FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

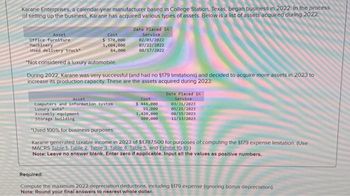

Transcribed Image Text:Karane Enterprises, a calendar-year manufacturer based in College Station, Texas, began business in 2022. In the process

of setting up the business, Karane has acquired various types of assets. Below is a list of assets acquired during 2022

Asset

Office furniture

Machinery

Used delivery truck

*Not considered a luxury automobile.

Cost

$ 370,000

1,604,000

84,000

Date Placed in

Service

02/03/2022

07/22/2022

08/17/2022

During 2022, Karane was very successful (and had no $179 limitations) and decided to acquire more assets in 2023 to

increase its production capacity. These are the assets acquired during 2023:

Cost

$ 444,000

91,000

Asset

Computers and information system

Luxury auto

Assembly equipment

Storage building

"Used 100% for business purposes.

Karane generated taxable income in 2023 of $1,787,500 for purposes of computing the $179 expense limitation. (Use

MACRS Table 1. Table 2. Table 3. Table 4. Table 5, and Exhibit 10-10)

Note: Leave no answer blank. Enter zero if applicable. Input all the values as positive numbers.

Date Placed in

Service

03/31/2023

05/26/2023

1,420,000

800,000

08/15/2023

11/13/2023

Required:

Compute the maximum 2022 depreciation deductions, including 5179 expense (ignoring bonus depreciation)

Note: Round your final answers to nearest whole dollar.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Memanarrow_forwardAcquisition of Land and Building On February 1, 2019, Edwards Corporation purchased a parcel of land as a factory site for $100,000. It demolished an old building on the property and began construction on a new building that was completed on October 2, 2019. Costs incurred during this period are: Demolition of old building $ 8,000 Architect's fees 20,000 Legal fees for title investigation and purchase contract 5,000 Construction costs 625,000 Edwards sold salvaged materials resulting from the demolition for $2,000. Required: 1. At what amount should Edwards record the cost of the land and the new building, respectively? If an input box should be blank, enter a zero. Land Building Purchase price of land Demolition of old building Architect's fees Legal fees Construction costs Salvaged materials Total 2. Next Level If management misclassified a portion of the building's cost as part of the cost of the land, what would be the effect on the financial statements?arrow_forward! Required information [The following information applies to the questions displayed below.] Burbank Corporation (calendar-year-end) acquired the following property this year: (Use MACRS Table 1. Table 2, and Exhibit 10-10.) Asset Used copier New computer equipment Furniture New delivery truck Luxury auto Total Placed in Service November 12 June 6 Maximum cost recovery deduction July 15 October 28 January 31 Basis $ 12,200 18,400 36,400 23,400 74,400 $ 164,800 Burbank acquired the copier in a tax-deferred transaction when the shareholder contributed the copier to the business in exchange for stock. Note: Round your answer to the nearest whole dollar amount. Check my work a. Assuming no bonus or §179 expense, what is Burbank's maximum cost recovery deduction for this year?arrow_forward

- Required information [The following information applies to the questions displayed below.] Hero Sandwich Shop had the following long-term asset balances as of January 1, 2024: Land Building Equipment Patent Cost $86,000 451,000 227,900 205,000 Accumulated Depreciation Book Value $86,000 288,640 179,700 123,000 • Hero purchased all the assets at the beginning of 2022. • The building is depreciated over a 10-year service life using the double-declining-balance method and estimating no residual Land Building Equipment Patent 0 value. • The equipment is depreciated over a 9-year service life using the straight-line method with an estimated residual value of $11,000. HERO SANDWICH SHOP December 31, 2024 $(162,360) (48,200) (82,000) • The patent is estimated to have a five-year useful life with no residual value and is amortized using the straight-line method. • Depreciation and amortization have been recorded for 2022 and 2023 (first two years). 3. Calculate the book value for each of the…arrow_forwardMunabhaiarrow_forwardKarane Enterprises, a calendar-year manufacturer based in College Station, Texas, began business in 2022. In the process of setting up the business, Karane has acquired various types of assets. Below is a list of assets acquired during 2022: Date Placed in Asset Office furniture Machinery Used delivery truck* Cost Service $ 400,000 1,810,000 90,000 02/03/2022 07/22/2022 08/17/2022 *Not considered a luxury automobile. During 2022, Karane was very successful (and had no §179 limitations) and decided to acquire more assets in 2023 to increase its production capacity. These are the assets acquired during 2023: Asset Computers and information system Luxury auto* Assembly equipment Storage building Date Placed in Service 03/31/2023 Cost $ 450,000 92,500 1,450,000 800,000 05/26/2023 08/15/2023 11/13/2023 *Used 100% for business purposes. Karane generated taxable income in 2023 of $1,795,000 for purposes of computing the $179 expense limitation. (Use MACRS Table 1, Table 2, Table 3, Table 4,…arrow_forward

- Required information [The following information applies to the questions displayed below.] Evergreen Corporation (calendar year-end) acquired the following assets during the current year: (Use MACRS Table 1 and Table 2.) * Asset Machinery Computer equipment Used delivery truck* Furniture Date Placed in Service October 25 February 3 August 17 April 22 Depreciation Original Basis $ 102,000 34,000 47,000 190,000 The delivery truck is not a luxury automobile. Note: Do not round intermediate calculations. Round your answers to the nearest whole dollar amount. b. What is the allowable depreciation on Evergreen's property in the current year if Evergreen does not elect out of bonus depreciation and elects out of §179 expense?arrow_forwardWant the Correct answer of whatarrow_forwardRequired Information [The following information applies to the questions displayed below.] Karane Enterprises, a calendar-year manufacturer based in College Station, Texas, began business in 2018. In the process of setting up the business, Karane has acquired various types of assets. Below is a list of assets acquired during 2018: Office furniture Machinery Used delivery truck* *Not considered a luxury automobile. During 2018, Karane was very successful (and had no §179 limitations) and decided to acquire more assets in 2019 to Increase its production capacity. These are the assets acquired during 2019: Asset Computers & info. system Luxury autot Assembly equipment Storage building Asset Description 2018 Assets Office furniture Machinery Used delivery truck Totals 2019 Assets Computers & Info. System Luxury Auto Assembly Equipment Storage Building Cost $ 150,000 1,560,000 40,000 tUsed 100% for business purposes. Karane generated taxable income in 2019 of $1,732,500 for purposes of…arrow_forward

- i need the answer quicklyarrow_forward! Required information [The following information applies to the questions displayed below.] Burbank Corporation (calendar year-end) acquired the following property this year: (Use MACRS Table 1, Table 2 and Exhibit 10-10.) Asset Used copier New computer equipment Furniture New delivery truck Luxury auto Placed in Service November Basis 12 $ 7,800 June 6 14,000 July 15 October 28 January 31 32,000 19,000 70,000 $ 142,800 Total Burbank acquired the copier in a tax-deferred transaction when the shareholder contributed the copier to the business in exchange for stock. (Round your answer to the nearest whole dollar amount.) b. Assuming Burbank would like to maximize its cost recovery deductions by claiming bonus and §179 expense, which assets should Burbank immediately expense? (You may select more than one answer. Single click the box with the question mark to produce a check mark for a correct answer and double click the box with the question mark to empty the box for a wrong answer. Any…arrow_forwardEvergreen Corporation (calendar-year-end) acquired the following assets during the current year: (ignore §179 expense and bonus depreciation for this problem): (Use MACRS Table 1 and Table 2.) 2018 Asset Machinery Computer equipment Used delivery truck* Furniture Date Placed in Service October 25 February 3 August 17 April 22 $ Original Basis 102,000 34,000 47,000 190,000 *The delivery truck is not a luxury automobile a. What is the allowable MACRS depreciation on Evergreen's property in the current year assuming Evergreen does not elect §179 expense and elects out of bonus depreciation? (Round your intermediate calculations to the nearest whole dollar amount.) b. What would be the allowable MACRS depreciation on Evergreen's property in the current year if Evergreen does not elect out of bonus depreciation?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education