FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

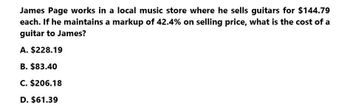

Transcribed Image Text:James Page works in a local music store where he sells guitars for $144.79

each. If he maintains a markup of 42.4% on selling price, what is the cost of a

guitar to James?

A. $228.19

B. $83.40

C. $206.18

D. $61.39

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- choose right answer in detailsarrow_forward11. Murray's Music sells a guitar for $349.85 while using a markup of 21% on cost. Find the cost.arrow_forwardQuestion; Use a calculator to determine the exact sale price of the speakers in #1 The speakers cost $59.89 and there on sale for 15% off Can someone please tell me what to do in the question? Or even just give me an example with different numbersarrow_forward

- Mike purchases a bicycle costing $176.90. State taxes are 5% and local sales taxes are 3% the store charges $20 for assembly. What is the total purchase price in moneyarrow_forwardHello tutor please provide Solutionsarrow_forwardA wholesaler sells a guitar for $1,427.40. What is the percent markup based on cost if the wholesaler paid $780 for the guitar? % Need Help? Read It Watch It Master Itarrow_forward

- Javier has a worm business in which he buys night crawlers from younger kids for 4 cents each and sells them for $1.25 per dozen. What is the percent markup on cost, to the nearest tenth of a percent?arrow_forwardO e. OMR156.75 Clear my choice non 6 et ered Ali is a student at the University. He recently purchased a car for OMR5,000 to use it for going to the University. Ali also expects that other friends might ask for transportation from him. He expects a total monthly revenue of OMR60. He expects fuel cost to be OMR30 per month. One of Ali's friends is a taxi driver. He offered Ali to take him to University for a monthly fee of OMR10. Because he does not have to drive, Ali believes that he can perform online work ed out of g question that would earn him a monthly revenue of OMR10. What is the differential revenue in this scenario? Select one: O a. OMR20 O b. OMR40 O c. OMR10 O d. OMR30 O e. OMR50 ious page Next page 18arrow_forward6. Noboru Yonmine sees a surfboard that regularly sells for $179 on sale at 30% oft. How much can Noboru save by purchasing the surfboard during the sale? 7. Eddie's Paint Store has marked down all paint and accessories 40%. Judy Meyers which regularly sell for $14.50 a gallon and two intal discount on Judy's purchases three gallosfpaint brushe purchases nolo on ollit oms Billy Johnsonarrow_forward

- 1. Xavier opens up a lemonade stand for two hours. He spends $10 for ingredients and sells $60 worth of lemonade. In the same two hours, he could have mowed his neighbor's lawn for $40. Xavier has an accounting profit of and an economic profit of a. $50, $10 b. $90, $50 c. $10, $50 d. $50, $90arrow_forward1. Mr. X, an importer of wheat, imported wheat for Tk. 70. He paid VAT @15%. He sold it to a wholesaler Mr. W for Tk. 100 and collected VAT @ 4.5%. Mr. W sold it to a retailer for Tk. 150 and collected VAT @7.5%. Give necessary journal entries for these transactions. 2. Mr. X, an importer of wheat, imported wheat for Tk. 70. He paid VAT @15%. He sold it to a wholesaler Mr. W for Tk. 100 and collected VAT @ 4.5%. Mr. W sold it to a retailer for Tk. 150 and collected VAT @15%. Mr. W maintains all the necessary documents/records as required by the VAT laws. Give necessary journal entries for these transactions.arrow_forwardABC Company sells clothes. They sold a coat for $100. It cost them $60 to get the coat from the manufacturer. Cost of Goods Sold would be: Group of answer choices $100 cannot be determined $40 $60arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education