FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

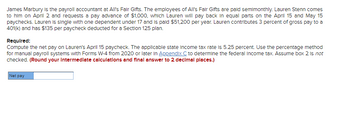

Transcribed Image Text:James Marbury is the payroll accountant at All's Fair Gifts. The employees of All's Fair Gifts are paid semimonthly. Lauren Stenn comes

to him on April 2 and requests a pay advance of $1,000, which Lauren will pay back in equal parts on the April 15 and May 15

paychecks. Lauren is single with one dependent under 17 and is paid $51,200 per year. Lauren contributes 3 percent of gross pay to a

401(k) and has $135 per paycheck deducted for a Section 125 plan.

Required:

Compute the net pay on Lauren's April 15 paycheck. The applicable state income tax rate is 5.25 percent. Use the percentage method

for manual payroll systems with Forms W-4 from 2020 or later in Appendix C to determine the federal income tax. Assume box 2 is not

checked. (Round your Intermediate calculations and final answer to 2 decimal places.)

Net pay

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Parker is a salaried, nonexempt administrator for Forise Industries and is paid biweekly. The annual salary is $66,600 with a standard workweek of 40 hours. During the pay period ending February 3, 2023, Parker worked 8 hours of overtime. Parker is married filing Jointly with two dependents under the age of 17. Required: Complete the following payroll register for Parker's pay. Note: Round your intermediate calculations and final answers to 2 decimal places. Company Forise Industries Name Filing Status Period Salary Hourly Rate Dependents Parker Total Period Ended: 2/3/2023 Number of Regular Hours Number of Overtime Regular Earnings Overtime Earnings Gross Earnings Hours $ 0.00 $ 0.00 $ 0.00arrow_forwardHolden Smith manages a Dairy World drive-in. His straight-time pay is $18 per hour, with time-and-a-half for hours in excess of 40 per week. Smith's payroll deductions include withheld income tax of 30%, FICA tax, and a weekly deduction of $10 for a charitable contribution to United Way. Smith worked 57 hours during the week. (Click the icon to view payroll tax rate information.) Read the requirements. Requirement 1. Compute Smith's gross pay and net pay for the week. Assume earnings to date are $10,000. (Round all amounts to the nearest cent.) Begin by computing Smith's gross pay for the week. Gross Pay Compute Smith's net pay for the week. (Round all amounts to the nearest cent.) Withholding deductions:arrow_forwardThe following information is available for the employees of Webber Packing Company for the first week of January Year 1 1. Kayla earns $26 per hour and 1½ times her regular rate for hours over 40 per week. Kayla worked 50 hours the first week in January. Kayla’s federal income tax withholding is equal to 11 percent of her gross pay. Webber pays medical insurance of $57 per week to a retirement plan for her. 2. Paula earns a weekly salary of $1,150. Paula’s federal income tax withholding is 17 percent of her gross pay. Webber pays medical insurance of $145 per week for Paula and contributes $135 per week to a retirement plan for her. 3. Vacation pay is accrued at the rate of 2 hours per week (based on the regular pay rate) for Kayla and $75 per week for Paula. Assume the Social Security tax rate is 6 percent on the first $110,000 of salaries and the Medicare tax rate is 1.5 percent of total salaries. The state unemployment tax rate is 5.4 percent and the federal unemployment…arrow_forward

- Marbury is the payroll accountant at All's Fair Gifts. The employees of All's Fair Gifts are paid semimonthly. Sten comes to Marbury on April 7 and requests a pay advance of $1,000, which Sten will pay back in equal parts on the April 15 and May 15 paychecks. Sten is single, with one dependent under 17, is paid $57,200 per year, contributes 3 percent of gross pay to a 401(k), and has $134 per paycheck deducted for a Section 125 plan. Required: Compute the net pay on Sten's April 15 paycheck. The applicable state income tax rate is 5.25 percent. Use the wage-bracket method for manual payroll systems with Forms W-4 from 2020 or later in Appendix C to determine the federal income tax. Assume box 2 is not checked. Note: Round your intermediate calculations and final answer to 2 decimal places. Net payarrow_forwardL4.arrow_forwardJustin Matthews is a waiter at the Duluxe Lounge. In his first weekly pay in March, he earned $300.00 for the 40 hours he worked. In addition, he reports his tips for February to his employer ($500.00), and the employer withholds the appropriate taxes for the tips from this first pay in March. Calculate his net take-home pay assuming the employer withheld federal income tax (wage-bracket, head of household), social security taxes, and state income tax (2%).arrow_forward

- Hansabenarrow_forwardPrepare the journal entry to record the payment of the payroll for the weekarrow_forwardReed is a waiter at Albicious Foods in South Carolina. Reed is single with one other dependent and receives the standard tipped hourly wage. During the week ending October 20, 2023, 44 hours were worked, and Reed received $250 in tips. Calculate Reed's gross pay, assuming tips are included in the overtime rate determination. Use Table 3-2. Required: 1. Complete the payroll register for Reed. 2a. Does Albicious Foods need to contribute to Reed's wages to meet FLSA requirements? 2b. If so, how much should be contributed? Complete this question by entering your answers in the tabs below. Req 1 Company Complete the payroll register for Reed. Note: Do not round intermediate calculations. Round your final answers to 2 decimal places. Name Req 2a Reed Totals Albicious Foods Filing Status Req 2b S Dependents 1 Other Hourly Rate or Period Wage Overtime Rate Period Ended: Number of Regular Hours 40.00 10/20/2023 Number of Overtime Hours 4.00 $ Regular Earningsarrow_forward

- Makena is a salaried, exempt employee with Caxkyat Stores. Makena is single with one dependent under 17 and earns $35,500 per year. Required: Complete the payroll register for the biweekly pay period ending March 11, 2022, with a pay date of March 16, 2022. Note: Round your dollar values to 2 decimal places. P/R End Date: Check Date: Name Makena Totals 03/11/2022 03/16/2022 Filing Status Dependents Hourly Rate or Period Wage M Company Name Number of Regular Hours \ Number of Overtime Hours Caxkyat Stores Commissions Regular Earnings 0.00 Overtime Earnings Gross Earnings $ 0.00arrow_forwardSean Matthews is a waiter at the Duluxe Lounge. In his first weekly pay in March, he earned $300.00 for the 40 hours he worked. In addition, he reports his tips for February to his employer ($500.00), and the employer withholds the appropriate taxes for the tips from this first pay in March. 2021 Wage-Bracket Method Tables. Round your answer to the two decimal places. Calculate his net take-home pay assuming the employer withheld federal income tax (wage-bracket, married, 2 allowances), social security taxes, and state income tax (2%).arrow_forwardParker is a salaried, nonexempt administrator for Forise Industries and is paid biweekly. The annual salary is $65,200 with a standard workweek of 40 hours. During the pay period ending February 4, 2022, Parker worked 8 hours of overtime. Parker is married filing jointly with two dependents under the age of 17. Required: Complete the following payroll register for Parker's pay. Note: Round your intermediate calculations and final answers to 2 decimal places. Company Name Parker Total Forise Industries Period Filing Status Dependents Salary Hourly Rate Period Ended: Number of Number of Overtime Regular Hours Hours Regular Earnings $ 2/4/2022 Overtime Earnings Gross Earnings 0.00 $ 0.00 $ 0.00arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education