Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

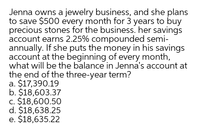

Transcribed Image Text:Jenna owns a jewelry business, and she plans

to save $500 every month for 3 years to buy

precious stones for the business. her savings

account earns 2.25% compounded semi-

annually. If she puts the money in his savings

account at the beginning of every month,

what will be the balance in Jenna's account at

the end of the three-year term?

a. $17,390.19

b. $18,603.37

c. $18,600.50

d. $18,638.25

e. $18,635.22

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- 88) Kathy is buying her first home. She is financing a total of $185,000 at an APR of 5% for 25 years. How much are her monthly payments? A) $952.33 B) $1,081.49 C) $1,441.23 D) $1,664.85 89) Juanita has determined that the PITI on the house she would like to purchase will be $1,260 per month. What is the minimum gross salary she will need to qualify for a mortgage from a reputable lender? A) $6,300 per month B) $4,500 per month C) $3,500 per month D) $5,040 per month 90) Tran currently makes $4,500 per month in gross income. He has a student loan payment of $250 per month and a car loan of $450 per month. His credit card payments average $300 per month. What is the largest PITI he could qualify for with a reputable lender? A) $620 B) $900 C) $1,260 D) $1,620 91) Bob and Mary Kay have gross household income of $7,000 per month. They both have great credit scores and the home they are interested in buying appraised higher than the selling price.…arrow_forwardNick invested $2,000 in a bank savings account today and another $2000 a year from now. If the bank pays interest of 10 percent per year, how much money will Nick have at the end of five years? $6,149 $5,221 $4,620 $6,442arrow_forwardAbigail received a 15 year loan of $280,000 to purchase a house. The interest rate on the loan was 5.80% compounded semi-annually. a. What is the size of the monthly loan payment? b. What is the balance of the loan at the end of year 2? c. By how much will the amortization period shorten if Abigail makes an extra payment of $30,000 at the end of year 2?arrow_forward

- Kelly deposits $1,000 in her savings account earning 4% per year. How much interest would she earn in a year? O A. $44 B. $4 O C. $40 O D. $400arrow_forwardA young couple wishes to accumulate $35,000 at the end of four years so that they may make a down payment on a house. What should their equal end-of-year deposits be accumulate the $35,000, assuming a 6% rate of interest? $7,718 $8,000 $6,915 $8,765arrow_forwardPretend that you are saving up for a down payment on a car or house. Pretend that we get an inheritance of $4,000 so we put the inheritance in a special bank account that pays 4.00% APR compounded quarterly for four-years. We also decide to save $400 a quarter into this savings account to help grow our down payment. a. How much money do we have in our savings account at the end of all these years? b. How much interest do we earn in total?arrow_forward

- Mike estimates that college tuition at State University will be $25,000 per year in five years. If Mike can earn six percent compounded semi-annually, how much must he deposit today in order, to fund his son's first year tuition in five years? Select one: A. $18,603 B. $18,683 C. $20,428 D. $20,508 Only typing answer Please answer explaining in detail step by step without table and graph thankyouarrow_forwardFinancial Math, question One: Ryan purchased an annuity that had an interest rate of 2.75% compounded semi-annually. It provided her with payments of $2,000 at the end of every month for 6 years. If the first withdrawal is to be made in 4 years and 1 month, how much did she pay for it? question two: Allison invested her savings in a bank at 4.25% compounded quarterly. How much money did she invest to enable withdrawals of $3,500 at the beginning of every 6 months from the investment for 6 years, if the first withdrawal is to be made in 12 years?arrow_forwardCurtis buys a piece of commercial property for $230,000. He is offered a 20-year loan by the bank, at an interest rate of 9% per year. The loan requires annual payments to be made. What is the annual loan paymen Curtis must make assuming the first payment will be due one year from the date of purchase? O A. $40,313.10 O B. $30,234.83 O C. $35,273.97 O D. $25,195.69 O Time Remaining: 00:29:43 Next dtv 11 DD F11 F9 F10 F8 F7 F5 esc F4 F2 F3 F1 & @ 2# $ % 8 1 3. 4 { P < COarrow_forward

- a. Andrea wants to know how much money she will have in 6 years if she deposits her $900 tax refund now and then deposits an additional $60 per month in her account that pays an APR of 1.5% compounded monthly. Use Excel to determine how much money will Andrea have in the account in 6 years? $ b. If Andrea changes her mind and decides that instead of setting aside $60 per month she wants to know how much she will have to deposit each month to save up a total of $7500, we can use goal seek to find the value for PMT which yields $7500 at the end of 6 years. How much money will Andrea need to deposit per month?arrow_forwardMick plans to start saving money for retirement. By taking 10% of monthly gross income. Mick is able to contribute $572 each money to a retirement plan. The account is expected to earn interest with an APR of 5.25% compounded monthly. Round to answers to two decimal cases places. a.How much money will be in Mick retirement account if he continues to make the same monthly investment for 40 years? b.Overall Mick contributed how much of her own money into the retirement account? c. What percent of the final balance in Mick retirement account was interest?arrow_forwardSherry Smart is buying a $350,000 home and will pay the mortgage monthly for 30 years. She has a good credit score and has qualified for a 5.125% loan interest. How much will she be paying monthly for the home? a. $2,013.67 b. $1,572.72 c. $975.88 d. $1,318.69arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education