FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

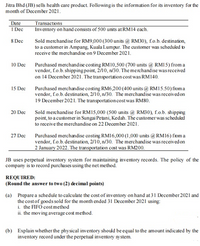

Transcribed Image Text:Jitra Bhd (JB) sells health care product. Following is the information for its inventory for the

month of December 2021.

Date

Transactions

I Dec

Inventory on hand consists of 500 units at RM14 each.

8 Dec

Sold merchandise for RM9,000 (300 units @ RM30), f.o.b. destination,

to a customer in Ampang, Kuala Lumpur. The customer was scheduled d

receive the merchandise on 9 December 2021.

Purchased merchandise costing RM10,500 (700 units @ RMI5) from a

vendor, f.o.b. shipping point, 2/10, n/30. The merchandise was received

on 14 December 2021. The transportation cost was RM140.

10 Dec

15 Dec

Purchased merchandise costing RM6,200 (400 units @ RM15.50) from a

vendor, f.o.b. destination, 2/10, n/30. The merchandise was received on

19 December 2021. The transportation cost was RM80.

20 Dec

Sold merchandise for RM15,000 (500 units @ RM30), f.o.b. shipping

point, to a customer in Sungai Petani, Kedah. The customer was scheduled

to receive the merchandise on 22 December 2021.

27 Dec

Purchased merchandise costing RM16,000 (1,000 units @ RM16) føm a

vendor, f.o.b. destination, 2/10, n/30. The merchandise was received on

2 January 2022. The transportation cost was RM200.

JB uses perpetual inventory system for maintaining inventory records. The policy of the

company is to record purchases using the net method.

REQUIRED:

(Round the answer to two (2) decimal points)

(a) Prepare a schedule to calculate the cost of inventory on hand at 31 December 2021 and

the costof goods sold for the month ended 31 December 2021 using:

i. the FIFO costmethod

ii. the moving average cost method.

(b) Explain whether the physical inventory should be equal to the amount indicated by the

inventory record under the perpetual inventory system.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 6 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- CHERRY Company has 10,000 units of merchandise with unit cost of ₱50 at the beginning of the year. Purchases in chronological order during the year are as follows: 2,000 units at ₱51; 1,000 units at ₱52; 500 units at ₱53. The entity sold 13,100 units during the year. What is the ending inventory cost at year-end using FIFO? A. ₱ 20,000 B. ₱ 21,200 C. ₱ 655, 000 D. ₱ 680, 000arrow_forwardThe following transactions are for Wildhorse Company. 1. On December 3, Wildhorse Company sold $584,300 of merchandise to Swifty Co., on account, terms 2/10, n/30, FOB destination. Wildhorse paid $370 for freight charges. The cost of the merchandise sold was $359,300. 2. On December 8, Swifty Co. was granted an allowance of $21,300 for merchandise purchased on December 3. 3. On December 13, Wildhorse Company received the balance due from Swifty Co. 1. Prepare the journal entries to record these transactions on the books of Wildhorse Company using a perpetual inventory system 2. Assume that Wildhorse Company received the balance due from Swifty Co. on January 2 of the following year instead of December 13. Prepare the journal entry to record the receipt of payment on January 2.arrow_forwardOn December 31, 2023, the following information was available from ORANGE Company's accounting records: COST RETAIL inventory Jan 1 ₱ 220, 500 ₱ 304, 500 Purchases 1,234,800 1,732,500 Additional Markups 63,000 Goods available for sale 1,455,300 2,100,000 Gross sales for the year totaled ₱ 1,659,000. Markdown amounted to ₱ 25,000. Total recorded sales discount is ₱ 105,000 (including employee discounts of ₱ 35,000). What is the cost of ORANGE company's inventory on December 31, 2023, under the average method? A. ₱ 266,560 B. ₱ 281,250 C. ₱ 289,150 D. ₱ 291,060arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education