Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:but

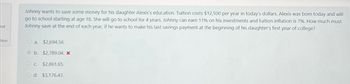

tion

Johnny wants to save some money for his daughter Alexis's education. Tuition costs $12,500 per year in today's dollars. Alexis was born today and will

go to school starting at age 18. She will go to school for 4 years. Johnny can earn 11% on his investments and tuition inflation is 7%. How much must

Johnny save at the end of each year, if he wants to make his last savings payment at the beginning of his daughter's first year of college?

O a. $2,694.56.

b. $2,789.04. X

OC. $2,861.65.

O d. $3,176.43.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Mr. J. J. Parker is creating a college fund for his daughter. He plans to make 15 yearly payments of $1500 each with the first payment deposited today on his daughter’s first birthday. Assuming his daughter will need four equal withdrawals from this account to pay for her education beginning when she is 18 (i.e. 18, 19, 20, 21), how much will she have on a yearly basis for her college career? J. J. expects to earn a hefty 12% annual return on his investment. (show work)arrow_forwardYour son just turned 4 years old. You anticipate he will start University when he turns 18. You would like to have funds in a registered education savings plan (RESP) to fund his education at that time. You anticipate he will spend 6 years in university, and it will cost $40,000 per year at the start of each school year. When he graduates (debt free) you would also like him to have $50,000 for a down payment on a condo or to travel. If the account promises to pay a fixed interest rate (APR) of 6% per year with monthly compounding, how much money do you have to deposit each quarter to ensure you will have enough when he starts university? Assume you will make the same deposit at the end of each quarter until he starts university.arrow_forwardThe Calvarusos have decided to invest in a college fund for their young son. They invested $40,000 in a deferred annuity that will pay their son at the beginning of every month for 4 years, while he goes to college. If the account earns 2.50% compounded monthly and the annuity payments are deferred for 15 years, what will be the size of the monthly payments?arrow_forward

- You want your daughter to be a millionaire. She is 3 years old today when you deposit $42,000 in an account that earns 8.2% per year. The funds in the account will be distributed to your daughter whenever the total reaches $1,000,000. How old will your daughter be when she gets the money?arrow_forwardout tion Johnny wants to save some money for his daughter Alexis's education. Tuition costs $12,500 per year in today's dollars. Alexis was born today and will go to school starting at age 18. She will go to school for 4 years. Johnny can earn 11% on his investments and tuition inflation is 7%. How much must Johnny save at the end of each year, if he wants to make his last savings payment at the beginning of his daughter's first year of college? O a. $2,694.56. b. $2,789.04. * $2,861.65. O d. $3,176.43. OCarrow_forward6) Susan is looking to purchase her first home five years from today. The house costs $1,550,000. She will have to make a down payment of 10% of this amount and plans to take a loan from the bank for the difference. Bank charges are approximately 15% of the loan amount. She plans to start saving from today to cover both the down payment and the bank charges. a. How much will she need to save to cover both the down payment and bank charges? b. If she currently has $195,000 in her account and will make no further deposits over the next five years, what rate of interest must she earn on this account in order to achieve the savings target calculated in part (a) above?arrow_forward

- Jan wants to plan for her daughter's education. Her daughter, Rachel was born today and will go to college at age 18 for five years. Tuition is currently $15,000 per year, in today's dollars. Jan anticipates tuition inflation of 6% and believes she can earn an 11% return on her investment. How much must Jan save at the end of each year, if she wants to make her last payment at the beginning of her daughter's first year of college? $4,680.37 $7,334.72 $3,882.03 $2,547.54arrow_forwardYou are saving for the university education of your two children. They are two years apart in age; one will begin university 15 years from today and the other will begin 17 years from today. You estimate your children's university expenses to be $45,000 per year per child, payable at the beginning of each school year. The annual interest rate is 7.5 percent. Your deposits begin one year from today. You will make your last deposit when your older child enters university. Assume four years of university. How much money must you deposit in an account each year to fund your children's education? (Do not round intermediate calculations. Round the final answer to 2 decimal places. Omit $ sign in your response.) Annual savings $arrow_forwardParents wanted to save enough money to send their daughter to college. The parents were unable to save money right at birth but rather started saving money when she was 5 years old and will save until she is 18 years old. The parents would like to save up $75,000 to cover tuition and other expenses. How much would the parents need to save each month in order to meet this requirement Assume the parents save the money into an account that generated an interest of 2% per year O a $360 O b. 3370 Oc$400 Od $490arrow_forward

- After retiring, Amina wants to be able to withdraw $30,500.00 every year from her account for 25 years. Her account earns 9% interest compounded annually.How much does Amina need in her account when she retires? Amina needs$________ in her account when she retires. How much total money will Amina pull out of her account? In total, Amina will pull out $________ from her account. How much of that money is interest? The amount of money that is interest is$________ .arrow_forwardConsider the case of the following annuities, and the need to compute either their expected rate of return or duration. Ryan inherited an annuity worth $3,280.16 from his uncle. The annuity will pay him five equal payments of $800 at the end of each year. The annuity fund is offering a return of . Ryan’s friend, Sebastian, wants to go to business school. While his father will share some of the expenses, Sebastian still needs to put in the rest on his own. But Sebastian has no money saved for it yet. According to his calculations, it will cost him $30,044 to complete the business program, including tuition, cost of living, and other expenses. He has decided to deposit $4,200 at the end of every year in a mutual fund, from which he expects to earn a fixed 7% rate of return. It will take approximately for Sebastian to save enough money to go to business school.arrow_forwardJohn, a 25-year-old teacher, wants to start saving for his retirement. John wants a comfortableretirement, so he needs to have one million dollars in his saving account, which pays 2.4% annualinterest rate, when he reaches 67 years of age.a. How much should John deposit into his saving account monthly now? Round your answer to thenearest cent.b. If John wants the one million dollars in his saving account to last him 20 years into hisretirement, how much could he withdraw from the saving account monthly? You can assume thesaving account will pay the same 2.4% annual interest rate. Round your answer to the nearestcent.c. If John increases his monthly deposit in part (a) by $200, how much will be in his saving accountif he wants to retire at 60 years of age? Round your answer to the nearest cent.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education