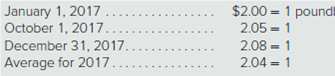

Sullivan’s Island Company began operating a subsidiary in a foreign country on January 1, 2017, by investing capital in the amount of 60,000 pounds. The subsidiary immediately borrowed 140,000 pounds on a five-year note with 10 percent interest payable annually beginning on January 1, 2018. The subsidiary then purchased for 200,000 pounds a building that had a 10-year expected life and no salvage value and is to be

Prepare an income statement, statement of

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 6 images

- A subsidiary of Reynolds Inc., a U.S. company, was located in a foreign country. The local currency of this subsidiary was the Euro (€) while the functional currency of this subsidiary was the U.S. dollar. The subsidiary acquired Equipment A on January 1, 2018, for €250,000. Depreciation expense associated with Equipment A was €25,000 per year. On January 1, 2020, the subsidiary acquired Equipment B for €150,000 and Equipment B had associated depreciation expense of €10,000. The subsidiary owned no other depreciable assets. Currency exchange rates between the U.S. dollar and the Euro were as follows: January 1, 2018 December 31, 2018. 2018 Average January 1, 2019 December 31, 2019 2019 Average January 1, 2020 December 31, 2020 2020 Average Multiple Choice O What amount would have been reported for depreciation expense related to the equipment owned by the subsidiary in Reynolds's consolidated balance sheet at December 31, 2018? O O O $29,500. $28,500. $30,000. $12,000. €1= $1.20 €1=…arrow_forwardCoparrow_forwardHow much of the transactions below should be charged against CELESTINE's Net Income for the year ended 2020?arrow_forward

- On January 1, 2017, Fisher Company makes the two following acquisitions: Purchases land habing a fair market value of $800,000 by issuing a 5-year, zero-interest-bearing promissory note in the face amount of $1,175,464. Purchases equipment by issuing a 4%, 8-year promissory note having a maturity value of $350,000 (interest payable annually). The company has to pay 8% interest for funds from its bank. Instructions: Record the two journal entries that should be recorded by Fisher Company for the two purchases on January 1, 2017. Record the interest at the end of the first year on both notes using the effective-interest method.arrow_forwardLlungby AB spent 1,000,000 krone in 2017 on the development of a new product. The company determined that 25 percent of this amount was incurred after the criteria in IAS 36 for capitalization as an intangible asset had been met. The newly developed product is brought to market in January 2018 and is expected to generate sales revenue for five years. Assume that a foreign company using IFRS is owned by a company using U.S. GAAP. Thus, IFRS balances must be converted to U.S. GAAP to prepare consolidated financial statements. Ignore income taxes. Required: Prepare journal entries for development costs for the years ending December 31, 2017, and December 31, 2018, under (1) IFRS and (2) U.S. GAAP. Prepare the entry(ies) that the U.S. parent would make on the December 31, 2017, and December 31, 2018, conversion worksheets to convert IFRS balances to U.S. GAAP.arrow_forwardSullivan's Island Company began operating a subsidiary in a foreign country on January 1, 2020, by investing capital in the amount of 69,000 pounds. The subsidiary immediately borrowed 146,000 pounds on a five-year note with 10 percent interest payable annually beginning on January 1, 2021. The subsidiary then purchased for 215,000 pounds a building that had a 10-year expected life and no salvage value and is to be depreciated using the straight-line method. Also on January 1, 2020, the subsidiary rented the building for three years to a group of local attorneys for 8,200 pounds per month. By year-end, rent payments totaling 82,000 pounds had been received, and 16,400 pounds was in accounts receivable. On October 1, 2020, 4,200 pounds was paid for a repair made to the building. The subsidiary transferred a cash dividend of 13,900 pounds back to Sullivan's Island Company on December 31, 2020. The functional currency for the subsidiary is the pound. Currency exchange rates for 1 pound…arrow_forward

- Dengararrow_forwardOn January 1, 2018, Ackerman sold equipment to Brannigan (a wholly owned subsidiary) for $150,000 in cash. The equipment had originally cost $135,000 but had a book value of only $82,500 when transferred. On that date, the equipment had a five-year remaining life. Depreciation expense is computed using the straight-line method. Ackerman reported $510,000 in net income in 2018 (not including any investment income) while Brannigan reported $167,300. Ackerman attributed any excess acquisition-date fair value to Brannigan's unpatented technology, which was amortized at a rate of $6,100 per year. a. What is consolidated net income for 2018? b. What is the parent's share of consolidated net income for 2018 if Ackerman owns only 90 percent of Brannigan? c. What is the parent's share of consolidated net income for 2018 if Ackerman owns only 90 percent of Brannigan and the equipment transfer was upstream? d. What is the consolidated net income for 2019 if Ackerman reports $530,000 (does not…arrow_forwardOn December 31, 2015 the Neptune Corporation acquired acustom-made plant asset by issuing a promissory note with a face value of $ 1,200,000, a due date of December 31, 2025 and a stated (coupon) rate of interest of 4%. Interest is compounded annually and is payable at the end on each year. The fair value of the customized asset is not readily determinable and the note receivable is not publicly traded. Given the company's incremental borrowing rate and current market conditions, the imputed rate of interest for the note is estimated as 7%. Determine the present value of the note and prepare the journal entry to record the transaction for Neptune Corporation.arrow_forward

- Sullivan's Island Company began operating a subsidiary in a foreign country on January 1, 2020, by investing capital in the amount of 68,000 pounds. The subsidiary immediately borrowed 160,000 pounds on a five-year note with 8 percent interest payable annually beginning on January 1, 2021. The subsidiary then purchased for 228,000 pounds a building that had a 10-year expected life and no salvage value and is to be depreciated using the straight-line method. Also on January 1, 2020, the subsidiary rented the building for three years to a group of local attorneys for 8,200 pounds per month. By year-end, rent payments totaling 82,000 pounds had been received, and 16,400 pounds was in accounts receivable. On October 1, 2020, 2,800 pounds was paid for a repair made to the building. The subsidiary transferred a cash dividend of 11,900 pounds back to Sullivan's Island Company on December 31, 2020. The functional currency for the subsidiary is the pound. Currency exchange rates for 1 pound…arrow_forwardAlankar Ltd. commenced business on 1st January 2018, when they purchased plant and equipment for 9,00,000. They adopted a policy of charging depreciation at 15% per annum on diminishing balance basis and over the years, their purchases of plants have been as follows01/01/2019 - Rs. 3,50,000 01/01/2022 - Rs. 4,00,000 On 1/1/2022 it was decided to change the method and rate of depreciation to straight line basis. On this date remaining useful life was assessed as 6 years for all the assets purchased before 1/1/2022 with no scrap value and 10 years for the asset purchased on 1/1/2022. Prepare depreciation schedule for 5 years. Books of accounts are closed on 31st December every year.arrow_forwardBomarks acquires an equipment from a foreign supplier on credit for $6 million on 31 March 2022, when the exchange rate was $1 = GH¢ 5. The entity incurred other direct costs of GH¢1.5 million in installing the equipment. The estimated useful life of the equipment is 10 years and the entity has obligation to restore the location to its original state after usage. The estimated cost of dismantling and restoration in 10 years is GH¢3.5 million and the entity’s cost of capital is 8%. Although the equipment was available for use from 1 May 2022, the entity did not bring it into use until 1 July, 2022. Bomarks also sold goods to a foreign customer for $3.5 million on 30 April 2022, when the exchange rate was $1 = GH¢5.75. The customer paid $1 million on 1 July when the rates were $1 = GH¢5.60. On that date, Bomarks paid half of the amount owed for the equipment. At the entity’s year-end of 31 December 2022, the closing exchange rate was $1 = GH¢5.9. The entity’s functional currency is the…arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education