Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

Asking this problem to right expert. solve it.

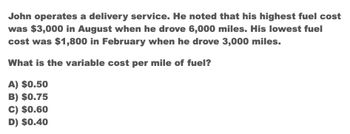

Transcribed Image Text:John operates a delivery service. He noted that his highest fuel cost

was $3,000 in August when he drove 6,000 miles. His lowest fuel

cost was $1,800 in February when he drove 3,000 miles.

What is the variable cost per mile of fuel?

A) $0.50

B) $0.75

C) $0.60

D) $0.40

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- tell me correct solutions for this account questionsarrow_forward6. Answer ALL THREE of the following required questions!arrow_forwardRussell Preston delivers parts for several local auto parts stores. He charges clients $0.75 per mile driven. Russell has determined that if he drives 3,480 miles in a month, his average operating cost is $0.55 per mile. If he drives 4,640 miles in a month, his average operating cost is $0.50 per mile. Russell has used the high-low method to determine that his monthly cost equation is total cost = $696 + $0.35 per mile. Required: 1. Determine how many miles Russell needs to drive to break even. 2. Assume Russell drove 2,040 miles last month. Without making any additional calculations, determine whether he earned a profit or a loss last month. 3. Determine how many miles Russell must drive to earn $1,000 in profit. 4. a. Prepare a contribution margin income statement assuming Russell drove 2,040 miles last month. b. Use the information provided in Req 4a to calculate Russell's degree of operating leverage. Complete this question by entering your answers in the tabs below. Req 1 Req 2…arrow_forward

- Russell Preston delivers parts for several local auto parts stores. He charges clients $0.75 per mile driven. Russell has determined that if he drives 3,270 miles in a month, his average operating cost is $0.55 per mile. If he drives 4,360 miles in a month, his average operating cost is $0.50 per mile. Russell has used the high-low method to determine that his monthly cost equation is total cost = $654 + $0.35 per mile. Required: Determine how many miles Russell needs to drive to break even. Assume Russell drove 1,935 miles last month. Without making any additional calculations, determine whether he earned a profit or a loss last month. Determine how many miles Russell must drive to earn $1,000 in profit. Prepare a contribution margin income statement assuming Russell drove 1,935 miles last month. Use the information provided in Req 4a to calculate Russell’s degree of operating leverage.arrow_forwardWhich one of the following statements is false? Group of answer choices A.Bill drives 20 each way between his home to his office – 40 miles round trip each day. During the day he drives to a client site. He drives a total of 63 miles that day. He may deduct the cost of 43 miles. B.Commuting expenses may be deductible if you are transporting tools. C.A consultant works out of her home. She may deduct the cost of driving to a client’s place of business. D.The expenses of driving between your regular job and a second job are deductible.arrow_forwardcan you help me with the last two problemsarrow_forward

- Joyce Murphy runs a courier service in downtown Seattle. She charges clients $0.48 per mile driven. Joyce has determined that if she drives 3,400 miles in a month, her total operating cost is $1,004. If she drives 5,300 miles in a month, her total operating cost is $1,308. Joyce has used the high-low method to determine that her monthly cost equation is total monthly cost $460+ $0.16 per mile driven. Required: 1. Determine how many miles Joyce needs to drive to break even. 2. Calculate Joyce's degree of operating leverage if she drives 5,500 miles. 3. Suppose Joyce took a week off and her sales for the month decreased by 22 percent. Using the degree of operating leverage. calculate the effect this will have on her profit for that month. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Calculate Joyce's degree of operating leverage if she drives 5,500 miles. Note: Round your intermediate calculations to 2 decimal places and final answer…arrow_forwardJoyce Murphy runs a courier service in downtown Seattle. She charges clients $0.54 per mile driven. Joyce has determined that if she drives 3,200 miles in a month, her total operating cost is $829. If she drives 5,900 miles in a month, her total operating cost is $1,153. Joyce has used the high-low method to determine that her monthly cost equation is total monthly cost = $445 $0.12 per mile driven. Required: 1. Determine how many miles Joyce needs to drive to break even. 2. Calculate Joyce's degree of operating leverage if she drives 6,100 miles. 3. Suppose Joyce took a week off and her sales for the month decreased by 23 percent. Using the degree of operating leverage, calculate the effect this will have on her profit for that montharrow_forwardThe owner of a car wash wants to increase his Revenue. He decides to reduce his price by $2.00. Currently he charges $10.99 for the Deluxe Car wash. In a typical week he sells 70 deluxe car washes. He knows from previous experience his sales will increase to 110 deluxe car washes per week. The other variable costs per car wash are $1.99 which includes all chemicals and labour costs. What percentage must his sales increase by to maintain his current Contribution ? 28.6% 28.2% 30.5% 32% None of these are correct or cannot be determined D View Feedbackarrow_forward

- 6. At a price of $10.95 per gallon, what will be the DOL (assume 23000 gallons are sold , that $94400 above fixed costs is to be earned, and that other costs are as initially given)(show your calculations). IceLess is an anti-icing solution sold in gallon plastic jugs. It is poured into the windshield washer bottle of your car. Wash your windshield and the solution prevents the glass from icing over for about four hours. Production incurs the following fixed and variable costs. It is priced initially at $5.50 per gallon. Fixed costs (per year) Variable Costs per gallon Rent: $18000 Glycol: $1.50 Utilities: 13200 FreezeFree 312: .50 Managerial salaries: 20000 Mfg labor: .20 Flammability permit: 12000 Packaging: .20 Other fixed expense: 2400 Inert ingredients: .60 Total fixed: $65600 Advertising: .30…arrow_forwardIn a recently opened shopping mall, Jagdeep sells handmade coffee mugs in a booth for $25 each and has calculated that he needs to sell 200 mugs to break even. Calculate his total variable costs to break even if his fixed costs are $2400? Which of the following answers is correct?arrow_forwardFlexgen Corporation uses trucks to transport bottles from the warehouse to different retail outlets. Gasoline costs are $0.25 per kilometre driven. Insurance costs are $5,500 per year. Calculate the total costs and the cost per kilometre for gasoline and insurance if the truck is driven (a) 21,000 kilometres per year or (b) 37,000 kilometres per year. Complete the table below. (Round the costs per kilometre to the nearest cent, $X.XX.) Total costs Cost per kilometre (a) Driven 21,000 kilometres (b) Driven 37,000 kilometresarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College