FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

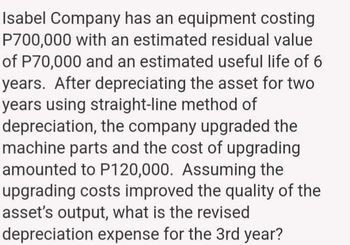

Transcribed Image Text:Isabel Company has an equipment costing

P700,000 with an estimated residual value

of P70,000 and an estimated useful life of 6

years. After depreciating the asset for two

years using straight-line method of

depreciation, the company upgraded the

machine parts and the cost of upgrading

amounted to P120,000. Assuming the

upgrading costs improved the quality of the

asset's output, what is the revised

depreciation expense for the 3rd year?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Company D recently purchased an equipment that costs $50,000, has a life of 4 years and a salvage value of $10,000. The production output of this equipment is 1800 on the first year, 2200 on the second year, 3000 units on the third year, and 4000 units on the fourth year. What is the accumulated depreciation charge on the second year?arrow_forwardGinsberg Company installs a computerized manufacturing machine in its factory at the beginning of the year at a cost of $94,500. The machine's useful life is estimated at 8 years, with a salvage value of $12,300. Cost Estimated useful life Salvage value Compute depreciation expense for year Compute depreciation expense for year $94,500 8 years $12,300 1 2 Required: Determine the machine's first-year depreciation using the double-declining-balance function. Determine the machine's second-year depreciation using the double-declining-balance function. Verify the machine's first-year depreciation WITHOUT using the double-declining-balance function. Verify the machine's second-year depreciation WITHOUT using the double-declining-balance function. $23,625 $17,719arrow_forwardStrong Metals Incorporated purchased a new stamping machine at the beginning of the year at a cost of $1,235,000. The estimated residual value was $65,000. Assume that the estimated useful life was five years and the estimated productive life of the machine was 300,000 units. Actual annual production was as follows: Year Units 1 70,000 2 67,000 3 50,000 4 73,000 5 40,000 Required: 1. Complete a separate depreciation schedule for each of the alternative methods. Straight-line. Units-of-production. Double-declining-balance.arrow_forward

- A company purchased a machine for $190,000. The machine has a useful life of 8 years and a salvage value of $10,000. It is estimated that the machine could produce 75,000 bolts over its useful life. In the first year, 15,000 bolts were produced. In the second year, production increased to 19,000 units. Using the units-of-production method, what is the amount of accumulated depreciation at the end of the second year? Multiple Choice $48,133. $86,133. $23,750. $81,600. $45,600.arrow_forwardMango Company purchased equipment for $100,000 and assigned it an estimated salvage value of $10,000 and a useful life of 10 years. After two years of using the double-declining balance method for depreciation, the company decided to switch to the straight-line method. The company also revised the equipment's remaining useful life to 6 years. What is the depreciation expense for the equipment for the third year? Answer a. $12,000 b. $9,000 c. $11,500 d. $13,500arrow_forwardThe Black Limo Company (BLC) purchased a limo on January 1 of Year 1. The limo cost $48,000. It had an expected useful life of 4 years and a $8,000 salvage value. At the start of Year 2, BLC determined the salvage value should be changed to $11,000. Based on this, the depreciation expense recorded in Year 2 will be $arrow_forward

- Mason Industries purchased a drilling rig for $75,900. Delivery costs totaled $2,831. The useful life is 7 years and the salvage value is $12,938. Prepare a depreciation schedule using the straight-line method.arrow_forwardA company used straight-line depreciation for equipment that cost $12,000, had a salvage value of $2,000, and a 5-year useful life. At the beginning of year 4 of its useful life, the estimate of the salvage value was reduced to $1,200 and its total useful life was increased to 6 years. The amount of depreciation that will be recorded during each of the remaining years of its useful life is: $2,000 $6,000 $1,600 $2,400arrow_forwardLayton Company purchased tool sharpening equipment on October 1 for $108,000. The equipment was expected to have a useful life of three years, or 12,000 operating hours, and a residual value of $7,200. The equipment was used for 1,350 hours during Year 1, 4,200 hours in Year 2, 3,650 hours in Year 3, and 2,800 hours in Year 4. In a table show depreciation expense, accumulated deprecation at the end of the year, beginning and ending book value (Use double declining method only) Cost Beginning Book Value Accumulated Deprecation Depreciation expense Book value at Endarrow_forward

- Sunland Company purchased a truck for $46,000. The company expected the truck to have a useful life of four years or 95,000 kilometres, with an estimated residual value of $8,000 at the end of that time. During the first and second years, the truck was driven 21,000 and 27,500 kilometres, respectively. Calculate the depreciation expense for the second year under the straight-line, units-of-production, and double-diminishing-balance methods. Assume the purchase of the truck was made at the beginning of the first month of the first year. (Round depreciation per kilometre to 2 decimal places, e.g. 1.25 and final answers to O decimal places, e.g. 5,275.) Straight-line method Units-of-production method $ GA LA Double-diminishing-balance method $ GA Year 2 Depreciation Expensearrow_forwardComputer equipment was acquired at the beginning of the year at a cost of $57,000 that has an estimated residual value of $9,000 and an estimated useful life of 5 years. Determine the 2nd year's depreciation using straight-line depreciation method.arrow_forwardWatkins Production purchased a new computerized machine at a cost of $450,000. The machine has a residual value of$64,000 and an expected life of 5 years. Calculate the depreciation expense, accumulated depreciation and book value for all 5 years ofthe machine's expected life using the straight-line method of depreciationarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education