FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

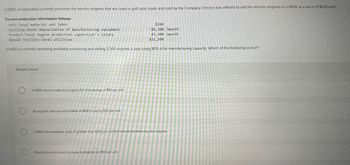

Transcribed Image Text:U-RIDE, Incorporated currently produces the electric engines that are used in golf carts made and sold by the Company. Electco has offered to sell the electric engines to U-RIDE at a price of $291 each.

Current production information follows:

Unit-level material and labor

$240

Facility-level depreciation of manufacturing equipment

Product-level engine production supervisor's salary

$6,300 /month

$3,300 /month

$21,500

Annual facility-level utilities

U-RIDE is currently operating profitably producing and selling 3,300 engines a year using 80% of its manufacturing capacity. Which of the following is true?

Multiple Choice

O

O

U-RIDE should make the engines for cost savings of $51 per unit.

Buying the units would increase U-RIDE's cost by $39 per unit.

U-RIDE has avoidable costs of greater than $291 per unit and should therefore buy the engines.

Buying the units would increase profitability by $90 per unit.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Pharoah International Corporation has two divisions, beta and gamma. Beta produces an electronic component that sells for $75 per unit, with the following costs based on its capacity of 213,000 units: Direct materials $22 Direct labour 17 Variable overhead 4 Fixed overhead 12 Beta is operating at 74% of normal capacity and gamma is purchasing 14,500 units of the same component from an outside supplier for $69 per unit. (a) Calculate the benefit, if any, to beta in selling to gamma 14,500 units at the outside supplier's price. Benefit $ per unitarrow_forwardFoc Give me correct answer with explanation.arrow_forwardBrecht Ltd produces a standard product which is sold for £85 each. The business incurred variable costs of £550,000 last year and total costs were £850,000. The business sold 11,000 units during the year and was operating at full capacity. The business intends to expand its output. This will involve building a factory extension, which will increase annual fixed costs by £120,000 per year. 1. Calculate the number of products that need to be sold in order for the business to break even, after the new factory extension has been built. 2. Calculate the profit (loss) that would be generated if the business sold 10,000 units (i) before the factory extension is built. (ii) after the factory extension is built.arrow_forward

- Conner Manufacturing has two major divisions. Management wants to compare their relative performance. Information related to the two divisions is as follows: Division 1: Sales: Expenses: Asset investment: $200,000 $150,000 $1,000,000 Division 2: Sales: $45,000 Expenses: $35,000 Asset investment: $200,000 Conner currently requires investments to meet a rate of return on asset investment of 5%. Which division has the greatest level of "residual income"? Select one: O a. Division 1 O b. Division 2 O c. Both divisions have the same return on investment ratioarrow_forwardAnswer all five of the required questions!arrow_forwardThe materials used by Hibiscus Company Division A are currently purchased from outside supplier at $53 per unit. Division B is able to supply Division A with 12,400 units at a variable cost of $47 per unit. The two divisions have recently negotiated a transfer price of $48 per unit for the 12,400 units. (a) By how much will each division's income increase as a result of this transfer? Enter an increase as a positive number and a decrease as a negative number. Division A $fill in the blank 1 Division B $fill in the blank 2 (b) What is the total increase in income for Hibiscus Company? $fill in the blank 3arrow_forward

- Can you please give answer?arrow_forwardA company’s productive capacity is limited to 480,000 machine hours. Product X requires 10 machine hours to produce; Product Y requires 2 machine hours to produce. Product X sells for $32 per unit and has variable costs of $12 per unit; Product Y sells for $24 per unit and has variable costs of $10 per unit. Assuming that the company can sell as many of either product as it produces, it should a. Produce X and Y in the ratio of 57% X and 43% Y. b. Produce X and Y in the ratio of 83% X and 17% Y. c. Produce equal amounts of Product X and Product Y. d. Produce only Product X. e. Produce only Product Y.arrow_forwardDeluxe Homes is a residential Home Builder. Based on their current production of 300 homes per year, they currently make a profit of $20,000 per unit, based on the following costs per unit: Direct labor $ 20,000 Direct materials 200,000 Variable overhead 30,000 Fixed overhead 40,000 Variable selling costs 10,000 Fixed selling costs 10,000 Total costs per unit $310,000 Required Each of these are separate situations: A. Prepare an income statement based on the information provided. B. What is the profit and cost per unit if production is increased to 400 homes per year, and there is an increase of $1.50 million in total fixed overhead costs?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education