Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Question list

Question 1

Question 2

Question 3

O Question 4

O Question 5

O Question 6

O Question 7

K

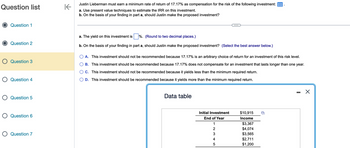

Justin Lieberman must earn a minimum rate of return of 17.17% as compensation for the risk of the following investment:

a. Use present value techniques to estimate the IRR on this investment.

b. On the basis of your finding in part a, should Justin make the proposed investment?

a. The yield on this investment is %. (Round to two decimal places.)

b. On the basis of your finding in part a, should Justin make the proposed investment? (Select the best answer below.)

A. This investment should not be recommended because 17.17% is an arbitrary choice of return for an investment of this risk level.

B. This investment should be recommended because 17.17% does not compensate for an investment that lasts longer than one year.

C. This investment should not be recommended because it yields less than the minimum required return.

D. This investment should be recommended because it yields more than the minimum required return.

Data table

Initial Investment

End of Year

1

2345

$10,915

Income

$3,367

$4,074

$3,565

$2,711

$1,200

-

X

Expert Solution

arrow_forward

Step 1: Analysis

Internal rate of return is a discount rate that equates the NPV of an investment opportunity to zero. It the rate of return that the firm will earn if invests in the project and receives given cash flows.

Decision criteria for acceptance or rejection of project on the basis of IRR

(a) If the IRR is greater than minimum rate, accept the project.

(b) I the IRR is less than minimum rate, reject the project.

Step by stepSolved in 4 steps with 2 images

Knowledge Booster

Similar questions

- A. Given the data in the table and the information below, please answer the following question. Show all working and formulas used. Maturity (T) r(1) r(2) r(3) r(4) r(5) r(6) Spot Rate (%) 0.15 0.22 0.25 0.28 0.20 0.13 Misty would like to invest 10,000. She is faced with the choice between 2 investments: Option 1: invest for 5 years; Option 2: invest for 3 years and reinvest for another 2 years at a forward rate of 0.07% Should she be indifferent between the choices? If not, which one is the optimal option to Misty? B. Sovereign debt (issued bonds) are typically considered as proxies for risk free. Discuss the reasons why sovereign debt may not be risk free. Why might credit ratings agencies give different credit ratings to sovereign debt issued by the same country, depending on coupons denominated in domestic or foreign currency. C. “Four Cs of credit analysis” is used by analysts to…arrow_forwardcould someone please help me outarrow_forwardQuestion 1 All else held constant, which of the following would make the put option on the common stock more valuable? A lower exercise price Stock price drops Stock price volatility reducesarrow_forward

- Sulsa invests $9,122.85 at t = 0 and $29,100 at t = 2. In return, she receives %3D $28,223 at t = 1 and $10,000 at t = 3. Write down a time 0 equation of value and verify that it is satisfied for V = 0.95, v = 0.97, and v = 0.99. Find the corresponding three yield rates. (Round your answers to two decimal places.) v = 0.95 % v = 0.97 v = 0.99 %arrow_forwardYou have calculated the value of an investment to be $100. If it costs $105, you should buy it. Select one: True Falsearrow_forwardYou are considering a safe investment opportunity that requires a $1,450 investment today, and will pay $950 two years from now and another $710 five years from now. a. What is the IRR of this investment? b. If you are choosing between this investment and putting your money in a safe bank account that pays an EAR of 5% per year for any horizon, can you make the decision by simply comparing this EAR with the IRR of the investment? Explain. a. What is the IRR of this investment? The IRR of this investment is %. (Round to two decimal places.)arrow_forward

- Which of the following is TRUE? O An American call option on a stock should never be exercised early O An American call option on a stock should be exercised early when dividends are expected O It can sometimes be optimal to exercise early an American call option on a stock even when no dividends are expected and there is no liquidity or portfolio rebalancing need. O An American call option on a stock should never be exercised early when no dividends are expected << Previous Next ▸arrow_forwardYou are thinking about investing in a project that will provide you a cash flow of $78922 in 3 years and of $88519 in 4 years. If your required return on investments of this risk is 15.14%, how much are you willing to pay for this opportunity? Round to 2 decimal places. Include a dollar sign ($) or percent (%) as appropriate. Answer:arrow_forwardYou are considering a safe investment opportunity that requires a $780 investment today, and will pay $870 two years from now and another $640 five years from now. a. What is the IRR of this investment? b. If you are choosing between this investment and putting your money in a safe bank account that pays an EAR of 5% per year for any horizon, can you make the decision by simply comparing this EAR with the IRR of the investment? Explain.arrow_forward

- (Use Calulator or Formula Approach) You are offered an investment that will pay you $200 in one year, $400 the next year, $600 the next year and $800 at the end of the fourth year. You can earn 12 percent on very similar investments. What is the most you should pay for this one?arrow_forwardYou are considering the purchase of real estate that will provide perpetual income that should average $60,000 per year. How much will you pay for the property if you believe its market risk is the same as the market portfolio's? The T-bill rate is 4%, and the expected market return is 12.5%. Property valuearrow_forwardYour broker has offered you an investment opportunity at a cost of $ 500. The opportunity offers $100 in 1 year, $200 in 2 years, and $300 in 3 years. If you require a 10% return on investments of similar risk, should you take the opportunity?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education