Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

Subject: acounting

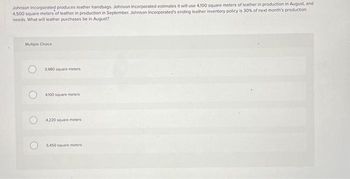

Transcribed Image Text:Johnson Incorporated produces leather handbags. Johnson Incorporated estimates it will use 4,100 square meters of leather in production in August, and

4,500 square meters of leather in production in September, Johnson Incorporated's ending leather inventory policy is 30% of next month's production

needs. What will leather purchases be in August?

Multiple Choice

3,980 square meters

4100 square meters

4,220 square meters

5450 square meters

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Ottis, Inc., uses 640,000 plastic housing units each year in its production of paper shredders. The cost of placing an order is 30. The cost of holding one unit of inventory for one year is 15.00. Currently, Ottis places 160 orders of 4,000 plastic housing units per year. Required: 1. Compute the annual ordering cost. 2. Compute the annual carrying cost. 3. Compute the cost of Ottiss current inventory policy. Is this the minimum cost? Why or why not?arrow_forwardHalifax Shoes has 30% of its sales in cash and the remainder on credit. Of the credit sales, 65% is collected in the month of sale, 25% is collected the month after the sale, and 5% is collected the second month after the sale. How much cash will be collected in August if sales are estimated as $75,000 in June, $65,000 in July, and $90,000 in August?arrow_forwardTrumbull Co. plans to produce 100,000 toy cars during September. Planned production for October is 125,000 cars. Sales are forecasted at 90,000 toy cars for September and 120,000 toy cars for October. Each toy car requires four wheels. Trumbulls policy is to maintain 10 percent of the next months production in inventory at the end of a month. How many wheels should Tram bull purchase during September? a. 195,000 b. 112,500 c. 102,500 d. 410,000arrow_forward

- Ranger Industries has provided the following information at June 30: Other information: Average selling price, 196 Average purchase price per unit, 110 Desired ending inventory, 40% of next months unit sales Collections from customers: In month of sale20% In month after sale50% Two months after sale30% Projected cash payments: Inventory purchases are paid for in the month following acquisition. Variable cash expenses, other than inventory, are equal to 25% of each months sales and are paid in the month of sale. Fixed cash expenses are 40,000 per month and are paid in the month incurred. Depreciation on equipment is 2,000 per month. REQUIREMENT You have been asked to prepare a master budget for the upcoming quarter (July, August, and September). The components of this budget are a monthly sales budget, a monthly purchases budget, a monthly cash budget, a forecasted income statement for the quarter, and a forecasted September 30 balance sheet. The worksheet MASTER has been provided to assist you. Ranger Industries desires to maintain a minimum cash balance of 8,000 at the end of each month. If this goal cannot be met, the company borrows the exact amount needed to reach its goal. If the company has a cash balance greater than 8,000 and also has loans payable outstanding, the amount in excess of 8,000 is paid to the bank. Annual interest of 18% is paid on a monthly basis on the outstanding balance.arrow_forwardOttis, Inc., uses 640,000 plastic housing units each year in its production of paper shredders. The cost of placing an order is 30. The cost of holding one unit of inventory for one year is 15.00. Currently, Ottis places 160 orders of 4,000 plastic housing units per year. Required: 1. Compute the economic order quantity. 2. Compute the ordering, carrying, and total costs for the EOQ. 3. How much money does using the EOQ policy save the company over the policy of purchasing 4,000 plastic housing units per order?arrow_forwardIf the sales forecast estimates that 50,000 units of product will be sold during the following year, should the factory plan on manufacturing 50,000 units in the coming year? Explain.arrow_forward

- Cloud Shoes manufactures recovery sandals and is planning on producing 12.000 units in March and 11,500 in April. Each sandal requires 1.2 yards if material, which costs $3.00 per yard. The companys policy is to have enough material on hand to equal 15% of next months production needs and to maintain a finished goods inventory equal to 20% of the next months production needs. What is the budgeted cost of purchases for March?arrow_forwardJohnson Inc. produces leather handbags. Johnson Inc. estimates it will use 4,100 square meters of leather in production in August, and 4,500 square meters of leather in production in September. Johnson Inc.'s leather inventory policy is 40% of next month's production needs. What will leather purchases be in August? Multiple Choice 5,900 square meters 4,100 square meters 3,940 square meters 4,260 square metersarrow_forwardEcology Co. sells a biodegradable product called Dissol and has predicted the following sales for the first four months of the current year: Sales in units O 3,010 O 3,100 O 3,190 O 2,830 O 3,700 Jan. 2,500 Ending inventory for each month should be 15% of the next month's sales, and the December 31 inventory is consistent with that policy. How many units should be purchased in February? Question 8 Feb. 3,100 March. 3,700 April. 2,800 F6 F7 F8arrow_forward

- D’Lightful Wheels Co. (DWC) manufactures bicycles. It expects to sell 20,000 bicycles in April and had 1,200 bicyclesin finished goods inventory at the end of March. DWC would like to complete operations in April with at least 1,500 completed bicycles in inventory. The bicycles sell for $100 each. How many bicycles would be produced in April? Question 18 options: 1) 20,000 bicycles 2) 20,300 bicycles 3) 19,700 bicycles 4) 18,800 bicyclesarrow_forwardJackson Inc. produces leather handbags. The production budget for the next four months is: July 5,300 units, August 7,700 units, September 8,400 units, October 8,100 units. Each handbag requires 0.5 square meters of leather. Jackson Inc.’s leather inventory policy is 30% of next month’s production needs. On July 1 leather inventory was expected to be 795 square meters. What will leather purchases be in July? Multiple Choice 2,760 square meters 4,035 square meters 3,010 square meters 3,160 square metersarrow_forwardXYZ Company prices its products by adding 30% to its cost. XYZ anticipates sales of $715,000 in March, $728,000 in April, and $624,000 in May. XYZ’s policy is to have on hand enough inventories at the end of the month to cover 25% of the next month’s sales. What will be the cost of the inventory that ABC should budget for purchases in April? Solution: Cost of Inventory = Sales price/1.3 March cost of inventory $715,000/1.3 $550,000 April cost of inventory $728,000/1.3 $560,000 May cost of inventory $624,000/1.3 $480,000 Ending Inventory = Beginning inventory + purchases – cost of goods sold (cogs) April ending inventory $480,000 x 25% $120,000 Beginning inventory $560,000 x 25% $140,000 $120,000 = $140,000 + purchases – cost of goods sold (cogs)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub  Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning