FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

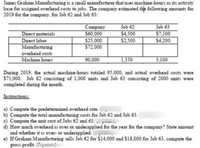

Transcribed Image Text:James Graham Manufacturing is a small manufacturer that uses machine-hours as its activity

base for assigned overhead costs to jobs. The company estimated thle following amounts for

2019 for the company, for Job 62 and Job 63:

Company

$60,000

$25,000

$72,000

Job 62

Job 63

Direct materials

Direct labor

Manufacturing

$4,500

$2,500

$7,100

$4,200

overhead costs

Machine hours

90,000

1,350

3,100

During 2019, the actual machine-hours totaled 95,000, and actual overhead costs were

$71,000. Job 62 consisting of 1,000 units and Job 63 consisting of 2000 units were

completed during the month.

Instructions:

a) Compute the predetermined overhead rate.

b) Compute the total manufacturing costs for Job 62 and Job 63.

c) Compute the unit cost of Jobs 62 and 63. - prm,

d) How much overhead is over or underapplied for the year for the company? State amount

and whether it is over- or underapplied.

e) If Graham Manufacturing sells Job 62 for $14,000 and $18,000 for Job 63, compute the

gross profit.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Similar questions

- Creative Solutions uses a job-costing system with two direct-cost categories (direct materials and direct manufacturing labor) and one manufacturing overhead cost pool. Creative Solutions allocates manufacturing overhead costs using direct manufacturing labor costs. Creative Solutions provides the following information: Direct material costs Direct manufacturing labor costs Manufacturing overhead costs Budget for 2019 Actual Results for 2019 $2,000,000 $1,900,000 $1,500,000 $1,450,000 $2629571 $2752429 During March, the job-cost record for Job X contained the following information: Direct materials used $40,000 Direct manufacturing labor costs $30,000 O a. 210510 O b. 2664777 O c. 573641.60 O d. 32183 Required: At the end of 2019, compute the under- or overallocated manufacturing overhead under normal costing. Tavlor TOP Teamarrow_forwardRobert Company produces pipes for concert-quality organs. Each job is unique. In April 2019, it completed all outstanding orders, and then, in May 2019, it worked on only two jobs, M1 and M2: (Click the icon to view the job information.) Direct manufacturing labor is paid at the rate of $26 per hour. Manufacturing overhead costs are allocated at a budgeted rate of $18 per direct manufacturing labor-hour. Only Job M1 was completed in May. Read the requirements. Requirement 1. Compute the total cost for Job M1. Job Costs May 2019 Total costs Job M1 Data table Robert Company, May 2019 Direct materials Direct manufacturing labor Job M1 $78,000 273,000 Job M2 $ 56,000 208,000arrow_forwardKapoor Catering Co. uses a job cost system. Its activities in November 2020, the first month of operation, were as follows: Information State University On-the-Go Home Precious Pre-school Direct Materials Cost (food) $56,000 $37,600 $80,900 Direct Labor Cost $46,600 $39,000 $53,200 Labor Hours 3,300 3,600 3,830 The company applies overhead at a rate of $19.50 per labor hour. It completed all of its jobs in November. Total revenue for the three jobs amounted to $407,200. The allocated overhead for the month was $148,700, of which $123,900 should be credited to accounts payable and $41,300 should be credited to Accumulated Depreciation.arrow_forward

- 2. Hayday Enterprises applies manufacturing overhead on the basis of machine-hours. At the beginning of 2019, the cost accountant estimated the following cost information for the year: Total DM Costs $440,000 Total DL Costs $890,000 Total MOH Costs $754,000 Total Machine Hours 2,000 Total DL Hours 90,000 At the end of 2019, Hayday Enterprises' cost accountant noted that the company used 2,500 machine hours and actual MOH was $912,000. Was manufacturing overhead under-applied or over-applied and by how much? Provide over-application as a positive number, and under-application as a negative.arrow_forwardKapoor Catering Co. uses a job cost system. Its activities in November 2020, the first month of operation, were as follows: Information State University On-the-Go Home Precious Pre-school Direct Materials Cost (food) $54,200 $34,800 $81,300 Direct Labor Cost $43,600 $40,000 $55,900 Labor Hours 3,050 3,630 4,000 The company applies overhead at a rate of $17.50 per labor hour. It completed all of its jobs in November. Total revenue for the three jobs amounted to $396,600. The allocated overhead for the month was $146,800, of which $122,000 should be credited to accounts payable and $40,400 should be credited to Accumulated Depreciation.1. Determine the costs that should be assigned to each of the jobs. State University On-the-Go Home Precious Pre-school TOTAL Direct Materials Direct Labor Actual Overhead Total Job Cost Manufacturing Overhead Debit Credit 2. Do the adjustment for…arrow_forward???arrow_forward

- During the month of January 2020, the job-cost record for Job 123 shows the following: Job 123: Machine Department Assembly Department Manufacturing overhead costs 19 500 7 500 Direct manufacturing labor costs 1 350 1 875 Direct manufacturing labor-hours 30 105 Machine-hours 210 30 Compute the total manufacturing overhead cost allocated to Job 123. Assume that Job 123 produced 450 units, calculate the cost per unit.arrow_forwardDuring 2019, Sheridan Company expected Job no. 59 to cost $200000 of overhead, $500000 of materials, and $100000 in labor. Sheridan applied overhead based on direct labor cost. Actual production required an overhead cost of $195000, $660000 in materials used, and $310000 in labor. All of the goods were completed. How much is the amount of over- or underapplied overhead? $5000 overapplied $5000 underapplied $425000 overapplied $425000 underappliedarrow_forwardRoger Company produces pipes for concert-quality organs. Each job is unique. In April 2019, it completed all outstanding orders, and then, in May 2019, it worked on only two jobs, M1 and M2: (Click the icon to view the job information.) Direct manufacturing labor is paid at the rate of $25per hour. Manufacturing overhead costs are allocated at a budgeted rate of $16per direct manufacturing labor-hour. Only Job M1 was completed in May. Read the requirements. Requirement 1. Compute the total cost for Job M1. Job Costs May 2019 Total costs Job M1 ... Data table Roger Company, May 2019 Direct materials Direct manufacturing labor Print Job M1 $70,000 275,000 209,000 Job M2 $ 54,000 Done - Xarrow_forward

- In its job costing system, Mason Co. applies MOH to jobs using a budgeted MOH rate based on DL dollars. The rate, which is 200% of DL dollars, was calculated last December and will be used throughout the current year. On August 1, Mason had one job, #150, in process, with DM costs of $2,000 and DL costs of $3,000. During August, DM and DL costs were added to Job #150, as well as new Jobs #151 and #152, as follows. Job #150 Job #151 Job #152 4,000 $ 1,000 5,000 $ 2,500 Actual MOH cost for the month of August was $20,000. During the month, Mason completed Direct materials O $ Direct labor $ 1,500 $ Jobs #150 and #151.arrow_forward???arrow_forwardKapoor Catering Co. uses a job cost system. Its activities in November 2020, the first month of operation, were as follows: Information State University On-the-Go Home Precious Pre-school Direct Materials Cost (food) $53,000 $36,900 $81,800 Direct Labor Cost $44,600 $40,700 $53,600 Labor Hours 2,920 3,510 4,160 The company applies overhead at a rate of $16.00 per labor hour. It completed all of its jobs in November. Total revenue for the three jobs amounted to $392,700. The actual overhead for the month was $147,400, of which $122,000 should be credited to accounts payable and $38,000 should be credited to Accumulated Depreciation.Determine the costs that should be assigned to each of the jobs.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education