FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

thumb_up100%

Transcribed Image Text:Multiple Choice

O

O

O

O

$85.00

$97.42

$91.00

$42.00

$43.00

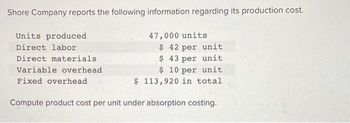

Transcribed Image Text:Shore Company reports the following information regarding its production cost.

47,000 units

$ 42 per unit

$ 43 per unit

$10 per unit

$ 113,920 in total

Compute product cost per unit under absorption costing.

Units produced

Direct labor

Direct materials

Variable overhead

Fixed overhead

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Percent of capacity 90% 100% 110% Direct labor hours 3,600 4,000 4,400 Units of output 720 800 880 Variable overhead $3,960 $4,400 $4,840 Fixed overhead 5,600 5,600 5,600 Total overhead $9,560 $10,000 $10,440 Normal capacity = 100% and overhead is applied based on direct labor hours Standard overhead rate = $10,000/4,000 = $2.50 per direct labor hour Direct materials are $69.50 per unit. Direct labor is $22.50 per hour. Prepare a flexible budget for overhead based on the above data. Flexible Budget 720 800 880 Direct Material $fill in the blank 1 $fill in the blank 2 $fill in the blank 3 Direct Labor fill in the blank 4 fill in the blank 5 fill in the blank 6 Variable Overhead fill in the blank 7 fill in the blank 8 fill in the blank 9 Fixed Overhead fill in the blank 10 fill in the blank 11 fill in the blank 12 Total $fill in the blank 13 $fill in the blank 14 $fill in the blank 15arrow_forward5arrow_forwardRaw materials $9.800 Work in process 65,847 Finished goods 30,640 Work in process consisted of the following jobs: Job 22 Job 24 Job 25 $4,800 Direct materials $6,200 Direct labour $5,190 9,210 6,447 10,500 7,350 9,500 Applied overhead 6,650 Total $24,050 $20,847 $20,950 Number of units 20 40 30 Finished goods consisted of Job 23, with the following costs: Job 23 Direct materials $8,200 Direct labour 13,200 Applied overhead 9,240 Total $30,640 50 Number of units Shown below are the direct cost data related to jobs started in October: Direct materials Job 26 $5,180 $11,200 Job 27 Job 28 $5,600 $4,200 $9,340 $5,910 Total $14,980 $26,450 Direct labour Number of units 20 30 20arrow_forward

- Direct materials Direct labor Variable manufacturing overhead (based on direct labor-hours) Direct materials (8,100 yards) Direct labor Variable manufacturing overhead Total $36,360 $ 7,070 $ 3,030 During August, the factory worked only 1,080 direct labor-hours and produced 2,700 sets of covers. The following actual costs were recorded during the month: Per Set of Covers $18.00 3.50 Total $ 46,980 $ 9,990 $ 4,590 1. Materials price variance 1. Materials quantity variance 2. Labor rate variance 1.50 $23.00 2. Labor efficiency variance 3. Variable overhead rate variance 3. Variable overhead efficiency variance At standard, each set of covers should require 2.0 yards of material. All of the materials purchased during the month were used in production. Per Set of Covers $ 17.40 3.70 1.70 $22.80 Required: 1. Compute the materials price and quantity variances for August. 2. Compute the labor rate and efficiency variances for August. 3. Compute the variable overhead rate and efficiency…arrow_forwardAnswer question Darrow_forwardDirect Materials Direct Labour Manufacturing Overhead Total cost to account for $385,000 139,750 86,000 $610,750 The units still in process are 100% complete with respect to direct materials and 35% complete with respect to conversion costs. The cost of the December 31 Work in Process Inventory would be: a. $436,500 O b. $174,250 O c. $218,125 Od. $610,750arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education