Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

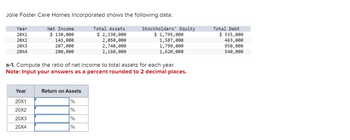

Transcribed Image Text:Jolie Foster Care Homes Incorporated shows the following data:

Net Income

$ 130,000

143,000

207,000

Total Assets

$ 2,330,000

2,050,000

2,740,000

200,000

2,160,000

Year

20X1

20X2

20X3

20X4

a-1. Compute the ratio of net income to total assets for each year.

Note: Input your answers as a percent rounded to 2 decimal places.

Year

20X1

20X2

20X3

20X4

Return on Assets

%

%

%

Stockholders' Equity

$ 1,795,000

1,587,000

1,790,000

1,620,000

%

Total Debt

$ 535,000

463,000

950,000

540,000

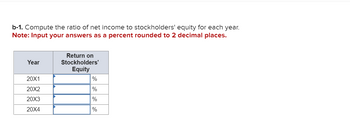

Transcribed Image Text:b-1. Compute the ratio of net income to stockholders' equity for each year.

Note: Input your answers as a percent rounded to 2 decimal places.

Year

20X1

20X2

20X3

20X4

Return on

Stockholders'

Equity

%

%

%

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- The Ivy Corporation shows the following data: Current assets: $480,000 Current liabilities: $210,000 Inventory:…arrow_forwardSolve using excel......Using the Balance Sheet in the St. Johns County, Florida 2015 CAFR calculate the following ratios for each of the five (5) funds shown, including “Total Governmental Funds:”a. Current Ratiob. Net Working Capitalc. Debt Ratio 1d. Debt Ratio 2e. Unrestricted Net Assets Ratiof. Response Ratioarrow_forwarda) What was the income-sharing ratio in 20Y3? Enter the percentage per member and then select the ratio. Idaho Properties, LLC _______% Silver Streams, LLC _______ % b) What was the income-sharing ratio in 20Y4? Enter the percentage per member and then select the ratio. Idaho Properties, LLC ____________% Silver Streams, LLC ____________% Thomas Dunn ____________% c) How much cash did Thomas Dunn contribute to Bonanza, LLC, for his interest? _______ d) What percentage interest of Bonanza did Thomas Dunn acquire?arrow_forward

- You find the following financial information about a company: net working capital = $7, 809; total assets $11,942; and long-term debt Multiple Choice $9, 115 $4, 507 $10, 339 $6, 129 $4, 133 = = = $1, 287; fixed assets $4,589. What is the company's total equity?arrow_forwardKindly help correctlyarrow_forwardA corporation has $91,000 in total assets, $30, 500 in total liabilities, and a $18,600 credit balance in retained earnings. What is the balance in the contributed capital accounts? Multiple Choice $79, 100 $49, 100 $60,500 $41,900arrow_forward

- The following table reports (in millions) earnings, dividends, capital expenditures, and R&D for Intel for the period 1990–95: Capital YearNet IncomeDividendsExpendituresR&D1990$650$0$680$5171991819094861819921,067431,22878019932,295881,93397019942,2881002,4411,11119953,5661333,5501,296What are the dividend payout rates for Intel during these years? Is this payout policy consistent with the factors expected to drive dividend policy, as discussed in the chapter? What factors do you expect would lead Intel’s management to increase its dividend payout? How do you expect the stock market to react to such a decision?arrow_forwardInsight Ltd. has the following capital Structure & after-tax Cost for different sources of funds used: Source of Funds Amount After-tax Cost Debt 15,00,000 5 Pref. Shares 12,00,000 10 Eq. Shares Retained Earnings 18,00,000 12 15,00,000 11 You are required to Calculate Weighted Average COC.arrow_forwardYou are an investment analyst at FI Investments tasked to value FBC firm a Southern Agricultural Conglomerate. The following financial information was recently released for FBC. The company’s 2018 and 2017 annual financial reports are contained in tables 1 and 2 below, along with important additional information: Table 1: FBC statement of financial position (R millions) 2018 2017 Cash and equivalents R149 R83 Accounts receivable 295 265 Inventory 275 285 Total current assets R719 R633 Total fixed assets 3 909 3 856 Accounts payable 228 220 Notes payable 0 0 Total current liabilities 228 220 Long term debt 1 800 1 650 Total liabilities and shareholders equity 3 909 3 856 Number of shares outstanding (millions) 100 100 Additional information: Depreciation (2018): R483. The firm spent R250m in profitable projects during the…arrow_forward

- Sonic Corporation recorded current assets of $345,200 and current liabilities of $318,650 for year 2020. Compute for Sonic's working capital for the year. Select one: a. $663,850 b. $26,550 O C. 92% d. 1.08arrow_forwardErastic Corporation has $17,000 in cash, $9,500 in marketable securities, $38,500 in account receivable, $46,000 in inventories, and $45,000 in current liabilities. The corporation’s current assets consist of cash, marketable securities, accounts receivable, and inventory. The corporation’s acid-test ratio is closest to: Multiple Choice 2.47 1.23 0.86 1.44arrow_forwardPlease helparrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education