management's target ending balance of merchandise inventory is 10% of the current month's budgeted cost of goods sold.

e. All accounts payable for inventory are paid in the month of purchase.

f. Other monthly expenses are $49,250, which includes $3,500 of depreciation and $2,000 of bad debt expense.

g. In the event of a shortfall, the company borrows money. In contrast, in the event of excess cash, the company invests in short-term

investments. Borrowings and investments are assumed to be made at the end of a month in increments of $6,250.

h. Interest on borrowings is 0% per year, payable every quarter, on the accumulated amount of the loan; similarly, interest earned on

investments is 8% per year on the accumulated investments and is received every quarter. Investments can be matured and the

principal amount redeemed in June or December of a year.

Required:

1. Prepare a merchandise purchases budget for October and November.

Total needs

Kat Ltd.

Merchandise Purchases Budget

October November December

Transcribed Image Text:Mc

Graw

Hill

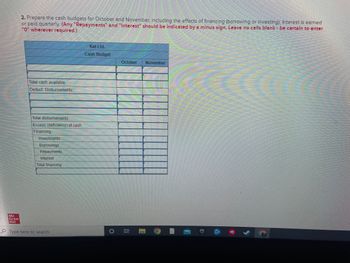

2. Prepare the cash budgets for October and November, including the effects of financing (borrowing or investing). Interest is earned

or paid quarterly. (Any "Repayments" and "Interest" should be indicated by a minus sign. Leave no cells blank be certain to enter

"0" wherever required.)

Total cash available

Deduct: Disbursements:

Total disbursements

Excess (deficiency) of cash

Financing:

Investments

Borrowings

Repayments

Interest

Total financing

Type here to search

Kat Ltd.

Cash Budget

O

October

Ri

November

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 5 images

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

How did you get 109200 and why not use the 126000

Solution

by Bartleby Expert

Follow-up Question

can you explain why you used the 2800$

Solution

by Bartleby Expert

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

How did you get 109200 and why not use the 126000

Solution

by Bartleby Expert

Follow-up Question

can you explain why you used the 2800$

Solution

by Bartleby Expert

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On December 1, the Accounts Receivable account of FDNACCT Services had a P84,000 debit balance. During December, the business earned P165,500 in revenue, of which 70% are on account. Total collections of account amounted to $23,000. How much is the balance of Accounts Receivable account as of December 31?arrow_forwardOn July 31, Bristlecone Pine Art Ltd. had a $54,500 balance in Accounts Receivable and a $3,100 credit balance in Allowance for Uncollectible Accounts. During August, Bristlecone Pine Art Ltd. made credit sales of $42,000. August cash collections on account were $17,800; write-offs of uncollectible receivables totalled $1,200; and an account of $400 was recovered. After careful assessment of the updated accounts receivables, Bristlecone Pine Art Ltd. estimates that $3,800 won't be collected. Blank #1: What is the updated Accounts Receivable balance? Blank #2: What is the updated Allowance for Uncollectible Accounts balance? Blanks #3-6: Record the estimated uncollectible amount accordingly. Enter the information in the following order: Blank #3: Debit account Blank #4: Debit $-amount Blank #5: Credit account Blank #6: Credit $-amount Required formatting: For $-amounts, only enter the plain number without $-sign, commas etc. Round results to full units (i.e., round to dollar).arrow_forwardAn analyst has obtained the following information regarding ABC, Inc. Using this information, he needs to estimate the company's Accounts Payable. Sales = $93,398Cost of Goods Sold (COGS) = $36,052Cash Cycle = 22 daysOperating Cycle = 86 daysAccounts Receivable Period = AR Period = Average Collection Period (ACP) = 40 daysWhat is the company's Accounts Payable balance?arrow_forward

- At December 1, 2023, Imalda Inc. reported the following information on its statement of financial position: Accounts receivable Allowance for doubtful accounts $154,000 4,500 (credit balance) The following transactions were completed during December 2023: December 5 Sold merchandise items for $67,000. An amount of $19,000 was received in cash and the rest on account; terms 2/10, n/60. The total cost of sales was $35,000. December 12 Collected amount due from customers for credit sales made on December 5. December 20 Collected $90,000 in cash from customers for credit sales made in November 2023. December 26 One of Imalda's customers that owed $3,000 to the company experienced financial problems and was forced to close its business in December. The full amount was considered uncollectible. Total Estimated % uncollectible The company records sales revenue net of the sales discount. If a customer pays after the discount period, the sales discount that is forfeited is recorded in a…arrow_forwardWhat is the Correct Answerarrow_forwardHarvest Company has the following December 31 General Ledger Account Balances after adjustments relating to Sales and Receivables: Sales $28,500 (of which 40% are credit sales still outstanding) Sales returns and Allowances $1,000 Miscellaneous Receivables $1,212 Allowance for Doubtful Accounts $1,502 Long term Receivables $9,014 Advances to Shareholders and Directors $4,266 Notes Receivables $2,903 (Current Portion) Bad Debt Expense is estimated as 4% of credit sales Required 1: Assuming no other transaction happened, what is the Bad Debt Expense reported on Decmber 31st? Required 2: Assuming no other transaction happened, what is the adjusted net balance of all current Receivables at December 31st? Required 3: Assuming no other transaction happened, what is the adjusted net balance of Accounts Receivables at December 31st?arrow_forward

- Ashvinnbhaiarrow_forwardA company had a beginning Accounts Receivable balance of $939,400 and a credit balance of $1,200 in the Allowance for Doubtful Accounts. During the month, total sales of $5,275,000 were made. Of the total sales, $4,150,000 were credit sales while the remaining amount was cash sales. The company collected $3,825,000 from customers for amounts owed. It estimates that 0.5% of credit sales are uncollectible. Prepare the adjusting entry at the end of the month. Account Names DR CR Blank 1. Fill in the blank, read surrounding text. Blank 2. Fill in the blank, read surrounding text. Blank 3. Fill in the blank, read surrounding text. Blank 4. Fill in the blank, read surrounding text. Blank 5. Fill in the blank, read surrounding text. Blank 6. Fill in the blank, read surrounding text. Blank 7. Fill in the blank, read surrounding text. Blank 8. Fill in the blank, read surrounding text. Blank 9. Fill in the blank, read surrounding text. Blank 10. Fill in the blank, read…arrow_forwardThe following information is available for Market, Incorporated and Supply, Incorporated at December 31. Accounts Accounts receivable Allowance for doubtful accounts Sales revenue Required Market, Incorporated Supply, Incorporated $56,800 $80,200 3,048 666,960 2,456 887,100 a. What is the accounts receivable turnover for each of the companies? b. What is the average days to collect the receivables? c. Assuming both companies use the percent of receivables allowance method, what is the estimated percentage of uncollectible accounts for each company? Complete this question by entering your answers in the tabs below. Required A Required B Required C What is the average days to collect the receivables? (Use 365 days in a year. Do not round intermediate calculations. Round your answers to the nearest whole number.) Company Market Supply Average Collection Period days daysarrow_forward

- A company had the following sales transactions: 1. Total debit card sales = $280,000. 2. Total credit card sales = $410,000. 3. Total cash sales = $840,000. 4. Total check sales = $160,000. There is a charge of 3% on all credit card transactions. There is no charge on debit card transactions. Calculate total sales revenue recorded for the year. Sales revenuearrow_forwardHarvest Company has the following December 31 General Ledger Account Balances after adjustments relating to Sales and Receivables: Sales $34,000 (of which 40% are credit sales still outstanding) Sales returns and Allowances $1,000 Miscellaneous Receivables $1,212 Allowance for Doubtful Accounts $1,502 Long term Receivables $9,014 Advances to Shareholders and Directors $4,508 Notes Receivables $2,903 (Current Portion) Bad Debt Expense is estimated as 4% of credit sales Required 1: Assuming no other transaction happened, what is the Bad Debt Expense reported on December 31st? $ 544 Required 2: Assuming no other transaction happened, what is the adjusted net balance of all current Receivables at December 31st? $ 14812 Required 3: Assuming no other transaction happened, what is the adjusted net balance of Accounts Receivables at December 31st? $ 23826arrow_forwardThe following information is available for Market, Inc. and Supply, Inc. at December 31: Accounts Market, Inc. Supply, Inc. Accounts receivable $ 58,600 $ 76,600 Allowance for doubtful accounts 2,748 3,156 Sales revenue 646,960 907,100 Requireda. What is the accounts receivable turnover for each of the companies?b. What is the average days to collect the receivables?c. Assuming both companies use the percent of receivables allowance method, what is the estimated percentage of uncollectible accounts for each company?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education