FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

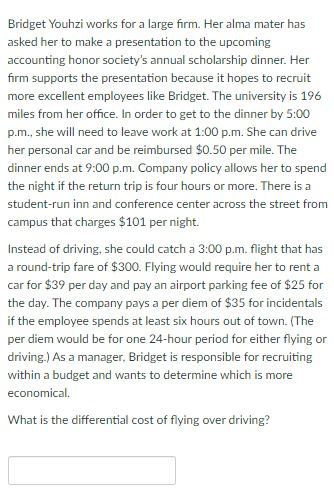

Transcribed Image Text:Bridget Youhzi works for a large firm. Her alma mater has

asked her to make a presentation to the upcoming

accounting honor society's annual scholarship dinner. Her

firm supports the presentation because it hopes to recruit

more excellent employees like Bridget. The university is 196

miles from her office. In order to get to the dinner by 5:00

p.m., she will need to leave work at 1:00p.m. She can drive

her personal car and be reimbursed $0.50 per mile. The

dinner ends at 9:00 p.m. Company policy allows her to spend

the night if the return trip is four hours or more. There is a

student-run inn and conference center across the street from

campus that charges $101 per night.

Instead of driving, she could catch a 3:00 p.m. flight that has

a round-trip fare of $300. Flying would require her to rent a

car for $39 per day and pay an airport parking fee of $25 for

the day. The company pays a per diem of $35 for incidentals

if the employee spends at least six hours out of town. (The

per diem would be for one 24-hour period for either flying or

driving.) As a manager, Bridget is responsible for recruiting

within a budget and wants to determine which is more

economical.

What is the differential cost of flying over driving?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- It known that variable costing should be used for pricing purposes. What is the benefit of using variable costing for pricing? Are there any benefits to using absorption costing for pricing instead? Explain your answer.arrow_forwardIn your own words, explain what differential costs mean. How are fixed costs and variable costs related to differential costs? Provide an example of differentials costs by considering a personal or professional decision you recently made where you had to choose between two alternatives. Identify the examples of differential costs within this experience.arrow_forwardPlease I want to learn how to make these problems with a good explanation. One of those there is the possible answer. I need only question 1 Thank youarrow_forward

- Which of the following assumptions of the CVP graph is not true? Multiple Choice Costs are linear. Total fixed expenses are constant within the relevant range. Variable costs go down as volume goes up. The selling prices do not change. Volume is the only factor affecting total cost.arrow_forwardThe major expenditures involved with buying a home include many things. Describe the up-front costs? Identify the components of PITI.arrow_forwardExamples of opportunity costs include: not getting a high yield because you have set aside funds in a low risk investment. ☐not having as much money in savings because you purchased new appliances to save energy costs. trading in a large car with poor gas mileage for a smaller car that is fuel-efficient. delaying investment while waiting for the time value of money to increase the pay received. having enough money to save for retirement and to pay for current expenses.arrow_forward

- Which of the following is a cost objective? Select one: O A. The cost of educating a student O B. The cost of constructing a house The cost of carrying a passenger O C. O D. All of the above.arrow_forwardWhich one of the following statement is not correct? O Both fixed and variable costs influence short-term decision-making. O Short-term decision-making is all about analysing those costs that will change as a result of taking a particular action. O Opportunity costs are only considered when resources are limited. O Break-even analysis is used to determine how many units of a product or a service a business has to sell to cover all its costs.arrow_forwardWhen the level of activity decreases, variable cost will increase or decrease ?arrow_forward

- 1. Fill in the missing numbers in the table. Use the following questions to help fill in the missing numbers in the table: a. What is the total contribution margin? b. What is the total variable expense? c. How many units were sold? d. What is the per-unit variable expense? e. What is the per-unit contribution margin? 2. Answer the following questions about breakeven analysis: a. What is the breakeven point in units? b. What is the breakeven point in sales dollars? 3. Answer the following questions about target profit analysis and safety margin: a. How many units must the company sell in order to earn a profit of $48,000? b. What is the current margin of safety in units? c. What is the margin of safety in sales dollars? d. What is the margin of safety in percentage?arrow_forwardWhich of the following is not another way of describing the marginal propensity to consume? a. autonomous consumption spending b. the slope of the consumption function c. the amount by which real consumption spending rises when real disposable income increases by one dollar d. MPC e. the change in real consumption spending divided by the change in real disposable incomearrow_forwardDescribe the differences in behavior of fixed costs, variable costs, semi-variable costs and step costs. Then discuss how break-even analysis and contribution margin can be useful in making business decisions.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education