FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

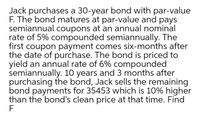

Transcribed Image Text:Jack purchases a 30-year bond with par-value

F. The bond matures at par-value and pays

semiannual coupons at an annual nominal

rate of 5% compounded semiannually. The

first coupon payment comes six-months after

the date of purchase. The bond is priced to

yield an annual rate of 6% compounded

semiannually. 10 years and 3 months after

purchasing the bond, Jack sells the remaining

bond payments for 35453 which is 10% higher

than the bond's clean price at that time. Find

F

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Assume that Peter purchased a 25-year, 7.24 percent coupon (annual payments) bond at par ($1,000). He sold the bond after 4 years for $1,095.55. He reinvested the coupon payments at the 4.75 percent compounded annually. Calculate the bond's total yield.arrow_forwardLola Ruiz has a bond that has 10 years to maturity, a face value of $1,000, an 7 percent interest rate, and a market price of $1,350. What is the dollar amount of annual interest on this bond?arrow_forwardA $1,000 par value bond was issued 20 years ago at a 9 percent coupon rate. It currently has 5 years remaining to maturity. Interest rates on similar debt obligations are now 10 percent. Compute the current price of the bond using an assumption of semiannual payments. If Mr. Robinson initially bought the bond at par value, what is his percentage loss (or gain)? Now assume Mrs. Pinson buys the bond at its current market value and holds it to maturity, what will her percentage return be? Although the same dollar amounts are involved in parts b and c,explain why the percentage gain is larger than the percentage loss.arrow_forward

- Mathias purchases a 10-year CD for $10000 with 2.8% APR compounded monthly, and a 10-year bond for $10000 with a 3.3% coupon rate, paid annually. How much will Mathias’s original $20000 investment be worth at the end of the 10 years? Round your answer to the nearest cent.arrow_forwardABC Company issued a $250,000 bond at the coupon rate of 2 percent payable semi-annually. Now, the bond has a remaining life of 4 years. i. Two years from now, you bought the ABC bond when the market interest rate for a new ABC bond is 4 percent. How much did you pay for the bond? ii. You sold the bond purchased in part i. after holding it for a year, when interest rates (for bonds of similar risk as ABC's bonds) fell to 3 percent. What is the percentage gain / loss on the bond? Illustrate your answer using the bond valuation equation.arrow_forwardAbner corporation’s bonds mature in 23 years and pay 7 percent interest annually. If you purchase the bonds for $900, what is your yield maturity? Your yield to maturity on the Abner bond is Round to two decimal placesarrow_forward

- Carol plans to invest in a 12 year bond issued by Iris Ltd that pays a coupon of 4.8 percent. Coupon payments are made semi-annually. If the current market rate is 6.4 percent, what is the maximum amount Carol should be willing to pay for this bond? Assume it has a par value of $1000.arrow_forwardLinda is interested in purchasing a corporate bond that was issued with an 8% annual coupon a semiannual interest payment of $40, and maturity in fifteen years. What is the par value of this bond?arrow_forwardJenna bought a bond that was issued by Sherlock Watson Industries (SWI) three years ago. The bond has a $1,000 maturity value, a coupon rate equal to 9%, a market rate (yield to maturity) of 10%, and it matures in 17 years. Interest is paid every six months; the next interest payment is scheduled six months from today.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education