Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

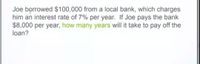

Transcribed Image Text:Joe borrowed $100,000 from a local bank, which charges

him an interest rate of 7% per year. If Joe pays the bank

$8,000 per year, how many years will it take to pay off the

loan?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- John deposits $1500 into a savings account earning simple interest at 2.19%annually. How much will he have in the account after 30 months?arrow_forwardEvan and Emmanuel want to buy a $250,000 home. They plan to pay 15% as a down payment, and take out a 30 year loan at 4.9% interest for the balance. a) How much is the loan going to be? b) What will the monthly payment be for Evan and Emmanuel? c) How much of the first payment is interest? d) What is the total of the payments? e) How much interest was paid?arrow_forwardHassnein recently deposited $34,000 in a savings account paying a guaranteed interest rate of 5 percent for the next 10 years. Required: a. If Hassnein expects his marginal tax rate to be 22.00 percent for the next 10 years, how much interest will he earn after-tax for the first year of his investment? b. How much interest will he earn after-tax for the second year of his investment if he withdraws enough cash every year to pay the tax on the interest he earns? c. How much will he have in the account after 4 years? d. How much will he have in the account after 7 years?arrow_forward

- If Greg borrows $140.00 from the bank at 6.5% exact simple interest, how much interest does Greg owe if he pays back the money after 250 days?arrow_forwardHarry Taylor plans to pay an ordinary annuity of $6,000 annually for ten years so he can take a year's sabbatical to study for a master's degree in business. The annual rate of interest is 2.9%. How much will Harry have at the end of three years? How much interest will he earn on the investment after three years? At the end of three years Harry will have $ (Round to the nearest cent as needed.) He will earn S interest on the investment after three years. (Round to the nearest cent as needed.)arrow_forwardJohn contributes $5,000 per month into an account. How much will he have in the account after 25 years if the account earns at an annual interest rate of 4.5% compunded yearly?arrow_forward

- Robert recently borrowed $20,000 to purchase a new car. The car loan is fully amortized over 4 years. In other words, the loan has a fixed monthly payment, and the loan balance will be zero after the final monthly payment is made. The loan has a nominal interest rate of 12 percent with monthly compounding. Looking ahead, Robert thinks there is a chance that he will want to pay off the loan early, after 3 years (36 months). What will be the remaining balance on the loan after he makes the 36th payment?arrow_forwardJames signed up for a 5-year loan on a sum of $10,000, with a 10% annual interest rate. The loan is repaid in a lump sum (single payment) at the end of the loan.Initially, he believed that this loan would have simple interest, and planned his finances accordingly.It turns out that the loan is subject to compound interest, compounded continuously.How much more will James have to pay in interest than he initially expected?arrow_forwardTodd is able to pay $360 a month for 6 years to finance a car purchase. a. If the interest rate is 6 percent compounded monthly, how much can Todd afford to borrow to buy a car? b. What is the effective annual rate of Todd's loan?arrow_forward

- Jimmy takes up a $50,000 loan from a bank and plans to repay the bank each month over the next 5 years, what is the yearly payment if the interest rate is 3% per annum?arrow_forwardAn investor deposits $100 into his credit union account that pays interest at the rate of 3.25% per year (payable at the end of each year). He leaves the money and all accrued interest in the account for 7 years. How much will he have at the end of the 7 years?arrow_forwardIf Bob borrowed $30,000, the bank would charge an interest rate of 4% p.a. compounded semi-annually. The loan and interest will have to be repaid to the bank over the 5 years with equal payments needing to be made at the beginning of each period. If Bob borrows the money from this bank, what will be the semi-annual payments that he will make? What is the total cash repayment for the loan over the period? Please dont provide answer in image format thank youarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education