ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

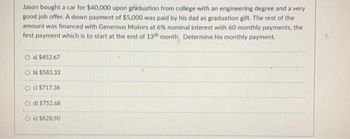

Transcribed Image Text:Jason bought a car for $40,000 upon graduation from college with an engineering degree and a very

good job offer. A down payment of $5,000 was paid by his dad as graduation gift. The rest of the

amount was financed with Generous Motors at 6% nominal interest with 60 monthly payments, the

first payment which is to start at the end of 13th month. Determine his monthly payment.

O a) $452.67

Ob) $583.33

c) $717.38

d) $752.68

Oe) $828.90

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- The Stafford plan now offers student loans at 4% annual interest. After two years the interest rate will increase to 7% per year. If you borrow $5,500 now and $5,500 each year thereafter for a total of four installments of $5,500 each, how much will you owe at the end of year 4? Interest is computed at the end of each year. Click the icon to view the interest and annuity table for discrete compounding when i= 4% per year. Click the icon to view the interest and annuity table for discrete compounding when i = 7% per year. At the end of year 4 you will owe (Round to the nearest dollar.)arrow_forwardSolve with both simple interest rate and compoundes as well!!!arrow_forwardyara is saving up for a new tesla. She has no money right now. she is going to put $6150 away in year 1, increasing by $1000 per year starting in the second year, and so on, for 12 years. Interest is 9.5% per year compounded monthly. Calculate: a. the present worth b. the future worth at the end of year 12 c. the future worth at the end of year 12 if there was zero compound interest appliedarrow_forward

- Calculate, to the nearest cent, the future value FV (in dollars) of an investment of $10,000 at the stated interest rate after the stated amount of time. 3% per year, compounded weekly (52 times/year), after 7 years FV = $ 12,336.00 x Need Help? Read It Watch Itarrow_forwardFind the APY in each of the following cases:(a) 10% compounded annually.(b) 9% compounded semiannually.(c) 12% compounded quarterly.(d) 7% compounded daily.arrow_forwardYou inherited $12,000 from your Great-Uncle Michael. If you invest it and average an 8% annual rate of return (compounded annually), how much will you have in 20 years?arrow_forward

- A person is planning to open a retirement account. He plans is to deposit $1,000 per month for next 45 years. This person visits four local banks and recorded the interest rates: Bank A) 0.08% per month compounded monthly Bank B) 6.2% per year compounded continuously Bank C) 8% per year compounded monthly Bank D) 7% per year compounded semi-annually Determine 1) Which bank should be selected? 2) How much money will be accumulated in 45 years in the selected bank?arrow_forwardhelp please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forwardJoseph Ray just received an inheritance of $50,000 from his great aunt. He plans to invest the funds for retirement. If Joseph can earn 6% per year with quarterly compounding for 30 years, how much will he have accumulated? $271,550 $269,113 $284,622 $298,466arrow_forward

- You borrow $20,000 to purchase a car and will repay the loan in uniform monthly payments for the next 48 months. The first payment is due one month after the purchase of the car. If the interest rate is 1% per month, determine the amount of your monthly car payment. Assuming you make each payment as scheduled, how much total interest will you pay over the four-year period?arrow_forwardPlease do not handwirte on paper. Please type! Thanks Bob and Billy each invest $1,000,000 and $1200, respectively, in their own account with the same interest. a) Who will double their money first? b). If Bob wants to buy a $45,000 car. He is approved by her bank for $38,000 at 3.99% compounded monthly for 72 months. If He buys the car with a loan from her bank, how much does she actually pay for the car at the end of the loan? Excluded taxes and other feesarrow_forwardBronn took out a fully amortizing, 5/1 hybrid, adjustable rate mortgage of $ 125973.08 with 18-year maturity. The interest rate is indexed to SOFR and the margin is 3%. At the time of the loan origination, SOFR was 1%. The lender, however, offers a teaser rate of 2% during the first 5 years. Note that the accrual rate is still based on the SOFR and the 3% margin. Bronn’s monthly payment during the 4th year equals $ ______ per month.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education