FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Note:-

- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism.

- Answer completely.

- You will get up vote for sure.

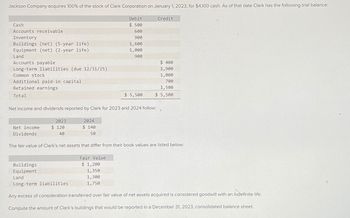

Transcribed Image Text:Jackson Company acquires 100% of the stock of Clark Corporation on January 1, 2023, for $4,100 cash. As of that date Clark has the following trial balance:

Debit

Credit

Cash

Accounts receivable

$ 500

600

Inventory

900

Buildings (net) (5-year life)

1,600

Equipment (net) (2-year life)

1,000

Land

900

Accounts payable

Long-term liabilities (due 12/31/25)

Common stock

Additional paid-in capital

$ 400

1,900

1,000

700

Retained earnings

1,500

$ 5,500

$ 5,500

Total

Net income and dividends reported by Clark for 2023 and 2024 follow:

2023

2024

Net income

Dividends

$ 120

$ 140

40

50

The fair value of Clark's net assets that differ from their book values are listed below:

Fair Value

Buildings

Equipment

Land

Long-term liabilities

$ 1,200

1,350

1,300

1,750

Any excess of consideration transferred over fair value of net assets acquired is considered goodwill with an indefinite life.

Compute the amount of Clark's buildings that would be reported in a December 31, 2023, consolidated balance sheet.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Search Google images for bad data visualizations. Post a link to the image.Describe what is inaccurate or misleading about the visualization. Replace the inaccurate and misleading information with what you think makes the image a good visualization.arrow_forwardMatch each of the components of faithful representation with its definition.Faithful Representation Definition1 . Freedom from error a. All information necessary to describe an item is reported. 2. Neutrality b. Information that does not bias the decision maker. 3. Completeness c. Reported amounts reflect the best available information.arrow_forwardSome accountants argue that the receiving department should be eliminated. Discuss the objective of eliminating the receiving function. What accounting/audit problems need to be resolved.arrow_forward

- what exactly is a cookie jar reserve? Does using a cookie jar reserve follow GAAP? Does using a cookie jar reserve appear to be an ethical practice? Support your opinion. Your post should be more than a single sentence.arrow_forwardIt says they answers are wrong from your example.arrow_forwardSelect the best answer for each of the follwing items and give reasons for your choice. a. Which of the following best describes the relationship between assurance services and attest services? (1) While attest services involved financial data, assurance services involve nonfinancial data (2) While attest services require objectivity, assurance services do not require objectivity (3) All attest services require independence. (4) Attest and assurance services are different terms referring to the same types of servicesarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education