ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

6b-

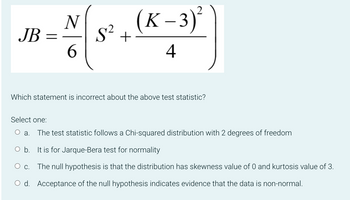

Transcribed Image Text:JB

N (K-3)²

S²

6

4

Which statement is incorrect about the above test statistic?

Select one:

a. The test statistic follows a Chi-squared distribution with 2 degrees of freedom

O b. It is for Jarque-Bera test for normality

O C. The null hypothesis is that the distribution has skewness value of 0 and kurtosis value of 3.

O d. Acceptance of the null hypothesis indicates evidence that the data is non-normal.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- 3. You purchased a 5-year property class item for $60,000. After using this item for 3 years you sold it for $5,000. What is your gain or loss for tax purposes? Use MACRS depreciation method.arrow_forwardPlease no written by hand solution Research the impact of COVID-19 on the Canadian Economy.500 wordsarrow_forwardThe cost of a depreciable asset is equal to: a. purchase cost + costs attributable to put the asset for use b. current market price of the asset c. only purchase cost of the asset d. purchase cost + estimated salvage or residual valuearrow_forward

- What is the difference between the CMS-1500 form and UB-04 form? Why is it important to complete these forms correctly?arrow_forwardWhich of the following is not a depreciable asset? a. Machinery. b. Vehicles c. Land. d. Building.arrow_forwardDepreciation can be applied to machinery, equipment, vehicles, telephone, computers, furniture. True or Falsearrow_forward

- Give typing answer with explanation and conclusion Chanveida finds a home listed for $48k. Similar homes in good condition sell for $60k (market value). She buys the home and then sells it. Her adjusted cost basis is $44,000, net sell price is $55,000, and overall tax rate is 30%. Assume no financing is used and there is no depreciation taken. Determine Chanveida's Net Profit from sale.arrow_forwardYou are trying to estimate the value of the XYZ Inc. company, as of the end of 2018. The after-tax cashflow from assets (FCFF) for the year ending 2018 is $145 milion. The estimated WACC is 10%. What comes closest to the current value of the firm XYZ if the cashflow from assets are not expected to grow In the future? 1305 million 1850 million 1611 million 1450 million 1700 millionarrow_forwardthe earnings on the assest funds of a permanent fund are to be used to support the city's library special revenue fund. How would the earnings be recorded?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education