FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Po.24.

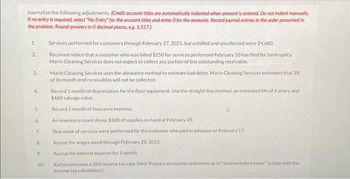

Transcribed Image Text:Journalize the following adjustments. (Credit account titles are automatically indented when amount is entered. Do not indent manually.

If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Record journal entries in the order presented in

the problem. Round answers to O decimal places, eg. 1,527)

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

Services performed for customers through February 27, 2025, but unbilled and uncollected were $4,680.

Received notice that a customer who was billed $250 for services performed February 10 has filed for bankruptcy.

Marin Cleaning Services does not expect to collect any portion of this outstanding receivable.

Marin Cleaning Services uses the allowance method to estimate bad debts. Marin Cleaning Services estimates that 3%

of its month-end receivables will not be collected.

Record 1 month of depreciation for the floor equipment. Use the straight-line method, an estimated life of 4 years, and

$460 salvage value.

Record 1 month of insurance expense.

An inventory count shows $500 of supplies on hand at February 28,

One week of services were performed for the customer who paid in advance on February 17.

Accrue for wages owed through February 28, 2025.

Accrue for interest expense for 1 month

Karen estimates a 20% income tax rate. (Hint: Prepare an income statement up to "income before taxes" to help with the

income tax calculation)

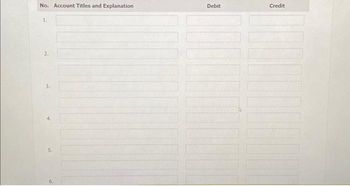

Transcribed Image Text:No. Account Titles and Explanation

1.

2.

3.

5.

6.

Debit

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education