FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Transcribed Image Text:Journalize each of the following transactions assuming a perpetual inventory system and PST at 8% along with 5% GST. Note: Any

available cash discount is taken only on the sale price before taxes.

Aug. 1 Purchased $2,100 of merchandise for cash.

2 Purchased $6,900 of merchandise; terms 3/10, n/30.

5 Sold merchandise costing $3,700 for $5,300; terms 2/10, n/30.

12 Paid for the merchandise purchased on August 2.

15 Collected the amount owing from the customer of August 5.

17 Purchased $6,100 of merchandise; terms n/15.

19 Recorded $7,100 of cash sales (cost of sales $5,900).

View transaction list

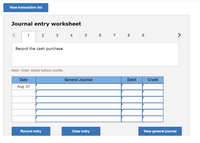

Journal entry worksheet

6 7 8

>

1

2

3

4

Record the cash purchase.

Note: Enter debits before credits.

Transcribed Image Text:View transaction list

Journal entry worksheet

1

2

4

5 6 7 8

>

Record the cash purchase.

Note: Enter debits before credits.

Date

General Journal

Debit

Credit

Aug.

Record entry

Clear entry

View general journal

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Question: During the current year, merchandise is sold for $194,200 cash and $454,200 on account. The cost of the merchandise sold is $505,800. What is the amount of the gross profit?arrow_forwardA sale of merchandise on account for $12,000 is subject to an 8% sales tax. (a) Should the sales tax be recorded at the time of sale or when payment is received?At the time of sale (b) What is the amount of the sale?$fill in the blank 2 (c) What is the amount of the increase to Accounts Receivable? If required, round your answers to nearest whole value.$fill in the blank 3 (d) What is the title of the account in which the $960 (12,000 x 8%) is credited?Sales Tax Payablearrow_forwardMerchandise subject to terms 4/15, n/28, FOB shipping point, is sold on account to a customer for $35,000. What is the amount of the cash discount allowed in case the customer pays within the discount period? Select one: a. $1,400 b. $9,800 c. $1,500 d. $5,250arrow_forward

- Journalize each of the following transactions assuming a perpetual inventory system and PST at 8% along with 5% GST. June (1) Purchased $2,000 of merchandise; terms 1/10, n/30. (5) Sold $ 1,000 of merchandise for $1,400; terms n/15. Please answers in Journal entry worksheetarrow_forwardMerchandise costing $714 is sold for $1,234 on terms 2/10, n/30. If the buyer pays within the discount period, When collection of cash within the 10 days, the debit to Cash will be $arrow_forwardJournalize each of the transactions In assuming a perlodic inventory system and PST at 7% along with 5% GST. Note: Any avallable cash discount is taken only on the sale price before taxes. Aug. 1 Purchased $2, 000 of merchandise for cash. 2 Purchased $6,800 of merchandise; terms 2/18, n/30. 5 Sold merchandise costing $3,690 for $5,200; terms 1/18, n/30. 12 Paid for the merchandise purchased on August 2. 15 Collected the amount owing from the customer of August 5. 17 Purchased $6,009 of merchandise; terms n/15. 19 Recorded $7,800 of cash sales (cost of sales $5,800). View transaction list Journal entry worksheet 3 4 5 6 7 > 1 2 Record the cash purchase. Note: Enter debits before credits. Date General Journal Debit Credit Aug. 01arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education