FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

None

Transcribed Image Text:K

The TechGuide Company produces and sells 7,200 modular computer desks per year at a selling price of $450 eac

current production equipment, purchased for $1,950,000 and with a 5-year useful life, is only 2 years old. It has a

terminal disposal value of $0 and is depreciated on a straight-line basis. The equipment has a current disposal price

$600,000. However, the emergence of a new molding technology has led TechGuide to consider either upgrading or

replacing the production equipment. The following table presents data for the two alternatives:

(Click to view the data for the two alternatives.)

Read the requirements.

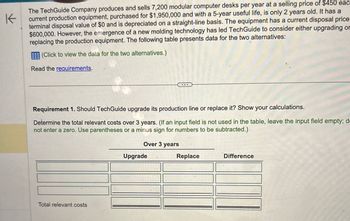

Requirement 1. Should TechGuide upgrade its production line or replace it? Show your calculations.

Determine the total relevant costs over 3 years. (If an input field is not used in the table, leave the input field empty; de

not enter a zero. Use parentheses or a minus sign for numbers to be subtracted.)

Total relevant costs

Over 3 years

Upgrade

Replace

Difference

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Zina Manufacturing Company started and completed Job 501 in December with the following Job Cost Sheet and transferred it to the warehouse. Direct Materials Date Dec 17 Dec 30 Total Direct Labor Amount Date Amount $2,000 Dec 20 $4,000 8,000 Dec 30 3,800 Total Job Cost Sheet - Job No. 501 Total Cost The journal entry to record the transaction is A) WIP Inventory FG Inventory B) Cost of Goods Sold WIP Inventory C) FG Inventory WIP Inventory D) FG Inventory WIP Inventory Debit Credit 35,800 17,800 17,800 Manufacturing Overhead Date Amount Dec 24 $10,000 Dec 30 8,000 Total 35,800 35,800 17,800 17,800 35,800arrow_forwardis thsi correct?arrow_forwardThis answer is incorrect. What's the correct one?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education