RDX Corporation produces washing machines and has always manufactured all the necessary parts. An external supplier has offered to sell a motor to the corporation for $35 each. To evaluate the offer the following costs relative to the current production of the motor has been extracted: Direct Materials Direct Labour Variable Manufacturing Overhead Fixed Manufacturing Overhead Per Unit $ 15 $ 12 $ 3 $ 20 15,000 Per Year $ 225,000 $ 180,000 $ 45,000 $ 300,000 Required: a. Assuming that the corporation has no alternative use for the facilities presently being used to manufacture the motor, should the corporation accept the offer to buy the part? b. Suppose that the corporation could use the spare facilities to produce another product which could generate a contribution of $150,000 per year, would the decision be different?

RDX Corporation produces washing machines and has always manufactured all the necessary parts. An external supplier has offered to sell a motor to the corporation for $35 each. To evaluate the offer the following costs relative to the current production of the motor has been extracted: Direct Materials Direct Labour Variable Manufacturing Overhead Fixed Manufacturing Overhead Per Unit $ 15 $ 12 $ 3 $ 20 15,000 Per Year $ 225,000 $ 180,000 $ 45,000 $ 300,000 Required: a. Assuming that the corporation has no alternative use for the facilities presently being used to manufacture the motor, should the corporation accept the offer to buy the part? b. Suppose that the corporation could use the spare facilities to produce another product which could generate a contribution of $150,000 per year, would the decision be different?

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

step by step please. parts a-b

Transcribed Image Text:Question 4

Part A

RDX Corporation produces washing machines and has always manufactured all the necessary parts. An

external supplier has offered to sell a motor to the corporation for $35 each.

To evaluate the offer the following costs relative to the current production of the motor has been extracted:

15,000

Per Year

Direct Materials

Direct Labour

Variable Manufacturing Overhead

Fixed Manufacturing Overhead

Per Unit

$ 15

$

12

$

3

$ 20

$ 225,000

$ 180,000

$ 45,000

$ 300,000

Required:

a. Assuming that the corporation has no alternative use for the facilities presently being used to

manufacture the motor, should the corporation accept the offer to buy the part?

b. Suppose that the corporation could use the spare facilities to produce another product which could

generate a contribution of $150,000 per year, would the decision be different?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

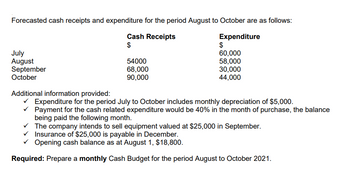

Transcribed Image Text:Forecasted cash receipts and expenditure for the period August to October are as follows:

Cash Receipts

Expenditure

$

$

60,000

58,000

July

August

September

October

54000

68,000

90,000

30,000

44,000

Additional information provided:

✓ Expenditure for the period July to October includes monthly depreciation of $5,000.

✓

Payment for the cash related expenditure would be 40% in the month of purchase, the balance

being paid the following month.

The company intends to sell equipment valued at $25,000 in September.

Insurance of $25,000 is payable in December.

Opening cash balance as at August 1, $18,800.

Required: Prepare a monthly Cash Budget for the period August to October 2021.

Solution

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education