FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

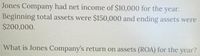

Transcribed Image Text:Jones Company had net income of $10,000 for the year.

Beginning total assets were $150,000 and ending assets were

$200,000.

What is Jones Company's return on assets (ROA) for the year?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- During the past year, the company’s financial results reflected the following: Selling, general, and administrative expenses of 200,000 Net sales of 1,200,000 Interest expense of 100,000 Research & development expense of 50,000 Cost of goods sold of 800,000 Income tax expense of 17,500 Calculate gross profit $ for the year.arrow_forwardNet Income and OCF During the year, BelykPaving Co. had sales of $2,600,000.Cost of goods sold.administrative and sellingexpenses,and depreciationexpense were $1,535,000,$465,000,and $520.000respectively. In addition,the company had an interesexpense of $245,000 and a tax rate of 35 percent. (lgnoreany tax loss carryback or carryforward provisions.忽略税收)a. What is the company's net income?b. What is its operating cash flow?c.Explain your results in parts (a) and (b).arrow_forwardABC Inc. had the following data for last year: Net income = $1000; Net operating profit after taxes (NOPAT) = $900; Total assets = $3,200; and Total operating capital = $2,200. Information for the just-completed year is as follows: Net income = $1,300; Net operating profit after taxes (NOPAT) = $1225; Total assets = $2,900; and Total operating capital = $2,800. How much free cash flow did the firm generate during the just-completed year?arrow_forward

- The Oscar Meyer Corporation earned $33 million in 2019 on sales of $450.5 million. The company's balance sheet also listed current assets of $27 million, and fixed assets of $378 million. What is the firms Return on Assets (ROA)? a. 0.211 b. 0.201 O c. -0.029 d. -0.049 e. 0.081arrow_forwardNet income?arrow_forwardIn a recent year, Cullumber Corporation had net income of $746000, interest expense of $146000, and a times interest earned ratio of 9. What was Cullumber Corporation's income before taxes for the year? Select answer from the options below $1168000 $943111 $1460000 $1314000arrow_forward

- In a recent year Ley Corporation had net income of $150,000, interest expense of $30,000, and a times interest earned ratio of 7. What was Ley Corporation's income before taxes for the year?arrow_forwardIf Net Working Capital Current Assets - Current Liabilities, what is Kelley Corp's net working capital for the year ending December 31, 2023, given the following account balances? Accounts Receivable: $40 Equipment: $20 Accumulated Depreciation: $10 Patent: $50 Inventory: $15 Accounts payable: $30 Goodwill: $65 Long-term note payable: $70 =arrow_forwardpm.6arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education