FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

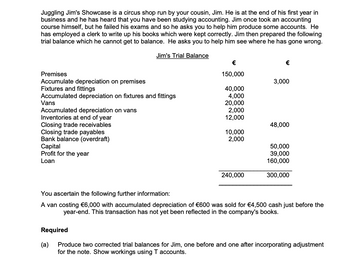

Transcribed Image Text:Juggling Jim's Showcase is a circus shop run by your cousin, Jim. He is at the end of his first year in

business and he has heard that you have been studying accounting. Jim once took an accounting

course himself, but he failed his exams and so he asks you to help him produce some accounts. He

has employed a clerk to write up his books which were kept correctly. Jim then prepared the following

trial balance which he cannot get to balance. He asks you to help him see where he has gone wrong.

Jim's Trial Balance

Premises

Accumulate depreciation on premises

Fixtures and fittings

Accumulated depreciation on fixtures and fittings

Vans

Accumulated depreciation on vans

Inventories at end of year

Closing trade receivables

Closing trade payables

Bank balance (overdraft)

Capital

Profit for the year

Loan

€

150,000

Required

(a)

40,000

4,000

20,000

2,000

12,000

10,000

2,000

240,000

€

3,000

48,000

50,000

39,000

160,000

300,000

You ascertain the following further information:

A van costing €6,000 with accumulated depreciation of €600 was sold for €4,500 cash just before the

year-end. This transaction has not yet been reflected in the company's books.

Produce two corrected trial balances for Jim, one before and one after incorporating adjustment

for the note. Show workings using T accounts.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Helen Hernandez, president of Double H Enterprises, applied for a $175,000 loan from Great Nations Bank. The bank requested financial statements as a basis for granting the loan. Helen instructed her accountant to provide the bank with a balance sheet, but to omit the other financial statements because her business incurred a net loss last year. Helen contends that as the owner of the business, it is her right to withhold certain financial statements from the bank. Do you agree with Helen? Why or why not? What type of information would banks require from a loan applicant and why would the loan officer request this information?arrow_forwardYou have recently been hired by Davis & Company, a small public accounting firm. One of the firm’s partners, Alice Davis, has asked you to deal with a disgruntled client, Mr. Sean Pitt, owner of the city’s largest hardware store. Mr. Pitt is applying to a local bank for a substantial loan to remodel his store. The bank requires accrual based financial statements but Mr. Pitt has always kept the company’s records on a cash basis. He does not see the purpose of accrual based statements. His most recent outburst went something like this: “After all, I collect cash from customers, pay my bills in cash, and I am going to pay the bank loan with cash. And, I already show my building and equipment as assets and depreciate them. I just don’t understand the problem.Mr. Pitt has relented and agrees to provide you with the information necessary to convert his cash basis financial statements to accrual basis statements. He provides you with the following transaction information for the fiscal…arrow_forwardDelia Alvarez, the owner of Delia's Lawn Service, wants to borrow money to buy new lawn equipment. A local bank has asked for financial statements. Alvarez has asked you to prepare financial statements for the year ended December 31. You have been given the unadjusted trial balance on page 175, and you suspect that Alvarez expects you to base your statements on this information. You are concerned, however, that some of the account balances may need to be adjusted. In your post, write how you would explain to Alvarez what additional information you need before preparing the financial statements. Alvarez is not familiar with accounting issues. Therefore, explain why you need this information, the potential impact of this information on the financial statements, and the importance of making these adjustments before approaching the bank for a loan.arrow_forward

- Please Explain Proper Step by Step and Do Not Give Solution In Image Format And Fast Answering Please Thanks In Advance ?arrow_forwardEverett Photography specializes in engagements and weddings, reunions, and family portraits. Everett is reviewing the following analysis of events provided by his accountant, but he cannot understand this analysis. Describe the events for Everett. Example - A. Everett bought $2,000 of photo supplies on account. Photo supplies debit, $2,000 Accounts payable credit, $2,000 Cash debit, $500. Unearned revenue credit, $500 Equipment debit, $5,000 Note payable, $5,000 Cash debit, $850 Revenue credit, $850 Accounts payable debit, $400 Cash credit, $400 Unearned revenue debit, $500 Revenue credit, $500 Accounts receivable debit, $2,500 Revenue credit, $2,500 Notes payable debit, $200 Cash credit, $200 Expense debit, $1,500 Photo supplies credit, $1,500arrow_forwardHello, I need help solving this accounting problem.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education