FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

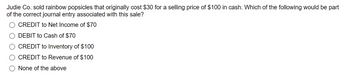

Transcribed Image Text:Judie Co. sold rainbow popsicles that originally cost $30 for a selling price of $100 in cash. Which of the following would be part

of the correct journal entry associated with this sale?

CREDIT to Net Income of $70

DEBIT to Cash of $70

CREDIT to Inventory of $100

CREDIT to Revenue of $100

None of the above

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Flounder Company purchased merchandise on account from a supplier for $32,100, terms 2/10, n/30. Flounder Company returned $8,600 of the merchandise and received full credit. a. If Flounder Company pays the invoice within the discount period, what is the amount of cash required for the payment? EE 6-2 p. 288 SHOW ME HOW b. What account is credited by Flounder Company to record the return?arrow_forwardDo not give answer in imagearrow_forwardPlease do not give solution in image format ? and fast answering please and explain proper steps by Step.arrow_forward

- Ramos Hair Styling is a wholesaler of hair supplies. Ramos Hair Styling uses a perpetual inventory system. The following transactions (summarized) have been selected for analysis: a. Sold merchandise for cash (cost of merchandise $30,957). b. Received merchandise returned by customers as unsatisfactory (but in perfect condition) for cash refund (original cost of merchandise $280). c. Sold merchandise (costing $6,460) to a customer on account with terms n/60. d. Collected half of the balance owed by the customer in (c). e. Granted a partial allowance relating to credit sales the customer in (c) had not yet paid. f. Anticipate further returns of merchandise (costing $200) after year-end from sales made during the year. $ 55,040 310 13,600 6,800 172 320 PA6-3 (Algo) Part 1 Required: 1. Compute Net Sales and Gross Profit for Ramos Hair Styling. Net Sales Gross Profit Sarrow_forwardVinubhaiarrow_forwardNonearrow_forward

- A customer returned merchandise purchased with cash with a sales price of $7,500. The cost of goods was $3,000. Which of the following represents the correct way to record this transaction assuming an adjusting entry had been prepared for estimated returns? A. Refunds Payable 7,500 Sales Revenue 7,500 Merchandise Inventory 3,000 Estimated Returns Inventory 3,000 B. Refunds Payable 7,500 Cash 7,500 Merchandise Inventory 3,000 Estimated Returns Inventory 3,000 C. Sales Returns and Allowances 7,500 Cash 7,500 Estimated Returns Inventory 3,000 Merchandise Inventory 3,000 D. Sales Revenue 7,500 Cash 7,500 Merchandise Inventory 3,000 Cost of Goods Sold 3,000arrow_forwardRamos Hair Styling is a wholesaler of hair supplies. Ramos Hair Styling uses a perpetual inventory system. The following transactions (summarized) have been selected for analysis: a. Sold merchandise for cash (cost of merchandise $30,957). b. Received merchandise returned by customers as unsatisfactory (but in perfect condition) for cash refund (original cost of merchandise $280). c. Sold merchandise (costing $6,460) to a customer on account with terms n/60. d. Collected half of the balance owed by the customer in (c). e. Granted a partial allowance relating to credit sales the customer in (c) had not yet paid. f. Anticipate further returns of merchandise (costing $200) after year-end from sales made during the year. $ 55,040 310 13,600 6,800 172 320 PA6-3 (Algo) Part 2 2. Compute the gross profit percentage. (Round your answer to 1 decimal place.) Gross Profit Percentage %arrow_forward[The following information applies to the questions displayed below.] Hughes Hair Design is a wholesaler of hair supplies. Hughes Hair Design uses a perpetual inventory system. The following transactions (summarized) have been selected for analysis: a. Sold merchandise for cash (cost of merchandise $32,397). $ 57,600 b. Received merchandise returned by customers as unsatisfactory (but in perfect condition) for cash refund (original cost of merchandise $320). 350 c. Sold merchandise (costing $7,600) to a customer on account with terms n/60. 16,000 d. Collected half of the balance owed by the customer in (c). 8,000 e. Granted a partial allowance relating to credit sales the customer in (c) had not yet paid. 180 f. Anticipate further returns of merchandise (costing $240) after year-end from sales made during the year. 360 Prepare journal entries to record transactions (a)–(f). (If no entry is required for a transaction/event, select "No Journal Entry Required"…arrow_forward

- Please don't give image format and no chatgpt answerarrow_forwardM&M Corp. paid its supplier $300 in cash for inventory that it had previously purchased on account. Which of the following would be part of the correct journal entry? DEBIT to Accounts Payable for $300 DEBIT to Inventory for $300 DEBIT to Cost of Goods Sold for $300 DEBIT to Accounts Receivable for $300arrow_forwardi need the answer quicklyarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education