FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

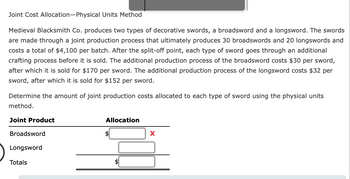

Transcribed Image Text:Joint Cost Allocation-Physical Units Method

Medieval Blacksmith Co. produces two types of decorative swords, a broadsword and a longsword. The swords

are made through a joint production process that ultimately produces 30 broadswords and 20 longswords and

costs a total of $4,100 per batch. After the split-off point, each type of sword goes through an additional

crafting process before it is sold. The additional production process of the broadsword costs $30 per sword,

after which it is sold for $170 per sword. The additional production process of the longsword costs $32 per

sword, after which it is sold for $152 per sword.

Determine the amount of joint production costs allocated to each type of sword using the physical units

method.

Joint Product

Broadsword

Longsword

Totals

Allocation

$

X

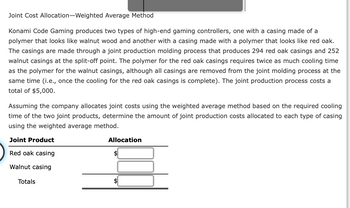

Transcribed Image Text:Joint Cost Allocation-Weighted

Average Method

Konami Code Gaming produces two types of high-end gaming controllers, one with a casing made of a

polymer that looks like walnut wood and another with a casing made with a polymer that looks like red oak.

The casings are made through a joint production molding process that produces 294 red oak casings and 252

walnut casings at the split-off point. The polymer for the red oak casings requires twice as much cooling time

as the polymer for the walnut casings, although all casings are removed from the joint molding process at the

same time (i.e., once the cooling for the red oak casings is complete). The joint production process costs a

total of $5,000.

Assuming the company allocates joint costs using the weighted average method based on the required cooling

time of the two joint products, determine the amount of joint production costs allocated to each type of casing

using the weighted average method.

Joint Product

Red oak casing

Walnut casing

Totals

Allocation

$

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- Lawn Products produces two products (X and Y) and a by-product (Z) from a joint process using a raw material (Alpha). The company chooses to allocate the costs on the basis of the physical quantities method. Last month, it processed 23,000 pounds of Alpha at a total cost of $99,000. The output of the process consisted of 28,800 units of product X, 35,200 units of product Y, and 7,100 units of by-product Z. By-product Z can be sold for $12,000. This is considered to be its net realizable value, which is deducted from the processing costs of the main products. Required: What amount of joint costs should be assigned to each of product X and product Y? Product X Product Y Joint Costsarrow_forwardJoint Cost Allocation-Weighted Average Method Konami Code Gaming produces two types of high-end gaming controllers, one with a casing made of a polymer that looks like walnut wood and another with a casing made with a polymer that looks like red oak. The casings are made through a joint production molding process that produces 294 red oak casings and 252 walnut casings at the split-off point. The polymer for the red oak casings requires twice as much cooling time as the polymer for the walnut casings, although all casings are removed from the joint molding process at the same time (i.e., once the cooling for the red oak casings is complete). The joint production process costs a total of $5,000. Assuming the company allocates joint costs using the weighted average method based on the required cooling time of the two joint products, determine the amount of joint production costs allocated to each type of casing using the weighted average method. Joint Product Red oak casing Walnut casing…arrow_forwardNorthern Company processes 100 gallons of raw materials into 75 gallons of product GS-50 and 25 gallons of GS-80. GS-50 is further processed into 50 gallons of product GS-505 at a cost of $7,250, and GS-80 is processed into 50 gallons of product GS-805 at a cost of $5,750. The production process starts at point 1. A total of $20,000 in joint manufacturing costs are incurred in reaching point 2. Point 2 is the split-off point of the process that manufactures GS-50 and GS-80. At this point, GS-50 can be sold for $725 a gallon, and GS-80 can be sold for $145 a gallon. The process is completed at point 3-products GS-505 and GS-805 have a sales price of $585 a gallon and $225 a gallon, respectively. Required: Allocate the joint product costs and then compute the cost per unit using each of the following methods: (1) physical measure, (2) sales value at split-off, and (3) net realizable value. (Do not round intermediate calculations. Round your final answers to nearest whole dollar amount.)…arrow_forward

- Make or Buy Specialty Metal Products, Inc. manufactures filters for use in custom over-the-range hoods. The costs per unit, for a batch of 10,000 filters, are as follows. Direct materials $4.00 Direct labor 2.00 Variable overhead 1.00 Fixed overhead 4.00 Total costs $11.00 Custom Kitchens has offered to sell 10,000 filters to Specialty Metal Products for $12 per filter. If Specialty Metal Products accepts Custom Kitchens’ offer, the facilities used to manufacture filters could be used to produce BBQ grates. Revenues from the sale of BBQ grates are estimated at $19,000, with variable costs amounting to 80% of sales. In addition, $1 per unit of the fixed overhead associated with the manufacture of filters could be eliminated. Compute the following: Cost to make filters Answer Cost to buy filters Answer Should Specialty Metal Products accept Custom Kitchens’ offer? A. Yes, the cost to purchase the filters is less than the cost to make them. B. No, the…arrow_forwardMickley Corporation produces two products, Alpha6s and Zeta7s, which pass through two operations, Sintering and Finishing. Each of the products uses two raw materials—X442 and Y661. The company uses a standard cost system, with the following standards for each product (on a per unit basis): Product Raw Material Standard Labor Time X442 Y661 Sintering Finishing Alpha6 1.8 kilos 2.0 liters 0.20 hours 0.80 hours Zeta7 3.0 kilos 4.5 liters 0.35 hours 0.90 hours Information relating to materials purchased and materials used in production during May follows: Material Purchases Purchase Cost Standard Price Used in Production X442 14,500 kilos $ 52,200 $ 3.50 per kilo 8,500 kilos Y661 15,500 liters $ 20,925 $ 1.40 per liter 13,000 liters The following additional information is available: The company recognizes price variances when materials are purchased. The standard labor rate is $19.80 per hour in Sintering and $19.20 per hour in Finishing. During…arrow_forwardLawn Products produces two products (X and Y) and a by-product (Z) from a joint process using a raw material (Alpha). The company chooses to allocate the costs on the basis of the physical quantities method. Last month, it processed 26,000 pounds of Alpha at a total cost of $102,000. The output of the process consisted of 30,150 units of product X, 36,850 units of product Y, and 7,400 units of by-product Z. By-product Z can be sold for $10,800. This is considered to be its net realizable value, which is deducted from the processing costs of the main products. Required: What amount of joint costs should be assigned to each of product X and product Y?arrow_forward

- Johnson Glass Inc. manufactures two products from a joint process: wine glasses and drinking glasses. Wine glasses are allocated $7,900 of the total joint costs of $26,000. There are 3,500 wine glasses produced and 3,500 drinking glasses produced each year. Wine glasses can be sold at the split-off point for $5 per unit, or they can be hand painted for additional processing costs of $8,600 and sold for $9.50 for each deluxe wine glass. If the wine glasses are processed further and made into deluxe wine glasses, the effect on operating income would be $15,750 net increase in operating income. $15,750 net decrease in operating income. $7,150 net increase in operating income. $7,150 net decrease in operating income.arrow_forwardDinesharrow_forwardJoint Cost Allocation—Physical Units Method Board-It, Inc., produces the following types of 2 × 4 × 10 wood boards: washed, stained, and pressure treated. These products are produced jointly until they are cut. One batch produces 45 washed boards, 35 stained boards, and 20 pressure treated boards. The joint production process costs a total of $710 per batch. Using the physical units method, allocate the joint production cost to each product. Round your answers to two decimal places.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education