FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

thumb_up100%

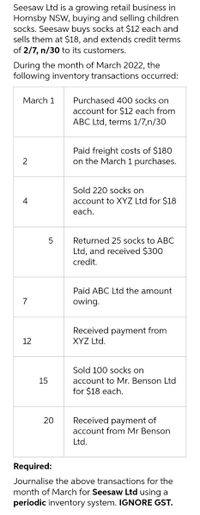

Transcribed Image Text:Seesaw Ltd is a growing retail business in

Hornsby NSW, buying and selling children

socks. Seesaw buys socks at $12 each and

sells them at $18, and extends credit terms

of 2/7, n/30 to its customers.

During the month of March 2022, the

following inventory transactions occurred:

March 1

Purchased 400 socks on

account for $12 each from

ABC Ltd, terms 1/7,n/30

Paid freight costs of $180

on the March 1 purchases.

2

Sold 220 socks on

4

account to XYZ Ltd for $18

each.

Returned 25 socks to ABC

Ltd, and received $300

credit.

Paid ABC Ltd the amount

7

owing.

Received payment from

12

XYZ Ltd.

Sold 100 socks on

15

account to Mr. Benson Ltd

for $18 each.

Received payment of

account from Mr Benson

20

Ltd.

Required:

Journalise the above transactions for the

month of March for Seesaw Ltd using a

periodic inventory system. IGNORE GST.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Jayarrow_forwardBlue Company sells one product. Presented below is information for January for Blue Company. Jan. 1 11 Jan. 4 4 13 20 27 Jan. 4 Date Jan. 11 Jan. 13 Jan. 13 Blue uses the FIFO cost flow assumption. All purchases and sales are on account. Jan. 20 Assume Blue uses a perpetual system. Prepare all necessary journal entries. (If no entry is required, select "No entry for the account titles and enter O for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually. List all debit entries before credit entries.) Jan. 27 Jan. 27 V V Inventory > Sale V Purchase Sale Purchase Sale Accounts Receivable Account Titles and Explanation Sales Revenue (To record the sale) Cost of Goods Sold Inventory Purchases (To record the cost of inventory) Accounts Payable Accounts Receivable Sales Revenue (To record the sale) Cost of Goods Sold Inventory 164 units at $6 each 132 units at $9 each 169 units at $6 each 106 units at $10 each Purchases 122 units at $4…arrow_forwardVaiarrow_forward

- Nix'It Company's ledger on July 31, its fiscal year-end, includes the following selected accounts that have normal balances. Nix'It uses the perpetual inventory system. Retained earnings Dividends Sales Sales discounts Sales returns and allowances Prepare the company's year-end closing entries. View transaction list Journal entry worksheet 1 2 Date July 31 3 4 Record the entry to close the income statement accounts with credit balances. Note: Enter debits before credits. $ 120,300 Cost of goods sold 7,000 Depreciation expense 175,000 Salaries expense 3,400 Miscellaneous expenses 6,000 Record entry General Journal Clear entry Debit Credit $ 106,500 10,800 35,000 5,000 View general journal >arrow_forwardHere is the new question. Unfortunately it did not go over completely last time. May I please get some help on this practice questionarrow_forwardWhen using QBO time tracking, you can record: Multiple Choice Time billable to a specific vendor Time billable to a specific customer How many shipments of inventory items were received Number of purchase orders from each supplierarrow_forward

- The Inventory module window has journal icons for Select one: O a. inventory sales and inventory purchases b. item assembly and inventory adjustments O c. inventory sales and inventory adjustments O d. all of the above Show Transcribed Text You should use the adjustments journal to record - Select one: O a. adjustments to inventory purchase prices from the supplier as an allowance for damages O b. adjustments to inventory sale prices to customers as an allowance for damages c. adjustments to inventory in stock for damaged goods O d. all of the abovearrow_forwardWMC uses a periodic inventory system and the FIFO cost method. Required: 1. Determine the effect of these errors on retained earnings at January 1, 2021, before any adjustments. (Ignore income taxes.) 2. Prepare a journal entry to correct the errors.arrow_forwardUse the following sales journal to record the transactions. All credit sales are terms of n/30. (If a box is not used in the journal leave the box empty; do not select information or enter a zero.) A (Click the icon to view the transactions.) Sales Journal Page Invoice Customer Post. Accounts Receivable DR Cost of Goods Sold DR Date No. Account Debited Ref. Sales Revenue CR Merchandise Inventory CR 2024 Jun. More Info Jun. 1 Sold merchandise inventory on account to Fred Jig, $1,270. Cost of goods, $1,000. Invoice no. 101. Jun. 8 Sold merchandise inventory on account to lan Frog, $2,225. Cost of goods, $1,580. Invoice no. 102. Jun. 13 Sold merchandise inventory on account to Jillian Trump, $380. Cost of goods, $300. Invoice no. 103. Jun. 28 Sold merchandise inventory on account to Glen Whitney, $900. Cost of goods, $610. Invoice no. 104. Print Donearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education