FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

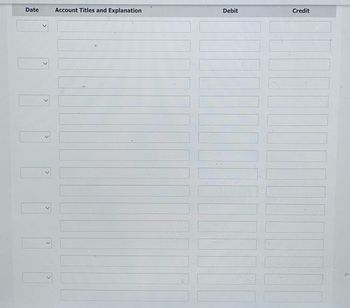

Transcribed Image Text:Date

Account Titles and Explanation

Debit

Credit

MATE

AND

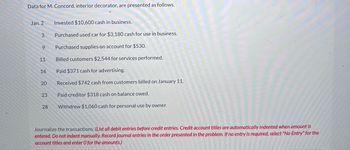

Transcribed Image Text:Data for M. Concord, interior decorator, are presented as follows.

Jan. 2

3

9

11

16

20

23

28

Invested $10,600 cash in business.

Purchased used car for $3,180 cash for use in business.

Purchased supplies on account for $530.

Billed customers $2,544 for services performed.

Paid $371 cash for advertising.

Received $742 cash from customers billed on January 11.

Paid creditor $318 cash on balance owed.

Withdrew $1,060 cash for personal use by owner.

Journalize the transactions. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is

entered. Do not indent manually. Record journal entries in the order presented in the problem. If no entry is required, select "No Entry" for the

account titles and enter O for the amounts.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Do not give answer in imagearrow_forwardThe intangible assets section of Riverbed Company at December 31, 2022, is presented here. Patents ($70,000 cost less $7,000 amortization) Franchises ($44,800 cost less $17,920 amortization) Total Jan. 2 Sept. 1 The patent was acquired in January 2022 and has a useful life of 10 years. The franchise was acquired in January 2019 and also has a useful life of 10 years. The following cash transactions may have affected intangible assets during 2023. Oct. 1 $63,000 Nov.- Dec. 26,880 $89,880 Paid $21,600 legal costs to successfully defend the patent against infringement by another company. Paid $50,000 to an extremely large defensive lineman to appear in commercials advertising the company's products. The commercials aired in September and October. Acquired a franchise for $111,600. The franchise has a useful life of 50 years. Developed a new product, incurring $145,000 in research and development costs during December. A patent was granted for the product on January 1, 2024.arrow_forwardPlease Introduction and show work without plagiarism please i request please sir urgently help mearrow_forward

- (b) To record estimated liability. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List all debit entries before credit entries.) Period 1 Account Titles and Explanation Period 2 Account Titles and Explanation Save for Later Debit Debit Credit Credit Attempts: 0 of 1 used Submit Answerarrow_forwardDo has commercial and lacks commercial substance please using the same template as first picarrow_forwardHow does a revolving line of credit work? Please do not copy and pastearrow_forward

- Pharoah Stores is a new company that started operations on March 1, 2024. The company has decided to use a perpetual inventory system. The following purchase transactions occurred in March: Pharoah Stores purchases $9,200 of merchandise for resale from Octagon Wholesalers, terms 2/10, n/30, FOB shipping point. Mar. 1 2 The correct company pays $140 for the shipping charges. 3 21 22 23 30 31 Pharoah returns $1,100 of the merchandise purchased on March 1 because it was the wrong colour. Octagon gives Pharoah a $1,100 credit on its account. Pharoah Stores purchases an additional $11,500 of merchandise for resale from Octagon Wholesalers, terms 2/10, n/30, FOB destination. The correct company pays $160 for freight charges. Pharoah returns $500 of the merchandise purchased on March 21 because it was damaged. Octagon gives Pharoah a $500 credit on its account. Pharoah paid Octagon the amount owing for the merchandise purchased on March 1. Pharoah paid Octagon the amount owing for the…arrow_forwardPlease help me. Thankyou.arrow_forwardCh. 3 Classwork Chart of Accounts Common Stock Cash Accounts Receivable Supplies Inventory Prepaid Insurance Prepaid Rent Office Equipment Accumulated Depreciation Accounts Payable Notes Payable Unearned Revenue Retained Earnings Dividends Fees Earned Sales Cost of Goods Sold Depreciation Expense Insurance Expense Rent Expense Supplies Expense Utility Expense Wages Expense M4 Engineering began operations in January of 2020. M4 Engineering provides structural engineering services to local these parks. Listed below are some transaction from the first quarter of 2020. a) On January 1, the owners deposited $200,000 into the business bank account in exchange for Common Stock. b) On January 2, M4 Engineering signed a 1-year lease for an office building in Long Beach. The owner required the rent for the year be paid in advance. M4 Engineering gave the landlord a check for $30,000. c) On January 5, M4 Engineering signed a $75,000 contract to provide engineering services beginning on April 1.…arrow_forward

- answer in text form please (without image), Note: .Every entry should have narration pleasearrow_forwardView Policies Current Attempt in Progress Carla Vista Company manufactures pizza sauce through two production departments: cooking and canning. In each process, materials and conversion costs are incurred evenly throughout the process. For the month of April, the work in process inventory accounts show the following debits: Beginning work in process inventory Direct materials Direct labour Manufacturing overhead Costs transferred in Cooking $-0- 26,900 7,350 32,800 Canning $3,750 7,620 7,490 26,000 52,200 I dit ontries Credit account titles are automatically indented when the anarrow_forwardIf a $335.00 debit item in the general journal is posted as a credit: By how much will the trial balance be out of balance? Explain how you might detect such an error.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education