FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

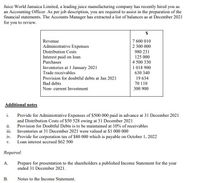

Transcribed Image Text:Juice World Jamaica Limited, a leading juice manufacturing company has recently hired you as

an Accounting Officer. As per job description, you are required to assist in the preparation of the

financial statements. The Accounts Manager has extracted a list of balances as at December 2021

for you to review.

Revenue

7 600 010

Administrative Expenses

2 300 000

Distribution Costs

980 231

Interest paid on loan

Purchases

125 000

4 500 330

1 018 900

Inventories at 1 January 2021

Trade receivables

630 340

Provision for doubtful debts at Jan 2021

19 634

Bad debts

70 110

Non- current Investment

300 900

Additional notes

i.

Provide for Administrative Expenses of $500 000 paid in advance at 31 December 2021

and Distribution Costs of $50 528 owing at 31 December 2021

Provision for Doubtful Debts is to be maintained at 10% of receivables

ii.

iii. Inventories at 31 December 2021 were valued at $1 000 000

iv. Provide for corporation tax of S80 000 which is payable on October 1, 2022

Loan interest accrued $62 500

V.

Required:

А.

Prepare for presentation to the shareholders a published Income Statement for the year

ended 31 December 2021.

В.

Notes to the Income Statement.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- helparrow_forwardCurrent Attempt in Progress On May 10, Sunland Company sold merchandise for $5.800 and accepted the customer's Best Business Bank MasterCard. At the end of the day, the Best Business Bank MasterCard receipts were deposited in the company's bank account. Best Business Bank charges a 4.5% service charge for credit card sales. Prepare the entry on Sunland Company's books to record the sale of merchandise. (Omit cost of goods sold entries.) (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Date Account Titles and Explanation May 10 eTextbook and Media Save for Later Debit Credit Attempts: 0 of 2 used Submit Answerarrow_forwardSubmit it in excel form E9.3arrow_forward

- Domesticarrow_forwardKitchen Equipment Company uses the allowance method to account for uncollectibles. On October 31, It wrote off a $1,200 account of a customer, Gwen Rowe. On December 9, It recelved an $800 payment from Rowe. a. Make the appropriate entry for October 31. View transaction list Journal entry worksheet 1 Record the entry to write off $1,200-due from Gwen Rowe. Note: Enter debits before credits. Date General Journal Debit Credit October 31 Record entry Clear entry View general journalarrow_forwardJournalizing Payroll Transactions 1. Determine the amount of Social Security and Medicare taxes to be withheld. If required, round your answers to the nearest cent. 2. Record the journal entry for the payroll, crediting Cash for the net pay. When required, enter amounts in dollars and cents. If an amount box does not require an entry, leave it blank. On December 31, the payroll register of Hamstreet Associates indicated the following information: Wages and Salaries Expense $7,900 Employee Federal Income Tax Payable 900 United Way Contributions Payable 190 Earnings subject to Social Security tax 7,200 Payroll Withholdings 1. Determine the amount of Social Security and Medicare taxes to be withheld. If required, round your answers to the nearest cent. Social Security Tax $fill in the blank 6752ad03b03cf89_1 Medicare Tax $fill in the blank 6752ad03b03cf89_2 General Journal 2. Record the journal entry for the payroll,…arrow_forward

- Read through the information below for selected transactions during the month of December, 2021 and prepare the required jounal entry to record the transaction. Post each of the entries below to the general ledger T-accounts attached . Sold Merchandise for $5,000 to Lee Corp on account on December 9. Cost of the merchandise was $3,390 and the terms of the sale were 1/15, n/30.arrow_forwardVishanoarrow_forwardplease help me with thesearrow_forward

- Joanne is part of the accounts payable team at a local furniture store, responsible for recording invoices received by the business and payments made by the business. The furniture store receives an invoice for internet usage for the amount of $450. The invoice states that payment is due in 30 days, therefore Joanne records the transaction accordingly and sets a calendar reminder to pay on the due date. Based on this information, the journal entry in the furniture store's accounting system would include:arrow_forwardnkt.1arrow_forwardThe sales journal for Carothers Company is shown below. SALES JOURNAL Date Sales Slip No. Customer Name Post.Ref. AccountsReceivableDebit Sales taxPayableCredit SalesCredit Dec. 1 824 Jim Danta 3,212 312 2,900 7 825 Tom Tome 645 45 600 22 826 Sue Wasco 666 66 600 31 Totals 4,523 423 4,100 Show how the amounts would be posted to the general ledger accounts.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education