FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

thumb_up100%

The options for the blue shaded discerption tabs are:

Accounts payable, accounts receivable , cash, cost of goods sold, inventory, sales revenue, sales returns and allowances, sales discounts.

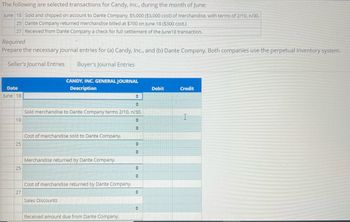

Transcribed Image Text:### Selected Transactions for Candy, Inc. During the Month of June

#### Transactions:

- **June 18**: Sold and shipped on account to Dante Company, $5,000 ($3,000 cost) of merchandise, with terms of 2/10, n/30.

- **June 25**: Dante Company returned merchandise billed at $700 on June 18 ($300 cost).

- **June 27**: Received from Dante Company a check for full settlement of the June 18 transaction.

#### Requirement:

Prepare the necessary journal entries for (a) Candy, Inc., and (b) Dante Company. Both companies use the perpetual inventory system.

#### Seller’s Journal Entries:

1. **CANDY, INC. GENERAL JOURNAL:**

| **Date** | **Description** | **Debit ($)** | **Credit ($)** |

|----------|--------------------------------------------------------|---------------|----------------|

| June 18 | Sold merchandise to Dante Company terms 2/10, n/30. | | |

| | | | |

| | Cost of merchandise sold to Dante Company | | |

| June 25 | Merchandise returned by Dante Company | | |

| | | | |

| | Cost of merchandise returned by Dante Company | | |

| June 27 | Sales Discounts | | |

| | Received amount due from Dante Company | | |

This table outlines the internal record-keeping entries that Candy, Inc. should make to reflect the sales and returns transactions that occurred in June, as well as the payment received from Dante Company. Each transaction listed demonstrates the importance of accounting for both the values received and the costs associated with any returns, adhering to the perpetual inventory system.

#### Explanation:

- **June 18**: Record the sale of merchandise on account, and the cost of sale.

- **June 25**: Record the merchandise return and its cost.

- **June 27**: Record the sales discount and the receipt of the amount due post-discount from Dante Company.

This exercise demonstrates how businesses must manage their accounts and inventory using a perpetual inventory system, ensuring that they accurately reflect every transaction's financial impact.

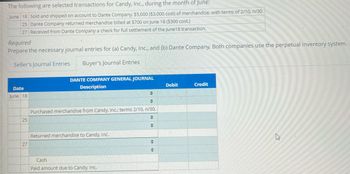

Transcribed Image Text:**Selected Transactions for Candy, Inc. during June:**

- **June 18:** Sold and shipped merchandise on account to Dante Company, $5,000 ($3,000 cost of merchandise), with terms of 2/10, n/30.

- **June 25:** Dante Company returned merchandise billed at $700 on June 18 ($300 cost).

- **June 27:** Received from Dante Company a check for the full settlement of the June 18 transaction.

**Required:**

Prepare the necessary journal entries for (a) Candy, Inc., and (b) Dante Company. Both companies use the perpetual inventory system.

**Seller's Journal Entries**

- Not displayed in the image, but would typically include sales, accounts receivable, returns and allowances, and cash collections.

**Buyer's Journal Entries (Dante Company):**

| **Date** | **Description** | **Debit** | **Credit** |

|----------|------------------------------------------------|-----------|-------------|

| June 18 | Purchased merchandise from Candy, Inc.; terms 2/10, n/30. | . | . |

| June 25 | Returned merchandise to Candy, Inc. | . | . |

| June 27 | Cash | . | . |

| | Paid amount due to Candy, Inc. | | |

**Explanation:**

1. **June 18: Purchased merchandise from Candy, Inc.; terms 2/10, n/30.**

- Not detailed in the provided section, but usually involves a debit to Merchandise Inventory and a credit to Accounts Payable.

2. **June 25: Returned merchandise to Candy, Inc.**

- Involves a debit to Accounts Payable and a credit to Merchandise Inventory for the return.

3. **June 27: Payment for the remaining balance to Candy, Inc.**

- Typically involves a debit to Accounts Payable, a credit to Cash, and if applicable, recognition of any purchase discounts taken (debit) based on the payment term of 2/10.

This setup illustrates how Dante Company records purchase, return, and payment transactions. The perpetual inventory system ensures real-time updates to inventory and cost accounts.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The normal balance of the following accounts is a debit Multiple Choice O Sales returns and allowances, and purchase discounts. Cost of goods sold, and purchase discounts Transportation-in and income summary Sales returns and allowances, cost of goods sold Sales discounts and interest revenuearrow_forwardIn recording the cost of goods sold based on data available from perpetual inventory records, the journal entry is a a. debit to Merchandise Inventory and a credit to Cost of Merchandise Sold b. debit to Accounts Receivable and a credit to Merchandise Inventory . debit to Cost of Merchandise Sold and a credit to Sales d. debit to Cost of Merchandise Sold and a credit to Merchandise Inventoryarrow_forwardThe internal control questionnaire for purchases and accounts payable includes the following questions. Next to each of the questions, indicate the letter of the related transaction assertion.A. OccurrenceB. CompletenessC. AccuracyD. ClassificationE. Cutoff_______ 1. Are vendor's monthly statements reconciled with individual accounts payable accounts?_______ 2. Are all purchases made only on the basis of approved purchase requisitions?_______ 3. Are vendors' invoices listed immediately upon receipt?_______ 4. Are vendors' invoices matched against purchase orders and receiving reports before a liability is recorded?_______ 5. Is the accounts payable customer ledger balanced periodically with the general ledger control account?_______ 6. Does the accounting manual give instructions to date purchase entries on the date of receipt of goods?_______ 7. Are shipping documents authorized and prepared for goods returned to vendors?_______ 8. Is the accounts payable department notified of goods…arrow_forward

- What accounts are used to recognize a retailer’s purchase from a manufacturer on credit?A. accounts receivable, merchandise inventoryB. accounts payable, merchandise inventoryC. accounts payable, cashD. sales, accounts receivablearrow_forwardPSc 3-4 Calculate Federal Income Tax Withholding Using the Percentage Method (Pre-2020 Form W-4) For each employee listed, use the percentage method to calculate federal income tax withholding for an employee who has submitted a pre-2020 Form W-4.Refer to Publication 15-T. NOTE: For simplicity, all calculations throughout this exercise, both intermediate and final, should be rounded to two decimal places at each calculation. 1: Tony Daniels (Married; 4 federal withholding allowances) earned weekly gross pay of $790. Federal income tax withholding = $ 2: Mario Gonzales (married; 5 federal withholding allowances) earned biweekly gross pay of $2,010. He participates in a flexible spending account, to which he contributes $110 during the period. Federal income tax withholding = $ 3: Angela Brown (single; 3 federal withholding allowances) earned monthly gross pay of $5,085. For each period, she makes a 401(k) contribution of 13.5% of gross pay. Federal income tax withholding = $ 4: Linda…arrow_forwardIf the balance in the inventory account is greater than the physical count, which of the following journal entries is recorded? a.Debit Merchandise Inventory and credit Inventory Short and Over b.Debit Merchandise Inventory and credit Cost of Goods Sold c.Debit Cost of Goods Sold and credit Merchandise Inventory d.Debit Inventory Short and Over and credit Merchandise Inventoryarrow_forward

- Match each of the five items listed below with one of the following locations: 1. Located on the Income Statement debit column of the worksheet 2. Located on the Income Statement credit column of the worksheet 3. Located on the Balance Sheet debit column of the worksheet 4. Located on the Balance Sheet credit column of the worksheet a. Sales Returns and Allowances b. Accrued Salaries Payable c. Sales d. Merchandise Inventory e. Accounts Receivable a. Sales Returns and Allowance 1. Located on the Income Statement debit column of the worksheet 2. Located on the Income Statement credit column of the worksheet 3. Located on the Balance Sheet debit column of the worksheet 4. Located on the Balance Sheet credit column of the…arrow_forwardWhat is the name of the account used to record sales of merchandise inventory? Multiple Choice Sales Returns and Allowances Sales Fees Income Accounts Receivablearrow_forwardTerminology Match each phrase with its definition. A. Sales discount B. Credit period C. Discount period D. FOB destination E. FOB shipping point F. Gross profit G. Merchandise inventory H. Purchases discount 1. 2. 3. 4. 5. 6. 7. 8. Goods a company owns and expects to see to its customers. Time period that can pass before a customer's full payment is due. Seller's description of a cash discount granted to buyers in return for early payment. Ownership of goods is transferred when the seller delivers goods to the carrier. Purchaser's description of a cash discount received from a supplier of goods. Difference between net sales and the cost of goods sold. Time period in which a cash discount is available. Ownership of goods is transferred when delivered to the buyer's place of business. 1arrow_forward

- The Inventory module window has journal icons for Select one: O a. inventory sales and inventory purchases b. item assembly and inventory adjustments O c. inventory sales and inventory adjustments O d. all of the above Show Transcribed Text You should use the adjustments journal to record - Select one: O a. adjustments to inventory purchase prices from the supplier as an allowance for damages O b. adjustments to inventory sale prices to customers as an allowance for damages c. adjustments to inventory in stock for damaged goods O d. all of the abovearrow_forwardThe journal entry to record a return of merchandise purchased on account under a perpetual inventory system would credit Accounts Payable. Purchase Returns and Allowances. Sales Revenue. Inventory.arrow_forwardUsing the five journals as named here: Sales, Purchases, Cash Receipts, Cash Disbursements, and General and using the following as possible column header titles: Date, Account, Acct. No., Check No., Purchase Order No., Sales Invoice No., Ref. or None and using the accounts listed below, record journal entries for the following transactions, which uses the perpetual inventory system: Accounts Payable Merchandise Inventory Sales Accounts Receivable Purchases Sales Discounts Cash Purchase Discounts Sales Returns and Allowances Cost of Goods Sold Purchase Returns and Allowances Sales Tax Payable PLEASE NOTE: You must enter the journal names, header titles, and account names exactly as written above (or in the transactions below) and all dollar amounts will be with "$" and commas as needed (i.e. $12,345). If no dollar amount is needed, please use "$0" - no quotation marks. On March 1, you paid Duke Mfg. (account number D101) for inventory purchased on Feb. 27 for $1,000.…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education