FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

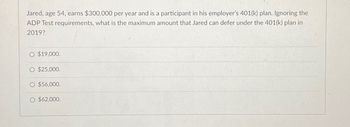

Transcribed Image Text:Jared, age 54, earns $300,000 per year and is a participant in his employer's 401(k) plan. Ignoring the

ADP Test requirements, what is the maximum amount that Jared can defer under the 401(k) plan in

2019?

O $19,000.

$25,000.

O $56,000.

O $62,000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Step 1: Steps to calculate maximum amount Jared can defer under the 401(k) plan in 2019

VIEW Step 2: Determine the maximum deferral limit for participants under the age of 50.

VIEW Step 3: Determine if Jared qualifies for any additional catch-up contributions.

VIEW Step 4: Add the maximum deferral restriction to any catch-up contributions

VIEW Solution

VIEW Trending nowThis is a popular solution!

Step by stepSolved in 5 steps with 3 images

Knowledge Booster

Similar questions

- Ava and her husband, Leo, file a joint return and are in the 24% tax bracket in 2019. Ava’s employer offers a child and dependent care reimbursement plan that allows up to $5,000 of qualifying expenses to be reimbursed in exchange for a $5,000 reduction in the employee’s salary (Ava’s salary is $75,000). Because Ava and Leo have two minor children requiring child care that costs $5,800 each year, Ava is wondering if she should sign up for the program instead of taking advantage of the credit for child and dependent care expenses. Analyze the effect of the two alternatives. How would your answer differ if Ava’s salary was $30,000, their AGI was $25,000, and their marginal tax rate was 10%?arrow_forwardRita is a self-employed taxpayer who turns 39 years old at the end of the year (2022). In 2022, her net Schedule C income was $304,000. This was her only source of income. This year, Rita is considering setting up a retirement plan. What is the maximum amount Rita may contribute to the self-employed plan in each of the following situations? Note: Round your intermediate calculations and final answers to the nearest whole dollar amount. Problem 13-85 Part b (Algo) b. She sets up an individual 401(k).arrow_forwardIn 2020, Amanda and Jaxon Stuart have a daughter who is 1 year old. The Stuarts are full-time students and they are both 23 years old. Their only sources of income are gains from stock they held for three years before selling and wages from part-time jobs.What is their earned income credit in the following alternative scenarios if they file jointly? Use Exhibit 8-10. (Leave no answer blank. Enter zero if applicable.) a. Their AGI is $15,000, consisting of $5,000 of capital gains and $10,000 of wages.arrow_forward

- Amber's employer, Lavender, Inc., uses a § 401(k) plan that permits salary deferral elections by its employees. Amber's salary is $99,000, and her marginal tax rate is 24% and she is 42 years old. a. What is the maximum amount Amber can elect for salary deferral treatment for 2022? b. If Amber elects salary deferral treatment for the above amount, how much can she save in Federal income taxes? Ner tax liability for 2022 would be reduced by $ c. What is the recommended amount that Amber should elect as salary deferral treatment for 2022, considering only the Federal income tax effects?arrow_forwardReggie is a self-employed taxpayer who turns 59 years old at the end of the year (2021). In 2021, his net Schedule C income was $300,000. This was his only source of income. This year, Reggie is considering setting up a retirement plan. What is the maximum amount he may contribute to the self-employed plan in each of the following situations? (Round your intermediate calculations to the nearest whole dollar amount.) a. He sets up a SEP IRA. b. He sets up an individual 401(k).arrow_forwardLO.6 Harvey is a self-employed accountant with earned income from the business of $120,000 (after the deduction for one-half of his self-employment tax). He uses a defined contribution Keogh plan. What is the maximum amount Harvey can contribute to his retirement plan in 2020?arrow_forward

- 4. Sandi, files her 2020 taxes as head of household taking her two children, ages 14 and 11, as dependents. Her 2020 wages were $95,000. Her divorce was finalized in 2019 and per the settlement she is required to pay $1,500 of alimony per month to her ex-spouse. She has taxable interest income of $2,000, qualified dividends of $12,000 and a long-term capital gain on stocks she sold in 2020 of $10,000. In addition, on December 31, 2020 she sold her residence for $400,000. She had purchased the house in June of 2017 for $225,000 and has lived in it since. Compute Sandi's taxable income and income tax liability for 2020?arrow_forwardIn 2020, Ashley earns a salary of $ 55,000, has capital gains of $ 3,000, and receives interest income of $ 5,000. Her husband died in 2018. Ashley has a dependent son, Tyrone, who is age eight. Her itemized deductions are $ 9,000. What is her filing status? Calculate Ashley’s taxable income for 2020.arrow_forwardClayton participates in his employer's nonqualified deferred compensation plan. For 2022, he is deferring 10 percent of his $364,000 annual salary. Assuming this is his only source of income and his marginal income tax rate is 32 percent, how much does deferring Clayton's income save his employer (after taxes) in 2022? The employer's marginal tax rate is 21 percent (ignore payroll taxes).arrow_forward

- Chris and Heather are engaged and plan to get married. During 2023, Chris is a full-time student and earns $9,400 from a part-time job. With this income, student loans, savings, and nontaxable scholarships, he is self-supporting. For the year, Heather is employed and has wages of $72,600. Click here to access the standard deduction table to use. Click here to access the Tax Rate Schedules. If an amount is zero, enter, "0". Do not round your intermediate computations. Round your final answer to the nearest whole dollar. a. Compute the following: Gross income and AGI Standard deduction (single) Taxable income Income tax Chris Filing Single Heather Filing Singlearrow_forwardMyers, who is single, has compensation income of $73,200 in 2022. He is an active participant in his employer's qualified retirement plan. Myers contributes $6,000 to a traditional IRA. Of the $6,000 contribution, how much can Myers deduct?arrow_forwardMazik, age 17, is a dependent of his parents.Mazik earned wages of $12,500 and had no investment income. What isMazik's standard deduction amount for 2020? What is the amount of Taxpayer Corp.'s 2023 NOL deduction?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education