Principles of Accounting Volume 1

19th Edition

ISBN: 9781947172685

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

?!

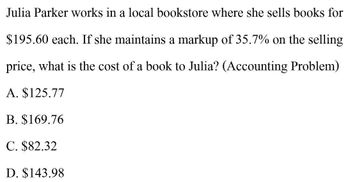

Transcribed Image Text:Julia Parker works in a local bookstore where she sells books for

$195.60 each. If she maintains a markup of 35.7% on the selling

price, what is the cost of a book to Julia? (Accounting Problem)

A. $125.77

B. $169.76

C. $82.32

D. $143.98

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- 6. Darlene Jaworski purchases an $84.00 calculator, a gold chain for $42.50, and a book for $13.80. The sales tax rate is 5.5%. What is the sales tax? 7. Clinton Horvath purchases a $147.50 tool set and a tool box for $27.55. The sales X rate is ax on Clinton's purchases? 8 Isabel Marau cight snark nlugn otarrow_forwardMike purchases a bicycle costing $152.70. State taxes are 4% and local sales taxes are 2%. The store charges $20 for assembly. What is the total purchase price (in $)? (Round your answer to the nearest cent.)_____arrow_forward4. Eunice Kross purchases a lawn chair for $28.00 and a picnic table for $140.00. The sales tax rate is 5%. a. What is the total selling price? b., What is the sales tax? 5.arrow_forward

- A certain person bought merchandise for $ 3,500 with conditions or terms of payment of 5/10, n / 30. In order to pay within the discount period, she took out a loan at 6% interest. How much did you save if you used the loan to pay for merchandise that had a cash discount? A. $147.77 B. $163. 92 C. $183. 94 D. $198. 23arrow_forward3. Annabelle McCloney purchases denim jeans for $14.95 and a velour top for $16.39. The sales tax ráte is 7%. What is the total purchase price of Annabelle's pur- chases? Turan AMIEM ca sales tarrow_forwardCynthia Roberts has a credit card account at Harry's Hardware, which uses the unpaid-balance method of computing finance charges. The periodic rate is 1.5 percent. Ms. Roberts's previous balance is $178.85, and she had payments and credits of $74.00. If she has new purchases of $98.74, what is her new balance? O $305.39 O $206.64 O $205.16 O $156.42arrow_forward

- Elsa bought some kitchen supplies from an online store. For shipping the store charges a $8.65 flat fee or 8.75% of the total purchase, whichever is greater. Suppose Elsa's total purchase is $85. How much shipping will they pay? Round to the nearest cent.arrow_forward3. Teresa Lucas purchases a $349.50 color TV set. The sales tax rate is 5%. What is the sales tax? 4. Eunice Kross nu The S140.00. rohoses a lawn 28,00 and a picnic tabIC TON tax rate iS 7o. a. What is price?arrow_forward5. At J&J Department Store, Sam Dodson purchases a cassette tape player for $88.98 and three tapes for $4.98 each. The sales tax rate is 4.5%. What is the sales tax on Sam's purchases? eold chain fo $42.50, and a 6.Darlene Jaworski purchases an $84.00 caloulator book for sale $13.80. The Sales tax?arrow_forward

- Mike purchases a bicycle costing $156.90 sales taxes are 5% and local sales taxes are 3%. The store charges $20 for assembly. What is the total purchase price in dollars round your answer to the nearest cent? The answer the guy gave me before was $189 it was incorrect. arrow_forwardAnwerarrow_forwardJamie Lee wants to determine if she can afford the monthly payments for all of her purchases before she completes the applica process. Use the information below to determine her debt payment-to-income ratio. Current Financial Situation Assets: Income: Checking account $1,900 Savings account $7,400 Gross monthly salary Net income $2,850 $2,195 Emergency fund savings account $2,900 Monthly Expenses: IRA balance $430 Rent obligation $370 Car $3,000 Utilities/Electric $80 Liabilities: Utilities/Water $50 Student loan $11,000 Utilities/Cable $75 (Jamie is still a full-time student, so Food $135 no payments are required on the loan Gas/Maintenance $140 until after graduation) Credit card payment $0 Acme Home Goods (Washer/dryer $1,650 Acme Home Goods $41 and refrigerator) Local Home Furnishings (Sofa $1,750 Local Home Furnishings $46 set) Big Box Store (52" LED HDTV) $1,150 Big Box Store $29 Automobile, Education, Personal, and Installment Loans Financial Institution or Account Number…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT