Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

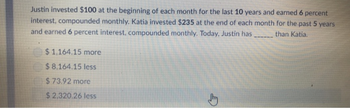

Transcribed Image Text:Justin invested $100 at the beginning of each month for the last 10 years and earned 6 percent

interest, compounded monthly. Katia invested $235 at the end of each month for the past 5 years

and earned 6 percent interest, compounded monthly. Today, Justin has than Katia.

$1,164.15 more

$ 8,164.15 less

$73.92 more

$2,320.26 less

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 7 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Imagine that Homer Simpson actually invested the $120,000 he earned providing Mr. Burns entertainment 9 years ago at 6.5 percent annual interest and that he starts investing an additional $2,400 a year today and at the beginning of each year for 15 years at the same 6.5 percent annual rate. How much money will Homer have 15 years from today?arrow_forwardYour grandma invested some money 64 years ago into an account earning 4.91% per year, compounded quarterly. She now has $11804 in her account Round to the pekny. How much money did your grandam invest 64 years ago? $ a. b. How much interest did she earn on the investment? $arrow_forwardTwins graduate from college together and start their careers. Twin 1 invests $1500 at the end of each year for 10 years only (until age 31) in an account that earns 9%, compounded annually. Suppose that twin 2 waits until turning 40 to begin investing. How much must twin 2 put aside at the end of each year for the next 25 years in an account that earns 9% compounded annually in order to have the same amount as twin 1 at the end of these 25 years (when they turn 65)? (Round your answer to the nearest cent.)arrow_forward

- Matthew invested the profit of his business in an investment fund that was earning 3.75% compounded monthly. He began withdrawing $2,500 from this fund every 6 months, with the first withdrawal in 4 years. If the money in the fund lasted for the next 3 years, how much money did he initially invest in the fund? $ $0.00 Round to the nearest centarrow_forwardBhaarrow_forwardEleven years ago, Chad invested $9,000. Six years ago, Allison invested $12,000. Today, both Chad's and Allison's investments are each worth $2,400. Assume that both Chad and Allison continue to earn their respective rates of return. Which one of the following statements is correct concerning these investments? Group of answer choices Allison has earned an average annual interest rate of 3.37 percent. Chad has earned an average annual interest rate of 6.01 percent. Three years from today, Allison's investment will be worth more than Chad's. One year ago, Chad's investment was worth less than Allison's investment. Allison earns a higher rate of return than Chadarrow_forward

- Joel invested $1,025 at the end of every month into an investment fund that was earning interest at 4.75% compounded monthly. She stopped making regular deposits at the end of 9 years when the interest rate changed to 5.00% compounded quarterly. However, she let the money grow in this investment fund for the next 4 years. a. Calculate the accumulated balance in her investment fund at the end of 9 years. $0.00 Round to the nearest cent b. Calculate the accumulated balance in her investment fund at the end of 13 years. $0.00 Round to the nearest cent c. Calculate the amount of interest earned over the 13-year period. $0.00 Round to the nearest centarrow_forwardTwins graduate from college together and start their careers. Twin 1 invests $2500 at the end of each year for 10 years only (until age 34) in an account that earns 9%, compounded annually. Suppose that twin 2 waits until turning 40 to begin investing. How much must twin 2 put aside at the end of each year for the next 25 years in an account that earns 9% compounded annually in order to have the same amount as twin 1 at the end of these 25 years (when they turn 65)? (Round your answer to the nearest cent.)arrow_forwardMiguel invested $1,900 at the beginning of every 6 months in an RRSP for 11 years. For the first 4 years it earned interest at a rate of 4.60% compounded semi-annually and for the next 7 years it earned interest at a rate of 5.10% compounded semi-annually.a. Calculate the accumulated value of her investment at the end of the first 4 years.A. $55,478.69B. $56,281.73C. $16,481.53D. $16,860.61b. Calculate the accumulated value of her investment at the end of 11 years.A. $55,478.69B. $56,281.73C. $49,155.52D. $16,860.61c. Calculate the amount of interest earned from the investment.A. $14,481.73B. $13,678.69C. $8,786.82D. $5,694.91arrow_forward

- Would love the help. 5arrow_forwardTyler invested the profit of her business in an investment fund that was earning 3.75% compounded monthly. She began withdrawing $4,500 from this fund every 6 months, with the first withdrawal in 4 years. If the money in the fund lasted for the next 5 years, how much money did she initially invest in the fund? $ $0.00 Round to the nearest centarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education