ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

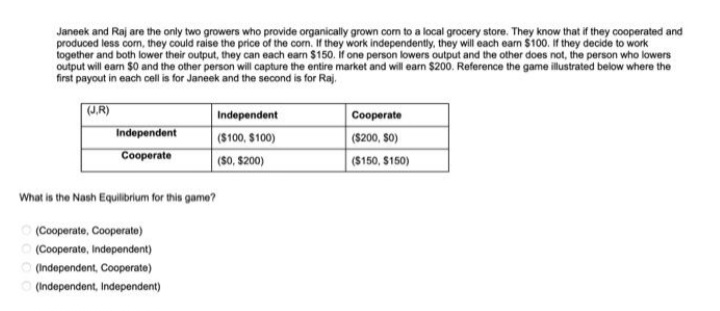

Transcribed Image Text:Janeek and Raj are the only two growers who provide organically grown com to a local grocery store. They know that if they cooperated and

produced less com, they could raise the price of the corn. If they work independently, they will each earn $100. If they decide to work

together and both lower their output, they can each earn $150. if one person lowers output and the other does not, the person who lowers

output will earn $0 and the other person will capture the entire market and will earn $200. Reference the game illustrated below where the

first payout in each cell is for Janeek and the second is for Raj.

(J.R)

Independent

Cooperate

Independent

($100, $100)

($0, $200)

What is the Nash Equilibrium for this game?

Ⓒ(Cooperate, Cooperate)

(Cooperate, Independent)

(Independent, Cooperate)

(Independent, Independent)

Cooperate

($200, 50)

($150, $150)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Betty and Sue both have accounting practices that specialize in income tax preparation. If they both advertise their services each year before the income tax season begins, they will each earn $3 per return. If neither one of them advertises, they will each earn $10 per return. If one advertises and the other one doesn’t, the one who advertises will earn $150 per return and the one who doesn’t advertise will only earn $1 per return. What interest rate would make it so that both of them had the incentive to not advertise? A. 10% and below B. 5% and above C. 5% and below D. 10% and above E. none of the abovearrow_forwardRod and Todd Flanders have been working jobs in HR that pay $40,000 and $20,000 per year, respectively. They are trying to decide whether to quit their jobs and jointly open a snow cone shack, which they estimate can earn $100,000 per year. According to the Nonstrategic view of bargaining, how will the snow cone shack proceeds be split? Rod and Todd Flanders have been working jobs in HR that pay $40,000 and $20,000 per year, respectively. They are trying to decide whether to quit their jobs and jointly open a snow cone shack, which they estimate can earn $100,000 per year. According to the Nonstrategic view of bargaining, how will the snow cone shack proceeds be split? Rod gets $50,000 and Todd gets $50,000 Rod gets $66,666.67 and Todd gets $33,333.33 they won't quit their jobs. Rod gets $60,000 and Todd gets $40,000arrow_forwardTwo organic emu ranchers, Bill and Ted, serve a small metropolitan market. Bill and Ted are Cournot competitors, making a conscious decision each year regarding how many emus to breed. The price they can charge depends on how many emus they collectively raise, and demand in this market is given by Q = 150 – P. Bill raises emus at a constant marginal and average total cost of $10; Ted raises emus at a constant marginal and average total cost of $20. Find the Cournot equilibrium price, quantity, profits, and consumer surplus. Suppose that Bill and Ted merge, and become a monopoly provider of emus. Further, suppose that Ted adopts Bill’s production techniques. Find the monopoly price, quantity, profits, and consumer surplus. Suppose that instead of merging, Bill considers buying Ted’s operation for cash. How much should Bill be willing to offer Ted to purchase his emu ranch? (Assume that the combined firms are only going to operate for one period.) Has the combination of the two…arrow_forward

- Please solve completearrow_forwardMike and Sophie are splitting up and need to decide who will get the car they purchased together. Using the method of sealed bids, Mike bids $5,000 and Sophie bids $4,500 for the car. Since Mike's bid is higher, he gets the car, and has to compensate Sophie with cash. How much will he have to pay Sophie in order to keep the division fair?arrow_forwardTwo countries decide to specialize in producing certain goods to export to other countries, and in return they import different goods from these other countries. The advantage of these exports and imports is: Group of answer choices the country will be able to produce at a point outside your production possibilities frontier. the country will be able to consume at a point outside your production possibilities frontier. the countries will be able to produce and consume at a point outside your production possibilities frontier. the country's production possibilities frontier will shift outward.arrow_forward

- = Two firms sell substitutable products; the market price is: P = 90-Q, where Q Q₁ + Q₂ is the total market quantity, which consists of Q₁ (the quantity produced by Firm 1) and Q₂ (the quantity produced by Firm 2). The firms choose their quantities simultaneously. Firm 1's costs are C₁ = 10- 6Q₁ +Q². Firm 2's costs are C₂ = Q². Which is the best response function for Firm 2? O O O O Q₂ = 15. 1 Q₂ = 30 - ²0₁₁ 3 Q₂ = 42 + ²³² Q₁₁ 2 = 1. 3 Q₂ = 45. What is the equilibrium market quantity Q? O Q = 15.25. O Q = 30. Q = 46.5. O Q = 50. What is the equilibrium market price P? O P = 90. O P = 60. O P = 43.5. O P = 10.arrow_forwardSuppose there are two manufacturers of Electronics, Samsung and LG. When producing electronics, both of these companies emit pollution into the air. Currently each company emits 50 tons of pollution into the atmosphere. The government has recently introduced a policy to limit the amount of pollution these companies can omit by only giving them 25 pollution permits each. Each permit can be used to emit 1 ton of pollution or it can be sold to another manufacturer. For Samsung to reduce pollution it would cost $120 per ton of pollution, while for LG it would cost $40 per ton of pollution. If two companies decide to exchange permits with each other, what would we expect to happen? Selected answer will be automatically saved. For keyboard navigation, press up/down arrow keys to select an answer. a b с d Samsung and LG will emit 25 tons of pollution each. LG will no longer pollute and Samsung will not lower the amount it pollutes. Samsung will no longer pollute and LG will not lower the…arrow_forwardSuppose that there are two firms in the market. The market demand is given by P=220 - 2Q, where Q is the total output (Q=Q1+Q2). Each firm has an identical cost function, TCi=8Qi, i=1, 2. Consider the collusion, in which they decide the output level together to maximize the joint profit. If they divide the production into half, then each firm should produce Qi= _______ units in order to maximize the joint profit.arrow_forward

- There are two adjacent coal fields A and B. Under the fields is a common pool of coal worth $12 million. Drilling to extract the coal costs $1 million. If each company drills, each will get half the coal and each will earn a $5 million profit. Either company could drill a second time. If one company has two of the three wells drilled, that company gets two-thirds of the coal, yielding a profit of $6 million, and the other company gets one-third of the coal, for a profit of $3 million. If both companies drill a second well, the companies again split the coal, and each earn a profit of $4 million. What is company A's dominant strategy? Should it drill one well, two wells, or is there no dominant strategy? What is company B's dominant strategy? Should it drill one well, two wells, or is there no dominant strategy? What is the Nash equilibrium?arrow_forwardTwo firms simultaneously decide whether or not to enter a market, and if yes, when to enter a market. The market lasts for 5 periods: starting in period 1 and ending in period 5. A firm that chooses to enter can enter in any of the five periods. Once a firm enters the market in any period it has to stay in the market through period 5. In any period tt that the the firm is not in the market, it earns a zero profit. In any period tt, if a firm is a monopolist in the market, it makes the profit 10t−24. In any period tt if a firm is a duopolist in the market it makes a profit of 7t−24. A firm's payoff is the total profit it earns in all the periods it is in the market. How many strategies does each firm have? Firm 1's best response to Firm 2's choice Do not enter is to enter in period: In a Nash equilibrium, Firm 1 enters in period _______ (if there is more than one answer, write any one)arrow_forwardWhich of the following is most likely to be rivalrous in some situations but non-rivalrous in others? Group of answer choices A pile of mulch provided by the town from which everyone can take. A public playground swingset. An open-access ebook. A fireworks show.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education