Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

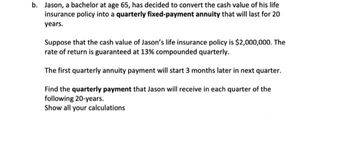

Transcribed Image Text:b. Jason, a bachelor at age 65, has decided to convert the cash value of his life

insurance policy into a quarterly fixed-payment annuity that will last for 20

years.

Suppose that the cash value of Jason's life insurance policy is $2,000,000. The

rate of return is guaranteed at 13% compounded quarterly.

The first quarterly annuity payment will start 3 months later in next quarter.

Find the quarterly payment that Jason will receive in each quarter of the

following 20-years.

Show all your calculations

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Mia plans to save for retirement starting at the age of 35 (year O). She will make a payment at the beginning of each year until age 64. Starting from age 65, she will withdraw 100,000 USD every year for 20 years until her age of 84. Her account balance will reach to $0 at the beginning of her age 85. The retirement plan Mia is looking at provides a interest rate of 10% annually. What would be the fair annual payment for 30 years of this retirement plan? $5175.61 $4275.33 $5293 $53669arrow_forwardSally has decided to invest $70 at the end of each mouth into a retirement plan that has an annual rate of 5.6%, compounded monthly. If Sally continues her investments for a period of 9 years, how much money will she have in the plan?arrow_forwardKhalil has decided to start an ordinary annuity.he plans to deposit $500 into this account each month at 2.4 % annual interest compounded monthly. How much will he have in this account in 20 years?arrow_forward

- To help out with her retirement savings, Linda invests in an ordinary annuity that earns 6.6% interest, compounded annually. Payments will be made at the end of each year. Continue How much money does she need to pay into the annuity each year for the annuity to have a total value of $97,000 after 17 years? Do not round intermediate computations, and round your final answer to the nearest cent. If necessary, refer to the list of financial formulas. 50°F Mostly cloudy Es O 2 2 W 0 3 E 4 X R O S F6 % 5 € T Y F8 & 7 a 7 U 27 D * 00 Submit Assignmen 2022 McGraw Hill LLC. All Rights Reserved. Terms of Use | Privacy Center | Accessibility F10 D X I 9 2 F11 PDF F12 NumLk Prt Sc ^ Pause Br +arrow_forwardBaxter desires to purchase an annuity on January 1, 2023, that yields him five annual cash flows of $11,000 each, with the first cash flow to be received on January 1, 2026. The interest rate is 10% compounded annually. The cost (present value) of the annuity on January 1, 2023, is ________. (Use spreadsheet software or a financial calculator to calculate your answer. Round intermediary calculations two decimal places and round your final answer to the nearest dollar.) Group of answer choices $55,000 $28,481 $45,869 $34,462arrow_forwardGary decides to set up a retirement fund by depositing $300 at the end of each week for 29 years. How much will he have after 29 years, if the interest rate is 2.11%, compounded semiannually?arrow_forward

- Ira Roth opens up a Roth IRA and places $4,500 in his retirement account at the beginning of each year for 20 years. He believes the account will earn 8 percent interest per year, compounded quarterly. How much will he have in his retirement account in 20 years?arrow_forwardTo ensure his retirement income, a 40-year old man plans to purchase annuity when he turns 65. The annuity will pay $7,500 at the end of each month for 20 years, and the value is calculated at 5% interest, compounding monthly. To pay for this annuity, he starts making annual level deposits in a mutual fund, which earns 8% interest each year. He makes the first one right away, and makes deposits at the beginning of each year for 25 years. How much does he need to deposit each year in order to save enough to buy his annuity?arrow_forwardChelsea's current annual salary is $60,000. This salary is expected to increase by 4% each year. At the end of each year for the next 20 years, Chelsea plans to deposit 10% of her annual salary in a retirement account is paying 6% interest compounded monthly. Determine the amount Chelsea will have in the account at the end of the 20 years.arrow_forward

- Una Day is planning to retire in 14 years, at which time she hopes to have accumulated enough money to receive an annuity of $17,000 a year for 19 years of retirement. During her pre-retirement period she expects to earn 8 percent annually, while during retirement she expects to earn 10 percent annually on her money. What annual contributions to this retirement fund are required for Una to achieve her objective and sleep well at night? (Use a Financial calculator to arrive at the answer. Do not round intermediate calculations. Round the final answer to the nearest whole dollar.) Annual contribution $ 7,422 xarrow_forwardMatthew will receive a series of payments at the beginning of each year for 20 years. The first payment is 100. The subsequent 9 payments increase by 5% from the previous payment. After the 10th payment, each payment decreases by 5% from the previous payment. The annual effective interest rate is 7%. Calculate the present value of these payments at the time the first payment is made.arrow_forwardUna Day is planning to retire in 11 years, at which time she hopes to have accumulated enough money to receive an annuity of $21,000 a year for 16 years of retirement. During her pre-retirement period she expects to earn 12 percent annually, while during retirement she expects to earn 14 percent annually on her money. What annual contributions to this retirement fund are required for Una to achieve her objective and sleep well at night? (Use a Financial calculator to arrive at the answer. Do not round intermediate calculations. Round the final answer to the nearest whole dollar.) Annual contribution $arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education